Ethereum: NFT winter carries on as Bitcoin, Solana take the stage

- Ethereum’s NFT trading activity plummeted sharply in December 2023.

- A major chunk of the volumes was scooped up by Bitcoin and Solana NFTs.

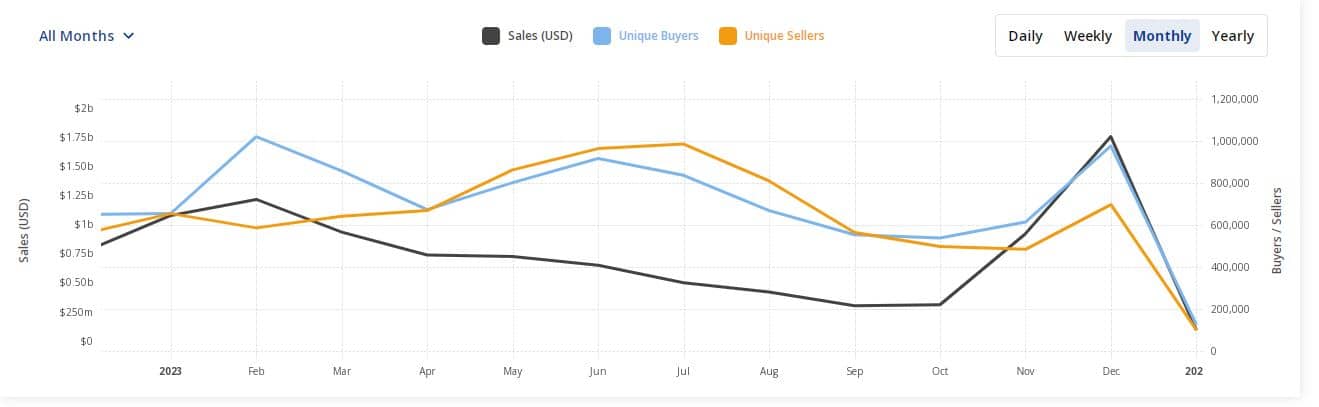

The worst of the non-fungible token (NFT) market might be behind us, as the last quarter of 2023 witnessed a significant surge in sales volume after months of progressive declines.

Trades worth $1.75 billion were settled in December, AMBCrypto discovered using CryptoSlam’s data, the most prolific month for NFT activity since June 2022. Noticeable spikes in the number of unique buyers and sellers were also observed.

All these developments gave a strong indication that the NFT winter may have thawed.

Ethereum loses sheen

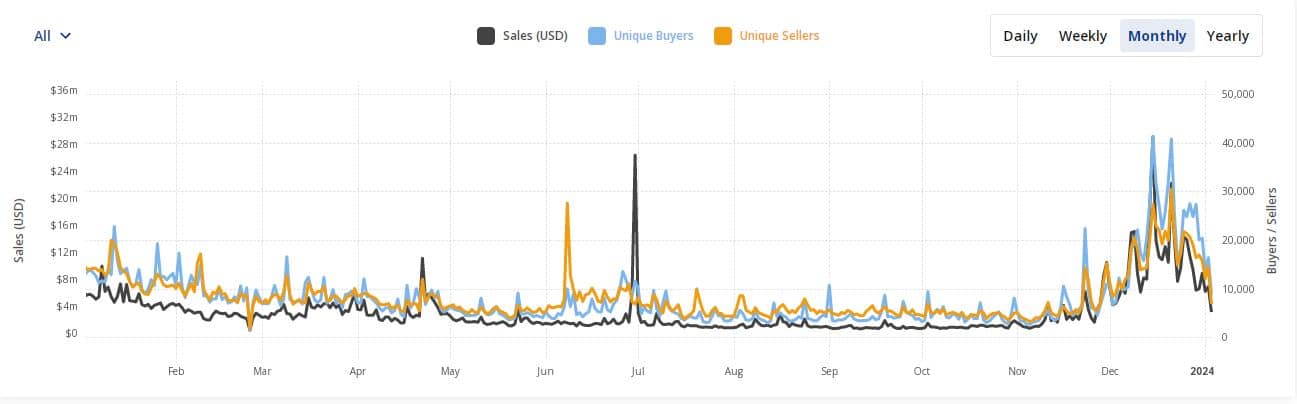

However, the same cannot be said for Ethereum [ETH], which was once the largest home for world-beating NFTs but now finds itself losing a big chunk of its market dominance.

