Ethereum: How has the upgrade actually made a difference

Ethereum’s EIP-1559 upgrade caused quite a stir in the crypto-verse and even helped pump the top alt’s price from under $2500 to $ 3,200. The hard fork took place on August 5.

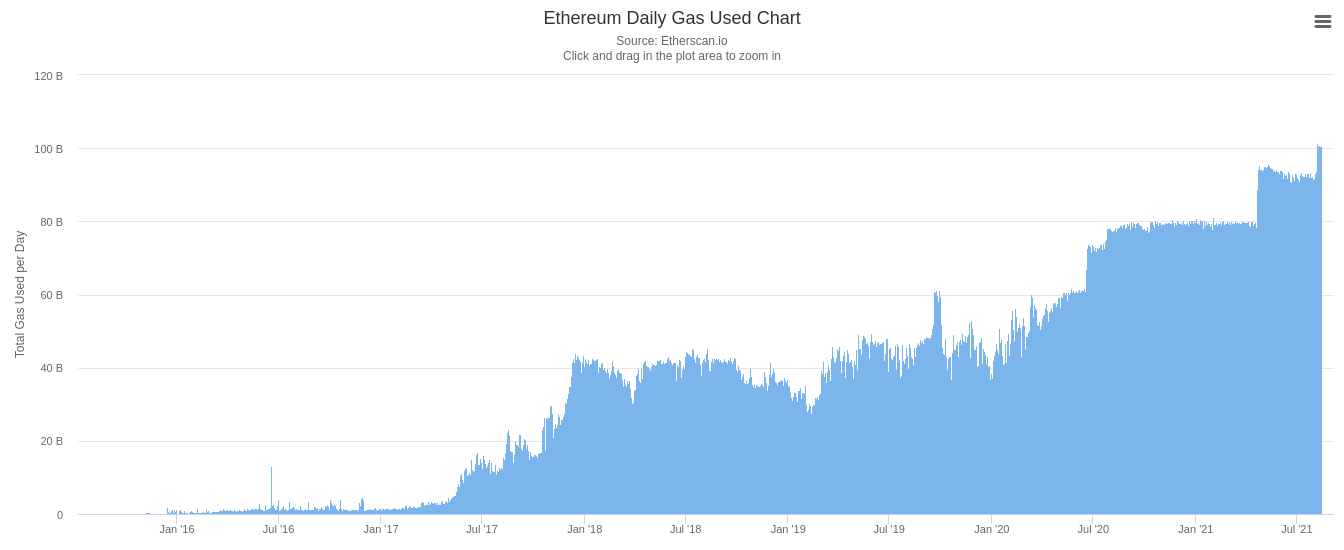

While in layman’s terms, the upgrade’s goal is to create a more secure, user-friendly, and scalable blockchain. It is set to make significant changes to transaction fees and gas refunds. Theoretically, all this sounds good and makes a worthy argument in the favour of the network and upgrade, but here’s how the upgrade actually made a difference. A look at the daily gas usage chart highlighted that the average gas used per day had increased from 92 billion to 100 billion which is a 9% increase.

There are primarily three reasons behind this, as highlighted by Ethereum founder Vitalik Buterin:

Ice age delay

The analysis shared by Buterin highlighted that the London fork led to a delay in the ice age, which had barely started to take effect when the London fork began. Pre-London, average block times were approximately 13.5 second, and post-London they stood at around 13.1 second. This accounted for an approximately 3% difference in block speed, explaining the 3% out of the 9% increase in on-chain gas usage.

Ethereum’s ‘Difficulty Bomb’ increases the difficulty exponentially over time and eventually leads to what is referred to as the ‘Ice Age’. It simply means that the chain becomes so difficult to mine that it grinds to a halt and stops producing blocks or freezes.

