Ethereum -Whale-induced sell-offs have THIS effect on its market trend

- Whales recently moved significant ETH to the exchanges.

- The positive trends have been wiped out with recent declines.

Ethereum [ETH] whales recently made a significant move, which notably affected the netflow in the market. This coincided with a drop in the price of ETH, accompanied by a gradual increase in the supply on exchanges.

Whales move over $100 million in Ethereum

Recent data from Lookonchain revealed that six Ethereum whales recently transferred ETH to the Binance and Coinbase exchanges.

The largest deposit amounted to 10,431 ETH, valued at $32.66 million, while the smallest was 2,000 ETH, valued at $6.28 million, from FTX/Alameda.

In total, 44,000 ETH, worth $140 million, were deposited to exchanges by these whales. Before this, another whale had deposited 11,892 ETH, approximately $38 million, to an exchange.

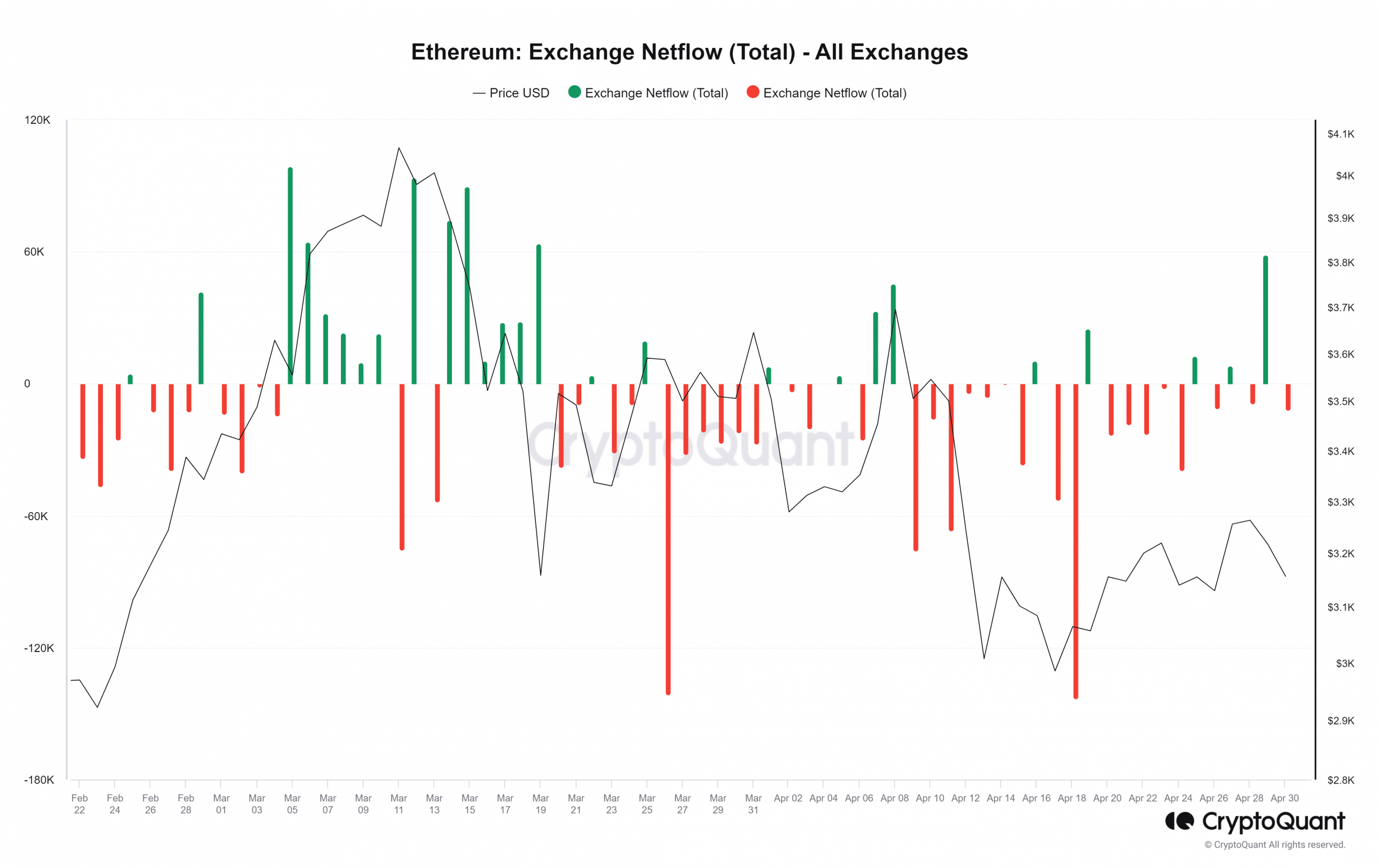

Ethereum netflow sees monthly high