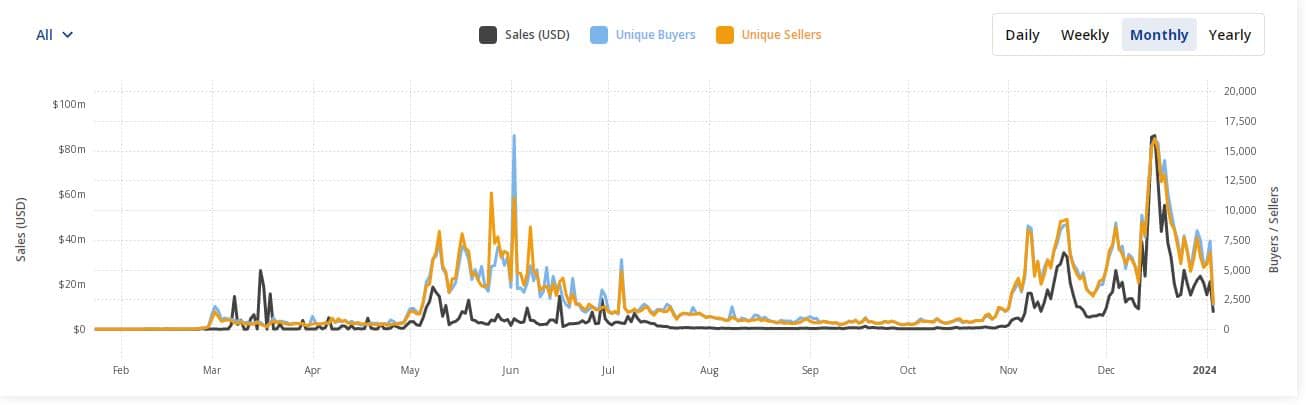

Although data scanned by AMBCrypto revealed a notable surge in ETH NFT sales in the initial part, the momentum soon plateaued during the November to mid-December period.

Worse, in the latter half of December, the trading activity plummeted sharply. In the last 30 days, the total number of NFT transactions fell 42% while the sales value dipped by 19.85%.

Even a cursory look at CryptoSlam’s website was enough to highlight how lackluster Ethereum has been lately in its NFT game.

None of the top 10 NFT collections by sales volume over the last month belonged to the traditional powerhouse, which birthed hugely popular brands like CryptoPunks and Bored Ape Yacht Club [BAYC].

A passionate NFT proponent also emphasized Ethereum’s thinning grip on the NFT market. The user Beanie took to social platform X and remarked,

“Literally no volume outside of some of the top pfp projects. 1/1 and generative art down bad. I expect this market trend of new chains to continue this year and projects to migrate away.”

So, who did it cede its dominance to?

Bitcoin takes the charge

The growth driver of the NFT industry in recent months has been Bitcoin [BTC]. In fact, BTC clocked the highest NFT sales in the last 30 days, totaling $869 million, more than doubling from the previous month.

In comparison, Ethereum generated sales of just $343 million.

Bitcoin-based collections were topping the charts and accounted for the bulk of the space in the top 1o collections list over the last month.

The primary driver of Bitcoin’s burgeoning NFT ecosystem, as it has become pretty obvious by now, was the Ordinals protocol.

Notice the two dramatic spikes in Bitcoin’s NFT activity on two occasions in the past year. The first was in May, and the second was towards the tail end. Both these periods were a result of strong demand for Ordinals.

For the curious, Ordinals work by embedding images or other data directly on the chain. They can be used to create digital assets like non-fungible tokens (NFTs).

One of the biggest advantages of Ordinals is that they are cheaper to mint and transact on the chain.

Solana emerges as another success story

Apart from Bitcoin, Solana made rapid gains in the NFT industry in the last few months. The blockchain processed trades worth $328 million over the last 30 days, within touching distance of Ethereum’s numbers.

In fact, Solana’s NFT sales more than tripled in December, with similar surges observed for the number of transactions, buyers, and sellers.

Solana’s marquee collection Mad Lads played a key role in boosting Solana’s NFT market. A collection of 10,000 unique profile picture (PFP) NFTs, Mad Lads saw a 6% increase in NFT sales over the last month.

However, the growth was led by Tensorians, the NFT collection launched by Solana’s newly thriving NFT marketplace Tensor.

Indeed, Tensorians registered trade volumes worth $27.7 million over the last month, marking an increase of 267%. It was the fifth-largest collection in terms of sales in the same period.