Ethereum NFT market’s resurgence might be short-lived, here’s why

- Yuga Labs’ NFTs drive Ethereum NFT market resurgence.

- APE token sees a decline amidst overall market growth.

Over the last few days, the Ethereum NFT market has taken a massive hit, as Bitcoin inscriptions took over. Ethereum-based NFTs such as BAYC and MAYC were severely affected as attention towards inscriptions increased.

However, new data suggests that the demand for Ethereum NFTs has resurfaced.

Time for a comeback?

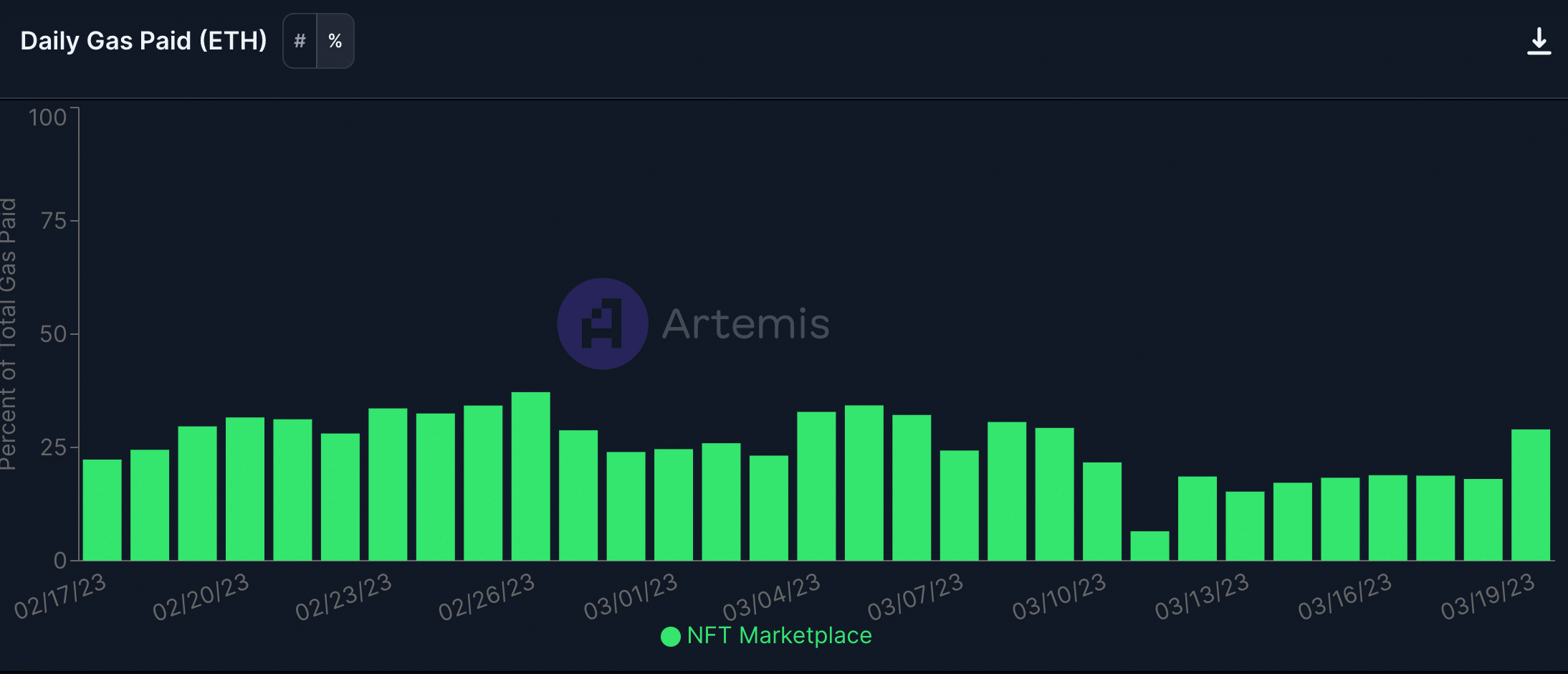

According to Artemis’ data, the gas used on Ethereum for NFT purposes witnessed a large spike. But NFT marketplaces haven’t been on the receiving end of the growth as sales have moved south.

