‘Ethereum has the largest piece of’ this pie

Times are tough and the market has moved from regular surges to phases of corrections. This occurred after almost a year of the rally by the cryptocurrency market which pushed its market capitalization above $2 Trillion at its peak. With the market rally coming to a brief halt, the market capitalization has also fallen to $1.43 Trillion and stablecoins were now making up for 7.7% of the total market cap.

Crypto snoozes as Stablecoins grow

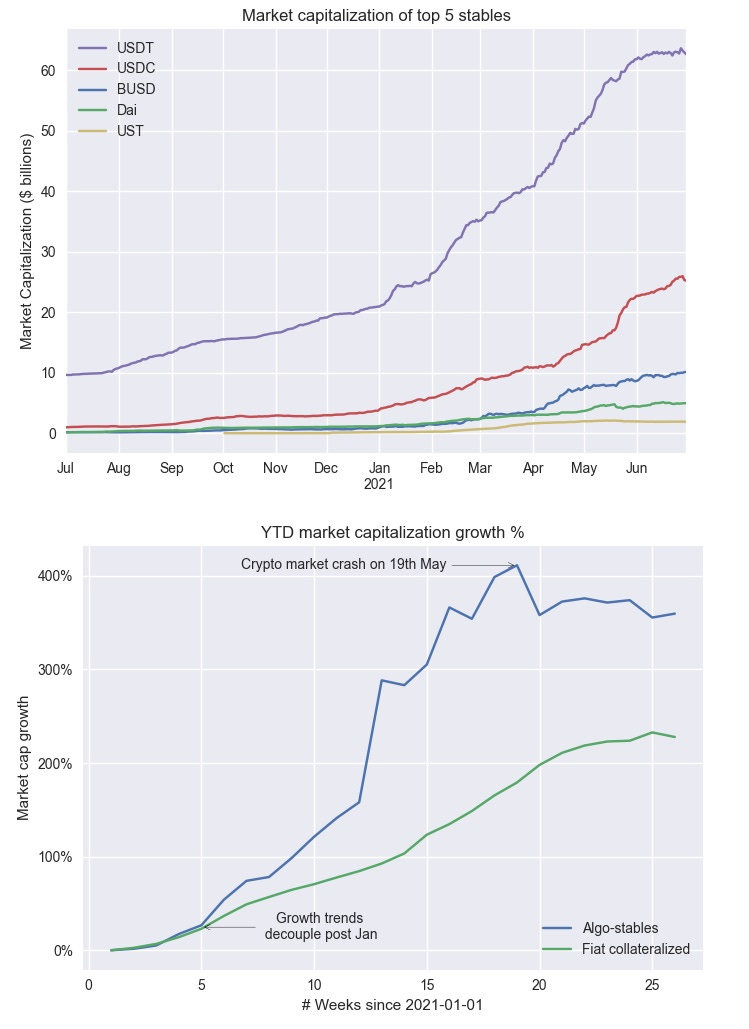

Stablecoins have become an important part of cryptocurrency trading and their significance has only grown in 2021. According to reports, the stablecoin market cap recently breached $111 billion which made up for 7.7% of the total crypto market cap.

As the cryptocurrencies gained high values at the beginning of the year, stablecoins like USDT [Tether] and USDC [USD coin] were prominently paired with crypto assets for trade. Even when the market ran into the bears’ trenches, the stablecoins market continued to grow. As per a report:

” YTD stablecoin marketcap growth is 3.7x, far outpacing the total YTD crypto marketcap growth of 1.9x.”

It was no surprise that USDT continued to dominate the stablecoins market with a $62.9 billion outstanding supply. This was equivalent to 58.56% market share, while USDC was at second place with a $25.3 billion outstanding supply.

Source: Our Network

Apart from USDT and USDC, algorithmic stablecoins created a sizeable category comprising ~8% of the total stablecoins market cap. This growth was stimulated by new projects like TerraUSD, Fei, Liquidity, and Frax that witnessed explosive growth this year.

The use of stablecoin was also stimulated by the largest altcoin, Ethereum [ETH]. The report added:

“Ethereum has the largest piece of the stablecoin pie, with $73.4 billion of the $111 billion outstanding supply issued on its blockchain.”

Along with alts, protocols like Aave, Curve.fi, and Yearn were also seeing a significant rise in stablecoins during this bearish season.

The use of stablecoins has always noted an upwards swing during periods of bearish volatility. As the crypto investors once again flooded stablecoins when the market crash, it could hint at a possible sign of trend reversal in the overall crypto market.