Ethereum: Odds of ETH hitting a new ATH in Q4 are…

- Ethereum rejects off a range high despite recession and potential world conflict fears.

- Blackrock steers increased wallet activity on ETH network.

Ethereum [ETH] has been accumulating since its peak and recently broke out of an upward pattern, testing the previous high and confirming the uptrend.

This swift rejection off the range-high is a clear indication that the broader uptrend on ETH is still strong which could see the asset make a new ATH in Q4 of 2024.

For traders or investors, now is a good time to buy Ethereum, as the current price action suggests a buying opportunity despite the recent market crash and growing fear over a recession or potential world conflict.

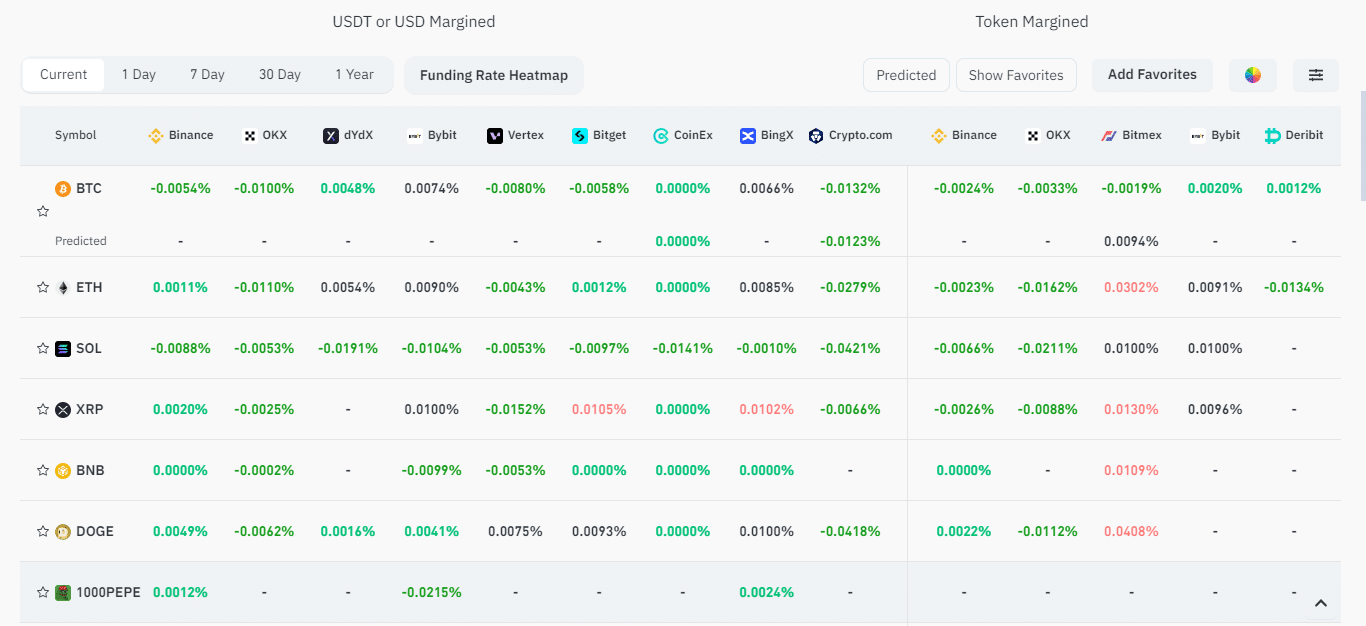

Negative funding rate precedes price surges

Negative funding rates often indicate upcoming price increases, a trend seen in various financial markets including crypto.

AMBCrypto team analysis found out that Ethereum is currently experiencing a downturn, and its funding rates are extremely negative. This usually signals a good time to buy.

Investors should consider this as an opportunity to invest in Ethereum before its price is potentially rebounding.