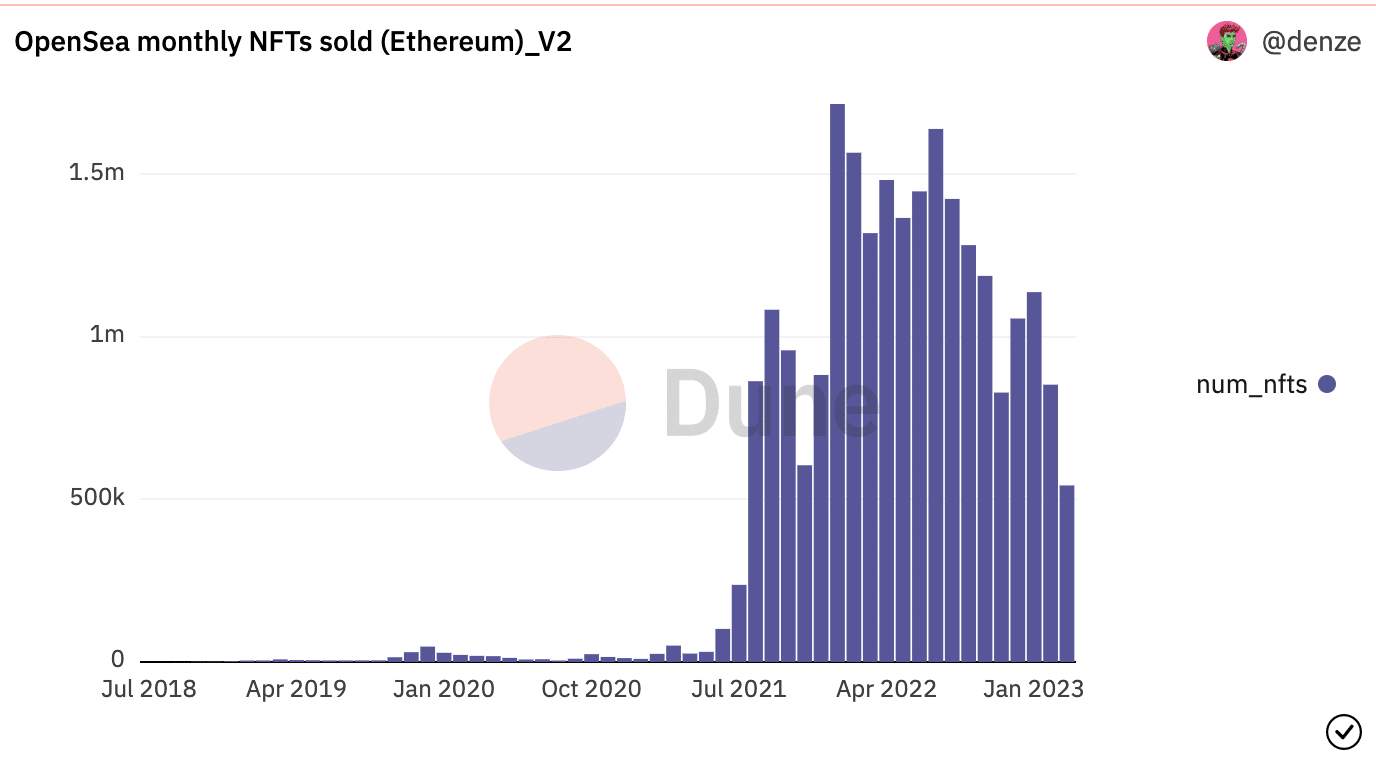

Based on Dune Analytics’ data, the monthly Ethereum NFTs sold on OpenSea continued to plunge indicating a fall in the health of the Ethereum NFT market.