A recent analysis of Ethereum inflows on CryptoQuant indicated that on 29th April, over 281,000 ETH were deposited into exchanges. While this was significant, it wasn’t the highest inflow observed in the month; that record was set on 13th April, with over 401,000 ETH deposited.

However, examining the exchange netflow revealed an interesting trend. On 29th April, the Netflow of ETH into exchanges was over 58,500, with inflows surpassing outflows. This marked the highest inflow of the month, with 19th March being the last instance of such notable activity.

These trends suggest increased selling pressure as more traders are selling ETH rather than buying. As of this writing, there was an inflow of over 57,000 ETH, but outflows, totaling around -8,900 ETH, dominated the Netflow.

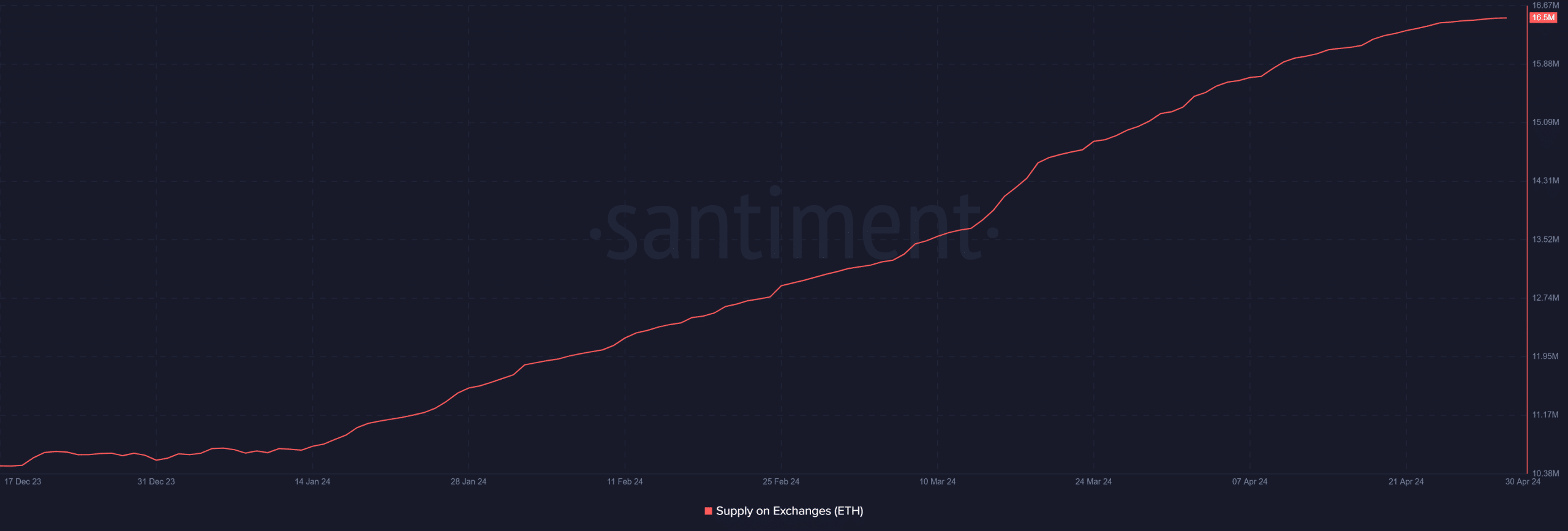

More Ethereum supplied to exchanges

Analysis of the supply on exchange metric revealed a gradual increase in the volume of Ethereum held on exchanges. At the beginning of the month, the supply of ETH on exchanges was around 15.31 million.

