Ethereum: Here’s a prolonged perspective to be considered before taking positions

What is it about the largest altcoin that can make an investor bet on it? Well, the fact that Ethereum2.0 deposit address on 10 March exceeded the total number of ETH locked which stood at 10 million, at the time of writing. Despite this, the market trend hasn’t been in favor of ETH’s positive price action.

Change your perspective

Ethereum, the prime altcoin has been acting as a ‘resource’ for different platforms. In 2015, the Ethereum network commenced its journey by offering 72 million ETH to around 10,000 Bitcoin addresses who participated in the ICO- distributed across to more than 144.7 million recorded wallets.

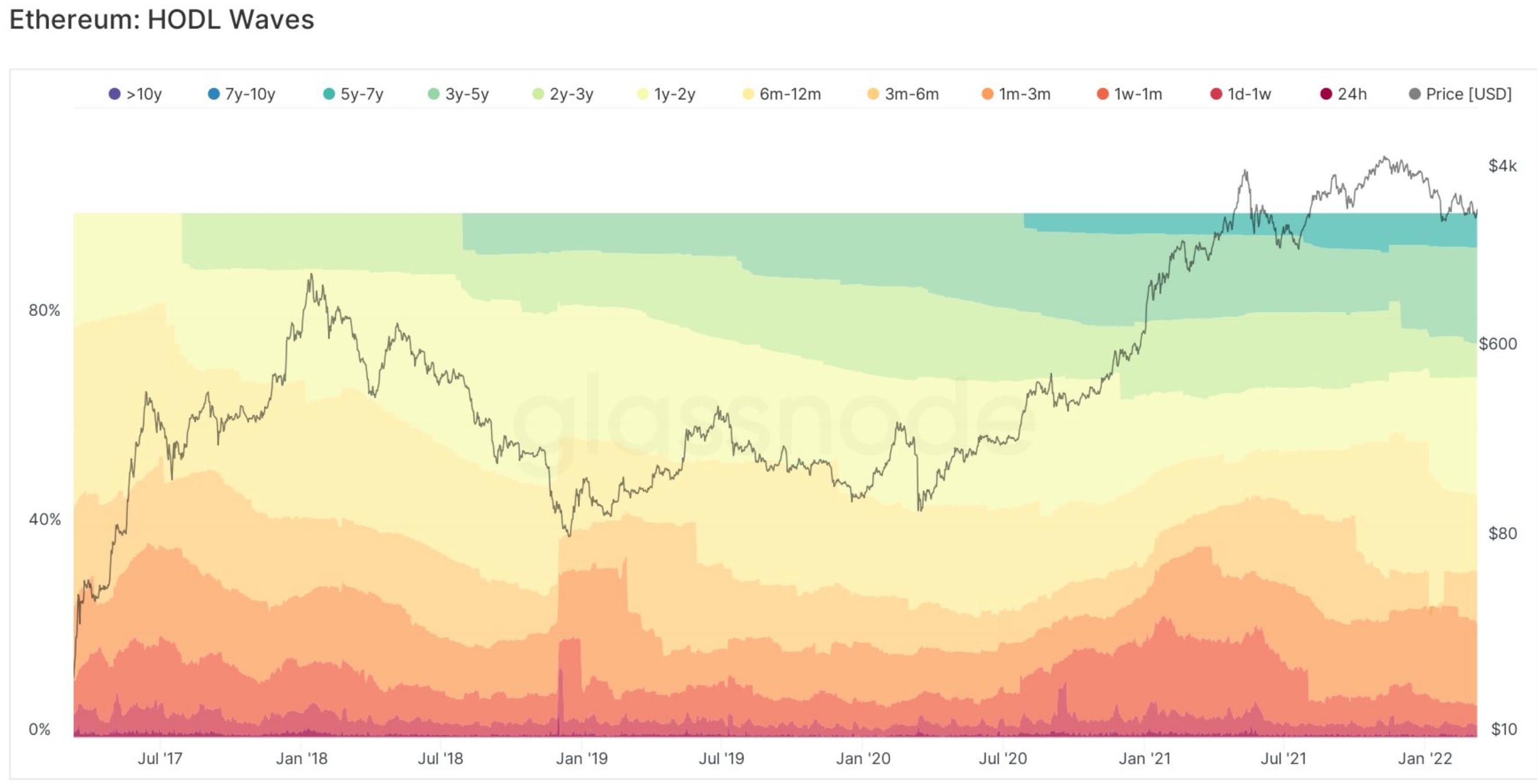

Despite ‘brutal redistribution trading hands’, a large majority of ETH remained static over the years. Here’s a sign of this- the graph below.

Source: Glassnode

As per the graph, only 6.5% of the supply was active in the last 5-7 years. And, only around 0.3% on average daily. Now, it’s safe to assume the circulating supply of ETH was much lower than generally expected.

Other positive factors included ETH’s percentage of supply in Smart Contracts as well as the introduction of EIP-1559. The latter introduced a fee-burning mechanism from the already existing ETH in the supply.

It’s safe to assume the circulating supply of ETH is much lower than generally expected.

Even more so with EIP-1559.

EIP-1559 introduced a fee burning coins from the already existing ETH in the supply.

It is on pace to burn 3.4M ETH this year.

That’s 2.8% of the whole supply. pic.twitter.com/mnoPD9TRjc

— croissant (@CroissantEth) March 10, 2022

In addition to this, stablecoins consumed a massive part of ETH. The king altcoin was often used to borrow stablecoins in DeFi. Probably the reason why stablecoins were attracting billions of dollars.

At press time, the total market cap of stablecoins accounted for more than $180 billion.

Bullish developments

Ethereum has long been criticized for its high gas fee. Well, it’s interesting to note that Ethereum transaction fees recently dropped to a 6-month low. As per Etherscan.io data, the average cost of transacting on Ethereum at press time was 40 gwei or $2.24.

Ethereum gas fees recently reached levels not seen since last summer ⛽ pic.twitter.com/QS4zVRPNBA

— CoinMetrics.io (we're hiring!) (@coinmetrics) March 9, 2022

At press time, unfortunately, ETH suffered yet another correction of 1.20% in 24 hours. It was trading at the $2,562 mark with speculations of further setbacks.