Ethereum: Here’s the latest prediction for its price and supply

- Ethereum’s net supply has been shrinking at an annual rate of 0.248%

- Projections highlighted interesting observations for Ethereum’s supply

More than 307,000 Ethereum [ETH] coins have exited circulation since the pivotal ‘Merge’ event. In fact, this was the lowest volume of ETH in circulation since the network made a historic shift from the proof-of-work (PoW) consensus mechanism to proof-of-stake (PoS).

ETH’s supply goes south

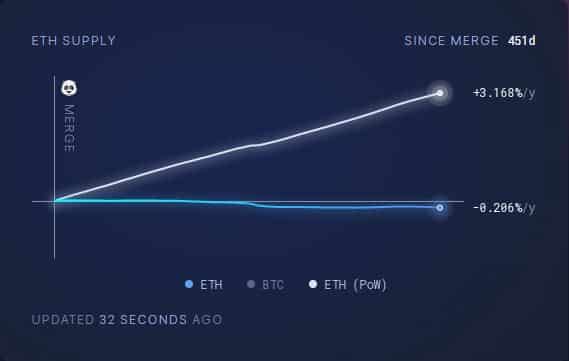

According to AMBCrypto’s scrutiny of ultra sound money data, the net supply has been shrinking at an annual rate of 0.248%. This might appear inconsequential to some but fathom this – Had the transition not taken place, ETH’s total supply would have increased by more than 4.71 million with an annual inflation rate of 3.168%.

Scarcity is critical to the long-term demand of any financial asset. In the case of cryptocurrencies, the fewer tokens in circulation, the greater the likelihood of price increases, provided demand for the asset remains the same.

At the time of writing, Ethereum’s current supply stood at 120.21 million. As per long-term projections, the supply has hit its peak, with the same to gradually start declining from next year. By the end of 2025, the total number of ETH in circulation is predicted to shrink to 117.7 million.