However, as of this writing, this volume has risen to approximately 16.5 million.

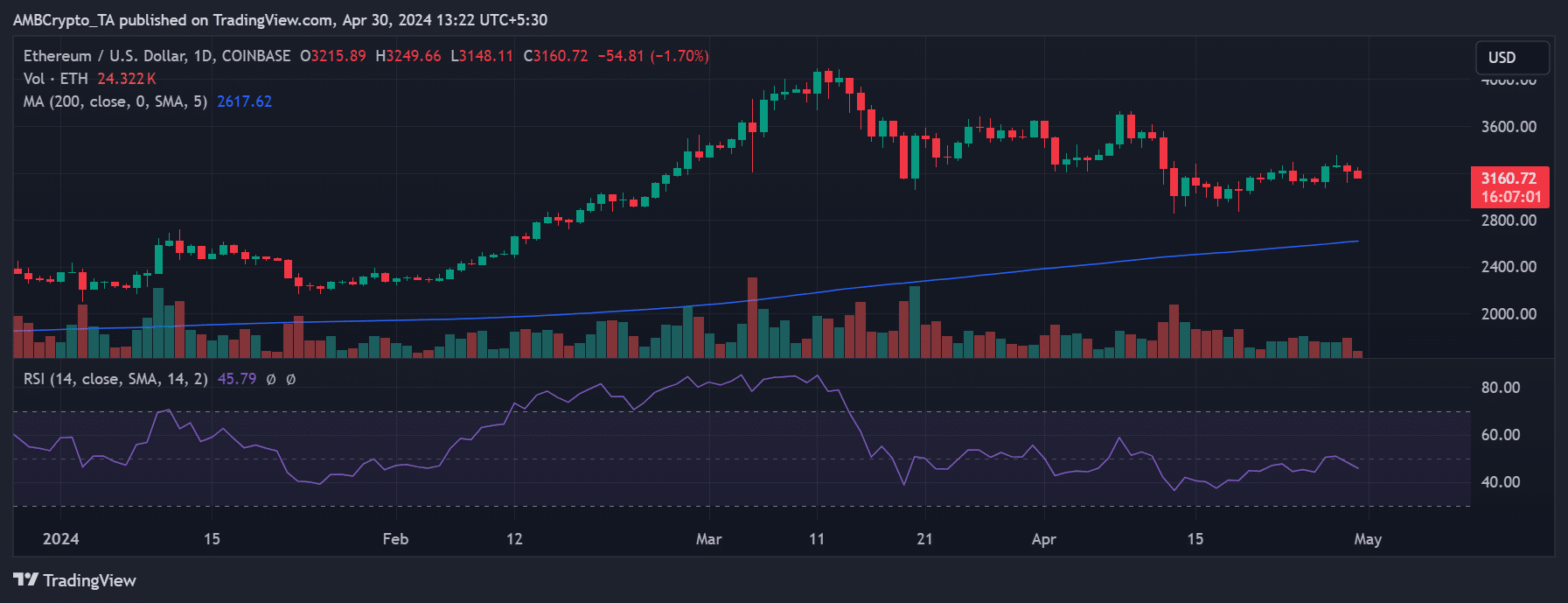

ETH goes back to bear trend

AMBCrypto’s analysis of the daily timeframe chart revealed a dip in Ethereum’s price on 29th April. Trading at around $3,215, ETH experienced a 1.44% decline, reversing the minor uptrend observed in the preceding days.

Read Ethereum (ETH) Price Prediction 2024-25

The chart indicated that this decline pushed Ethereum’s Relative Strength Index (RSI) back below the neutral line, signaling a return to a bear trend. At the time of this writing, ETH was trading at approximately $3,160, reflecting a further decline of around 1.7%.

Additionally, its RSI had moved even further below the neutral line.