However, the decline in sales could also be due to enormous competition in the NFT space, with new players such as Uniswap entering the market.

A large part of the interest in Ethereum NFTs could be attributed to the Yuga Labs NFT cohort, which dominated the NFT market at the time of writing.

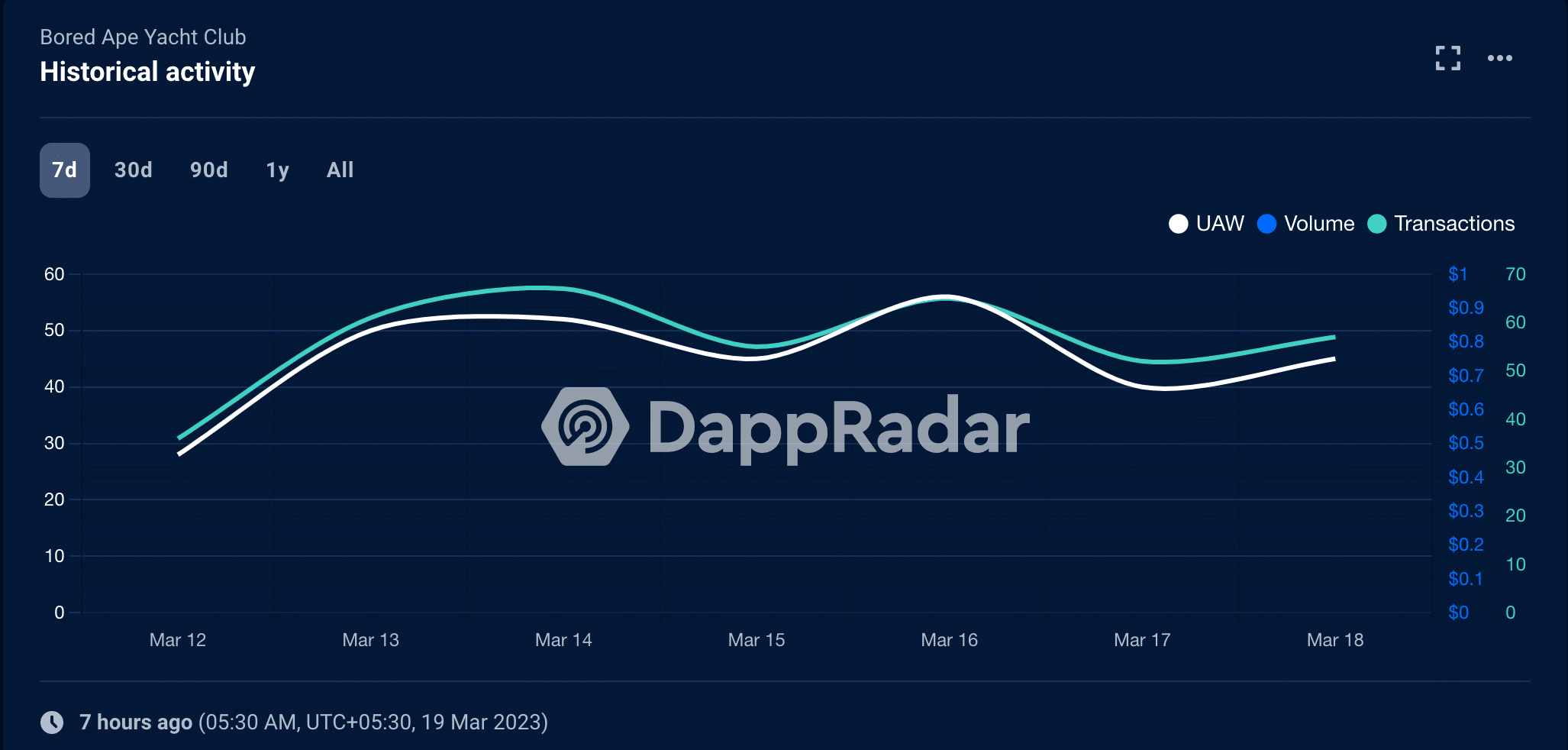

BAYC, one of the most popular NFT collections of Yuga Labs, at press time, observed a massive spike of 25.16% in the number of transactions. In fact, the number of unique wallets holding the NFT collections also increased by 22.27%, according to new data provided by DappRadar.