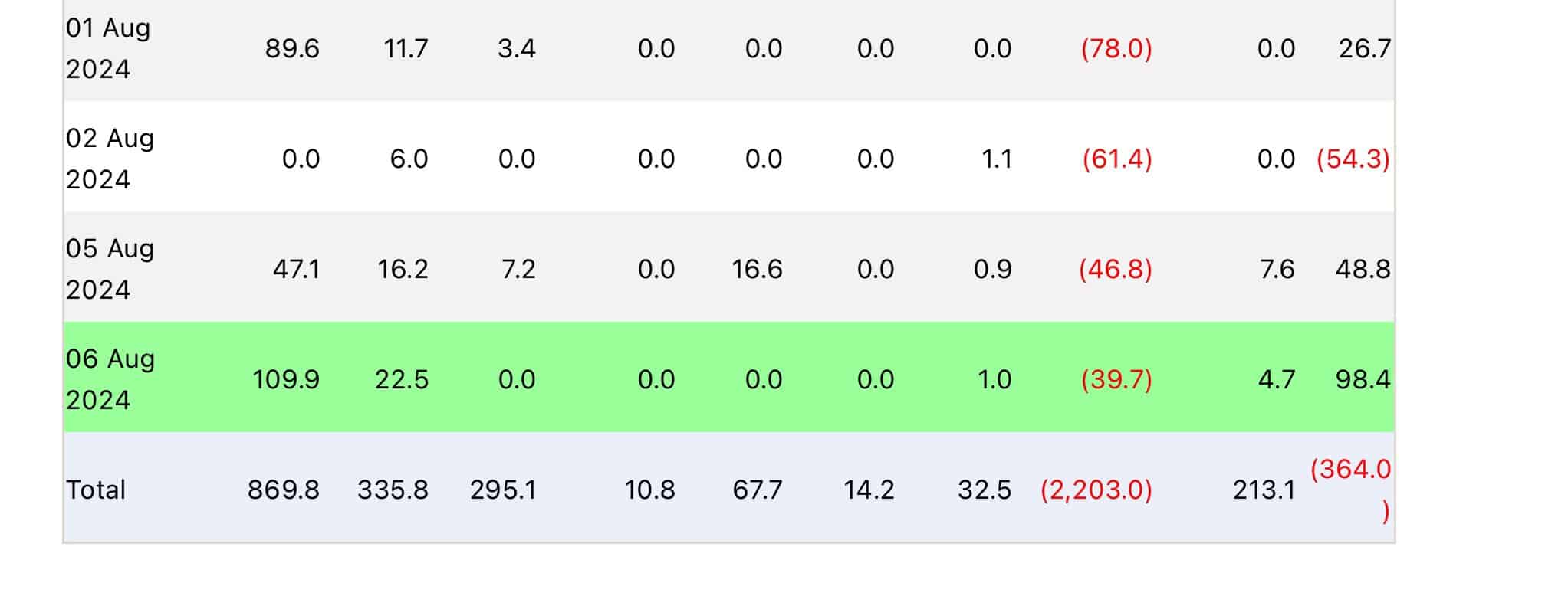

Blackrock’s $47.1M purchase worth of ETH

During the recent crypto market downturn, while many investors sold off their assets, major industrial players like whales and institutional funds seized the opportunity to load up more ETH assets.

BlackRock bought Ethereum worth $47.1 million as X user and market analyst Crypto Rover noted.

This move indicates that despite widespread market instability, significant investments from large institutions could drive Ethereum’s price upward in the future.

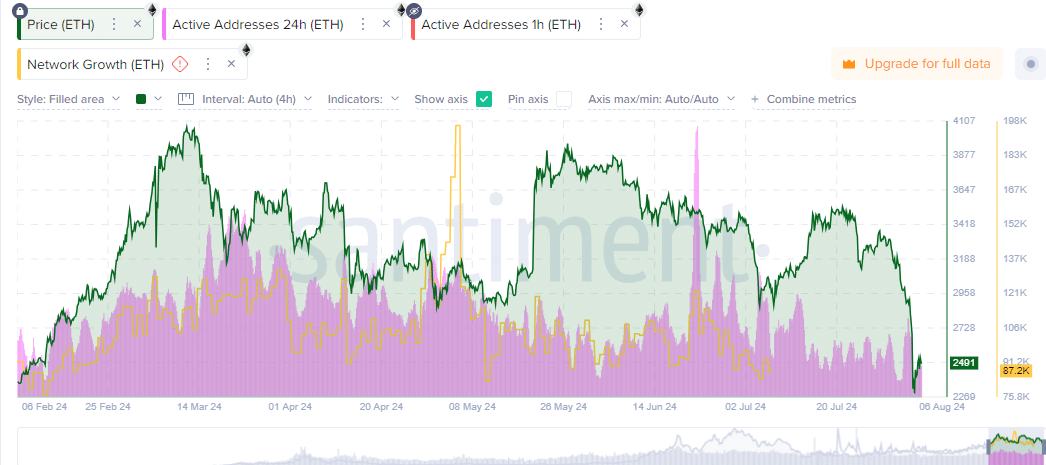

ETH wallet activity showing gradual but significant growth

The recent crypto market drop is the largest since the November 2022 FTX collapse. Despite its significance, the reaction has been relatively muted, which may actually be a positive indicator.

Read Ethereum’s [ETH] Price Prediction 2024-25

This fear has caused many traders to hesitate, presenting a buying opportunity for experienced investors.

Ethereum’s metrics at the time of writing this article, including price, active addresses, and network growth, are showing signs of recovery, suggesting that ETH may maintain its upward trend in the long run.

![Solana [SOL]](https://ambcrypto.com/wp-content/uploads/2025/08/Solana-SOL-1-400x240.webp)