Ethereum flipping Bitcoin – Here’s the full picture

Ethereum has considerably reduced the gap to Bitcoin. While comparing their market caps would not bequeath such sentiment (BTC’s $680 billion to ETH’s $292 billion), in terms of exposure, fundamental developments, and overall market intrinsic value, Ethereum is right in the mix and no longer under its shade.

Its rapid growth keeps bringing up the probable eventuality of Ether overturning BTC’s market cap in a few years. Earlier, the arguments were more theoretical, but with time, facts have begun to support ETH’s argument, or rather ‘Ethereans’ argument.”

What are these Ethereum flag-bearing facts?

These facts can be classified down to three key aspects,

i) Economic Value Settled

ii) Fees paid for network utilization

iii) Settlement Assurance

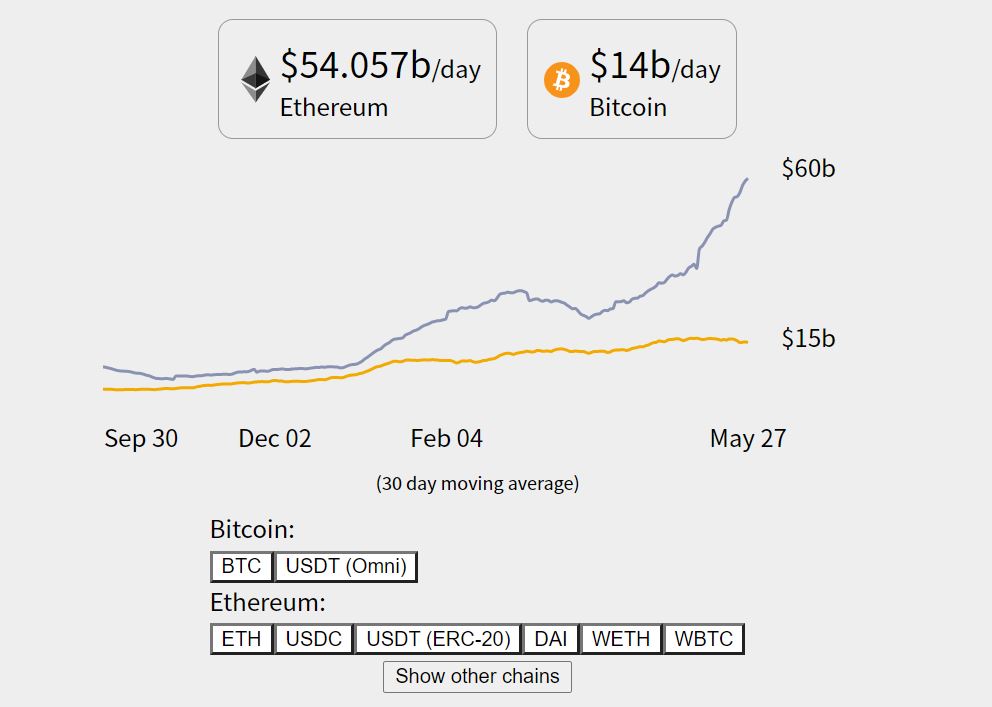

i) Since mid-2020, there has been no doubt that the economic value settled on Ethereum has reached a new level. Data suggested Ethereum facilitated 5 times more financial activity than BTC, with the same suggesting that users are willing to trust the network in securing their monetary value.

Here, it is important to note that the financial activity settled on ETH ranges from different DeFi products to other financial assets. However, Ethereum-dominated value also outperformed BTC as ETH still settles about $20 billion every day in comparison to BTC’s $14 billion.

ii) Now, users have recently raised their voice against ETH’s incapability to facilitate cheaper transactions. DeFi has completely blown up the space and market congestion has led to the highest average settlement fees. Yet, people haven’t moved away from it.

The 7-day average fees paid to miners stood at $32 million/day for ETH, at press time, to BTC’s $4 million/day. Ethereum’s block space is more valuable than any other blockchain’s because it facilitates so much more, while BTC’s chain remains anti-interoperable.

iii) When it comes to security, Bitcoin is still the supreme leader. But, for a brief moment, its throne was challenged. Data from howmanyconfs.com recently suggested that Ethereum was momentarily more secure than Bitcoin. While press time data would indicate BTC’s dominion, the narrative did flip for a while.

Now, ledger costliness is an efficient metric to understand settlement assurances. The higher miners are paid, the less risky it is for the network to get attacked.

Further, data from bitinfocharts indicate that Ethereum is processing payments roughly ~18 billion per year to miners at press time, while BTC’s daily tx fees and payouts added up to $13.55 billion per year. Ergo technically, Ethereum is paying more to its miner and has a higher ledger cost, meaning, it is more secure theoretically.

And yet, the flip should/would not happen

While facts and numbers do not lie, they do not convey the power or pull of market sentiment. Bitcoin is at the top of the heap not only because it was the first crypto-asset, but it has never been altered in any form, and the monetary policy has stuck out through bulls and bear markets.

With Bitcoin, there is a form of familiarity. Yes, it may not be the most efficient medium of transaction anymore, but more and more people are understanding and evaluating its long-term intrinsic value. Bitcoin is almost the complete project.

Ethereum continues to remain a puzzle, one which may or may not turn out to be a masterpiece. Its protocol keeps on changing, and while changes have made the network better, it might take a long time for people to actually grasp the innate value of the ETH blockchain.

Additionally, Bitcoin represents the last of PoW projects. After Ethereum’s migration to PoS, it enters a pool of tokens that are competing in the same protocol. We are talking about Cardano, Polkadot, Solana, etc. all being polarized as “Ethereum killers” and the competition is stiff. A non-tech person would be able to comprehend the value of Bitcoin, but Ether remains as complex as ever.

Ethereum is currently the jack-of-all-trades asset to Bitcoin’s Ace. The ace will always win irrespective of when you play your joker. It is imperative that Bitcoin-Ethereum continue to share the same form of reality. Anything other than that establishes another route to uncertainty, one where Bitcoin getting flipped might fuel more chaos than calm. That will not serve Ethereum’s purpose either.