A much-needed respite

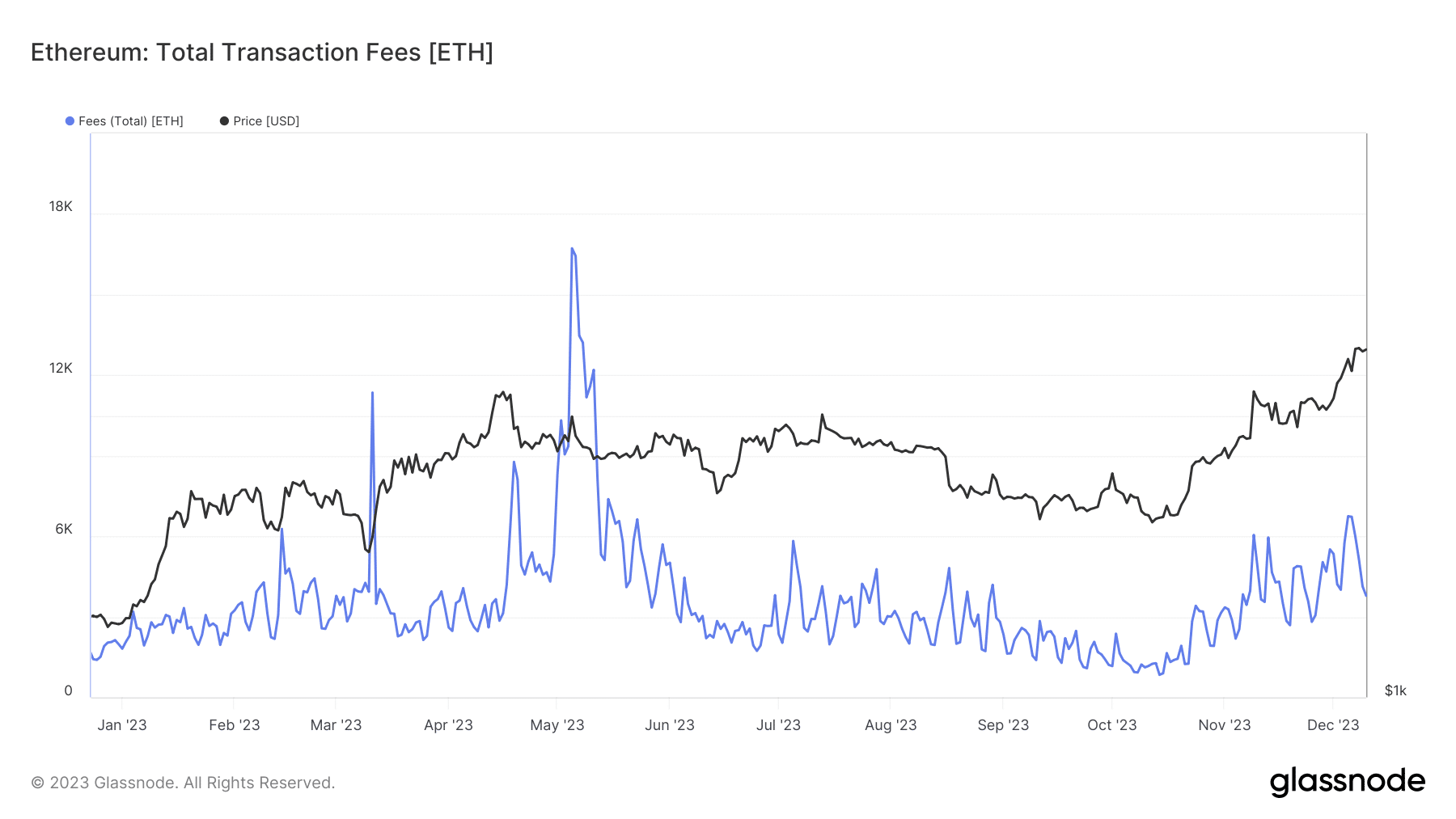

This is a welcome development as not too long ago, ETH became inflationary owing to poor participation on the network. For much of September and early October, more coins were getting created than they were burned.

As examined by AMBCrypto using Glassnode’s data, network fees tumbled to yearly lows during the aforementioned period. This suggested that transactions on the network had declined, leading to fewer ETH getting burned.

Note that a part of the fee charged for validating transactions, called base fee, is burned and removed from circulation. Generally, a bull market with high network usage aids deflation and vice versa.

Read ETH’s Price Prediction 2023-24

Market still upbeat, despite pullback

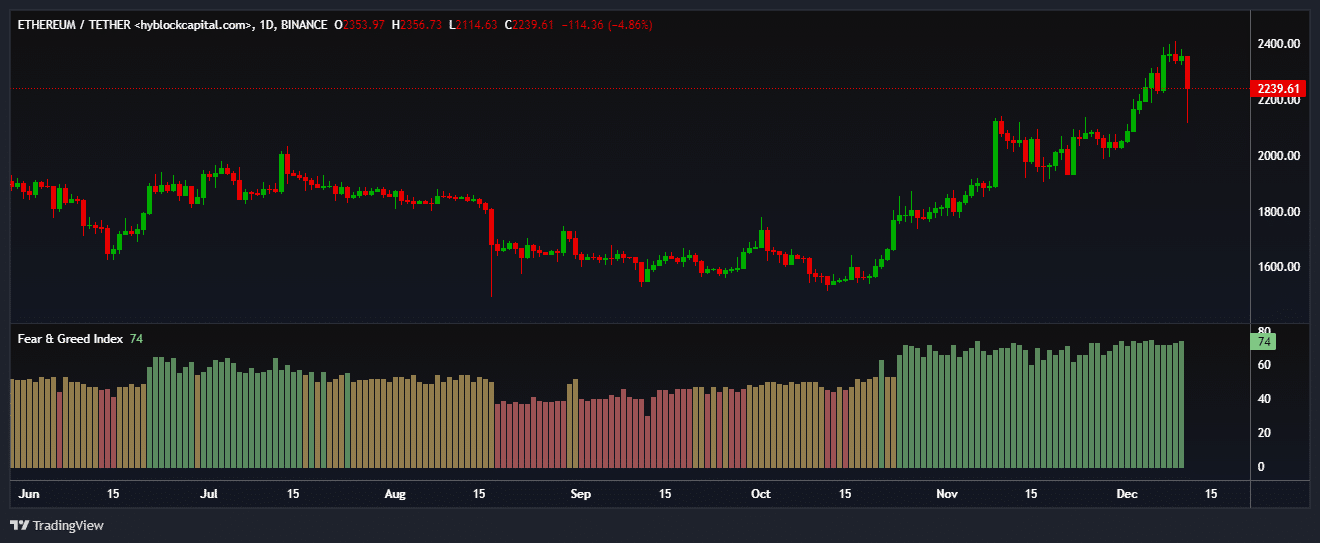

At press time, the second-largest cryptocurrency was exchanging hands at $2.240, having just recorded one of the sharpest corrections since the commencement of the bull rally in October.

Having said that, the market sentiment remains optimistic. Greed remains uniform across the market, with AMBCrypto using Hyblock Capital’s data to highlight the same. This is a key finding since it is generally assumed that greed drives the asset’s value higher.