Ethereum, Solana, EOS Price Analysis: 27 September

Ethereum showed signs of recovery as buyers started to make an entry into the market, over the last 24 hours, while the coin went up by 2.9%. Certain altcoins, however, independently moved on their charts and recorded losses. Solana and EOS were two of them.

Solana lost 2.7% and was moving towards its immediate support level, however, the technical indicators still pointed towards positive price movement. EOS also registered a 3.3% loss over the last day with signs of a price reversal over the next trading sessions.

Ethereum (ETH)

Ethereum recorded recovery by 2.9% over the last 24 hours and was trading at $3086.07. The altcoin was trading close to its resistance mark of $3190.56, post which, the price ceilings awaited the coin at $3387.06 and $3632.52. Technicals also reflected that the altcoin revived as it signalled towards positive price action.

The Relative Strength Index was above the half-line indicating that buying strength remained positive in the market. MACD displayed green bars on the histogram, after a bullish crossover. Chaikin Money Flow also was above the mid-line, over the past days, the indicator managed to remain above the half-line; an indication that capital inflows have remained consistent.

On the other side, in case of Ethereum dips, the support line stood at $2956.87 and then at $2761.65. Falling below the latter, Ethereum could trade at a multi-month low of $2595.82.

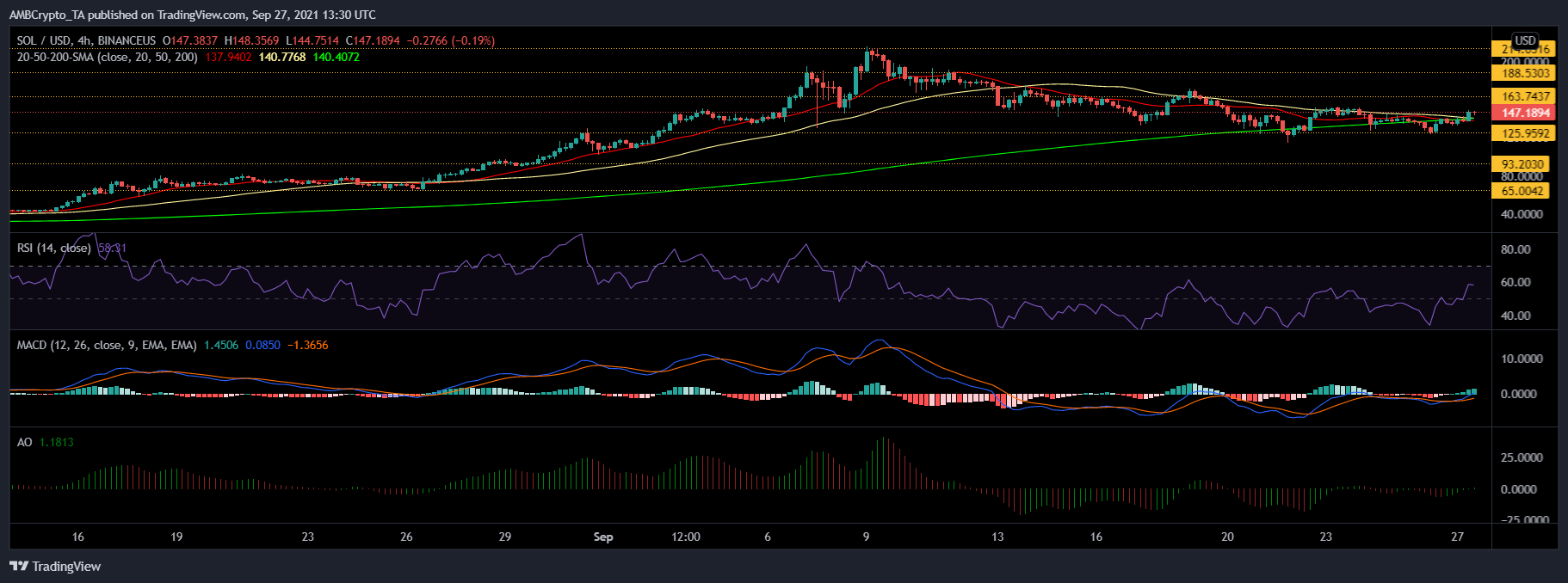

Solana (SOL)

Solana lost 2.7% of its price over the last day and was trading at $147.18. If SOL loses its momentum further, the support level stood at $125.95 and then at $93.20. Breaking below the latter, SOL would trade in its one-month low at $65.00. The technical charts interestingly pointed towards a positive price action. On the four-hour chart, the coin’s price stood above the 20-SMA line, which meant that price momentum was with the buyers.

The Relative Strength Index was also above the half-line as buying strength hadn’t left the market. MACD also flashed green bars on the histogram. Awesome Oscillator noted green signal bars.

Going by the technicals, prices can rise and find resistance at $163.74 and then at $188.53. Another additional price ceiling rested at $214.03, which was Solana’s all-time high price.

EOS

EOS declined by 3.3% over the last 24 hours and was trading at $3.98. The token was trading close to its immediate support level of $3.90, falling below which it could rest on the $3.59 price floor. The technical indicators were not quick enough to account for the losses incurred over the past day as they still remained positive.

Relative Strength Index was above the half-line suggesting that buying pressure still dominated the market. MACD noted green bars on the histogram. Parabolic SAR, however, displayed dotted lines above the candlesticks; a signal that indicated that the price of the coin was on a downtrend.

In case of EOS recovering its losses, it can move north and experience resistance at $4.54 and then at $5.10. The other price ceiling stood at $5.48.