MAYC, another collection of Yuga Labs, was not left behind, it too witnessed growth. According to NFTGO’s data, the volume of MAYC surged by 1.87%, at the time of reporting. Subsequently, its sales went up by 6.82% in the past 30 days.

A disconnect

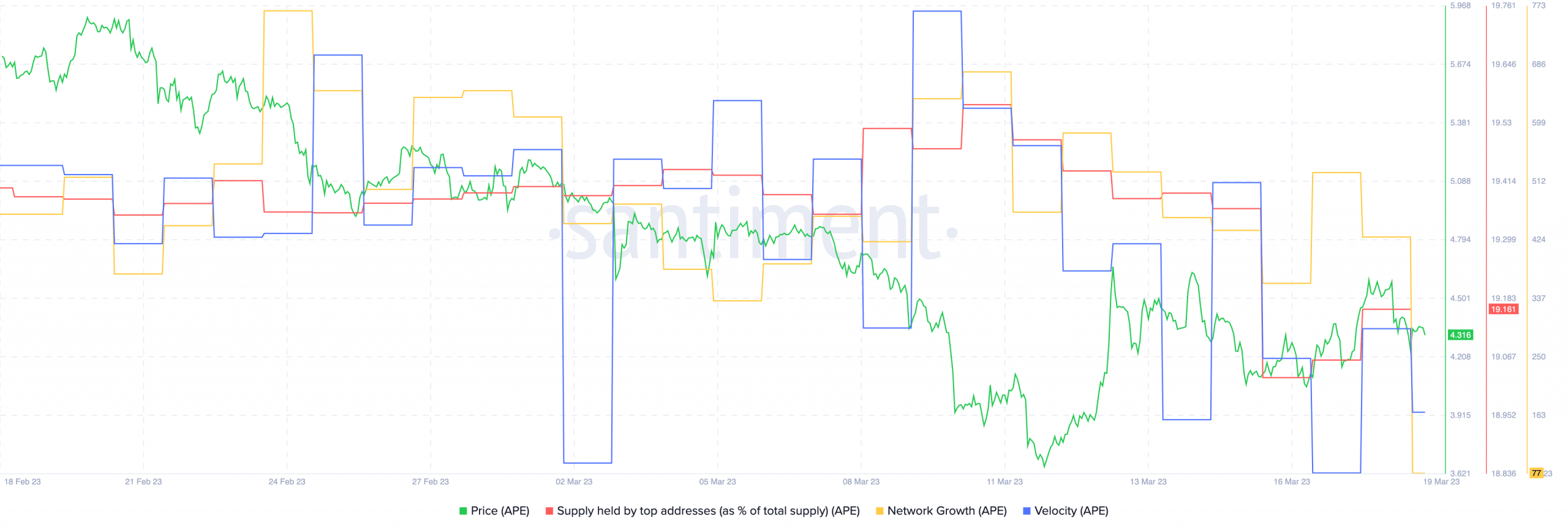

Although Yuga Labs’ NFTs witnessed a surge in demand, the APE token did not experience a similar level of interest.

According to data from Santiment, large addresses have started to sell their APE holdings. This has resulted in a price decline for APE. The coin was trading at $4.35 amid a market-wide sell-off.

Realistic or not, here’s APE’s market cap in BTC’s terms

Curiously enough, the velocity and network growth of the APE token fell. Thus, suggesting that new addresses were not interested in the token. Also, the frequency with which APE was being traded in the market had declined, at the time of writing.