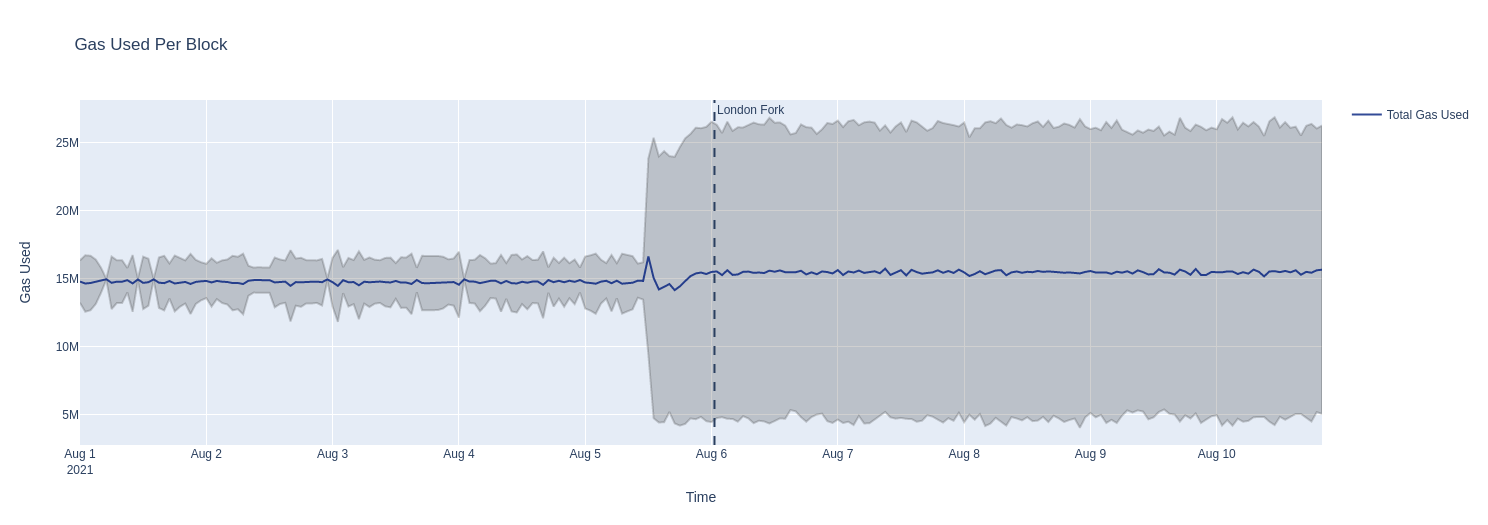

Pre-London blocks being not full

Pre-London, the maximum block gas used was 15 million, but not all blocks used the entire amount and would leave unused gas. Now since there’s too little remaining space to fit a single transaction, and on top of that, there are occasional block producers who make empty blocks. An analysis had suggested that around 2% of blocks were empty, meaning that pre-London there was around 2-3% unused space.

Post-London, however, 15 million is not the maximum limit, it’s the target, meaning that if the average gas used, including the empty blocks, the base fee will decrease until the average is back to the target. This again accounts for another 2-3% increase in on-chain gas usage.

Imperfections in the base fee adjustment formula

Finally, there were some mathematical imperfections in the base fee adjustment. EIP 1559 formula is not quite perfect in targeting 50%. For the base fee to remain constant the average usage needs to be slightly above 50%. The analysis further noted that since the theoretical minimum volatility bias is zero if every block is exactly 50% full, the base fee remains constant in each block.

The theoretical maximum volatility bias is the case where 53.13% of blocks are 100% full and 46.87% of blocks are empty helping the base fee to remain constant with blocks being on average 53.13% full. Actual usage seems to be right in the middle of these two extremes: taking data from one recent observed time span, average blocks were 51.5% full (so, around 3% above the “intended” fullness).

A data analysis roughly confirmed both of the last two numbers, looking carefully at the pre-London and post-London blue line, and the horizontal 15 million line on the chart below.

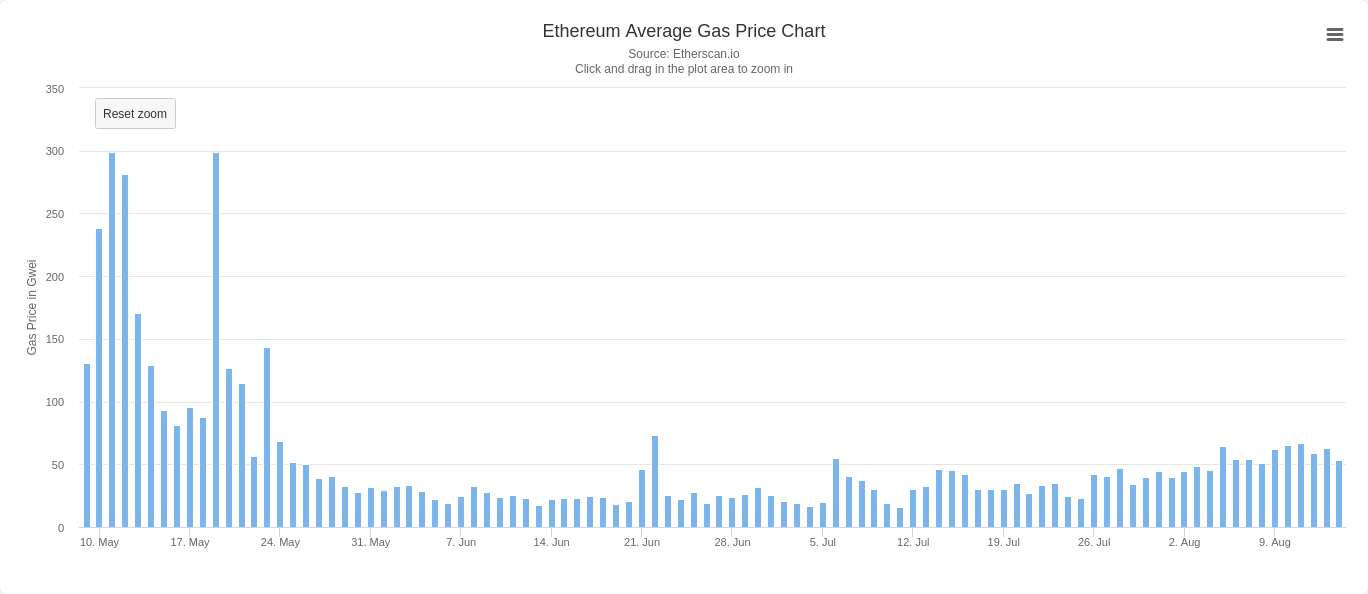

What about the high gas fee?

For now, Ethereum users could rejoice in the unintentionally 6% increased capacity that London brought. However, one thing that seemed to bother users most is the gas fee, it seemed like gas fees stabilization will take longer than anticipated. To this, Buterin said that the fees weren’t going up and the supposed fee increase is just the continuation of a month-long trend. Notably, however, the gas prices were supposed to go down and still held above the June end and July levels.