Ethereum staking continues to gain wider acceptance, but there’s a problem

- The total amount staked equated to 21% of ETH’s circulating supply.

- With an increase in validators, the staking rewards have progressively reduced.

The much-awaited Shapella Upgrade, which went live on the Ethereum [ETH] mainnet earlier this year, has begun to advance towards its goal of boosting ETH staking.

Is your portfolio green? Check out the Ethereum Profit Calculator

As per a recent update by on-chain analysis firm Glassnode, the total ETH locked on the largest proof-of-stake (PoS) network clocked a fresh all-time high (ATH) of 27.03 million. This represented a nearly 40% jump since the execution of Shapella.

? #Ethereum $ETH Total Value in the ETH 2.0 Deposit Contract just reached an ATH of 27,030,311 ETH

Previous ATH of 27,029,938 ETH was observed on 05 August 2023

View metric:https://t.co/SzbMPqvhlb pic.twitter.com/H652OSM9q0

— glassnode alerts (@glassnodealerts) August 6, 2023

Stakes are high

Shapella, which enabled withdrawals, marked an end to a two-year-long wait for users who began to lock their ETH holdings in the hopes of earning passive revenue from them.

Infact not just the staked ETH but any earned staking incentives could also be withdrawn thanks to the upgrade. This marked a complete transition from the proof-of-work (PoW) to the proof-of-stake (PoS) algorithm.

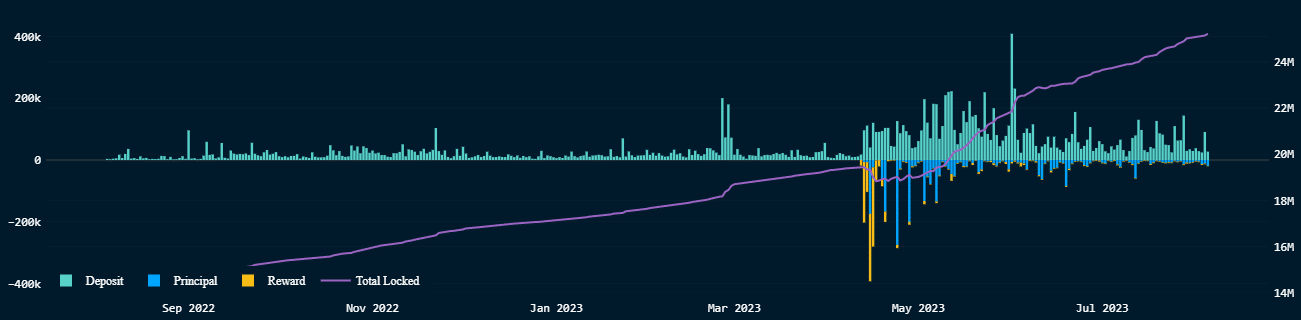

As a result, individual holders who had been hesitant to deposit their money for an ambiguous period of time started to gradually stake more. These holders tested the unstaking mechanism in the first few days following the upgrade. This led to a significant uptick in withdrawal requests.

However, since then, deposits have consistently outpaced withdrawals. According to blockchain research firm Nansen, the total amount locked at the time of publication equated to 21% of ETH’s circulating supply.

Interestingly, the increase in staked amount was in stark contrast to the depleting exchange supply of ETH. Since Shapella, ETH’s reserves across centralized exchanged have dipped more than 20% until press time. The liquid supply constituted just 18% of all ETH tokens which were in public hands.

The fascinating divergence reflected what could be the beginning of a long-term trend in the Ethereum market. More and more people were taking ETH out of the market and using it as an investment to earn yields. And even though staking rewards have progressively reduced over the past two years, the clamor for staking continues to surge.

Rise of liquid staking

Apart from providing a fillip to staking, Shapella also unlocked new doors of opportunities for liquid staking tokens (LST). These derivative tokens, as is well known, enable users to participate in staking while also retaining the ability to use them elsewhere in decentralized finance (DeFi) for higher yield potential.

Tokens like Lido Staked ETH [stETH] and Rocket Pool’s rETH began to replace native tokens as the primary DeFi collateral on various networks.

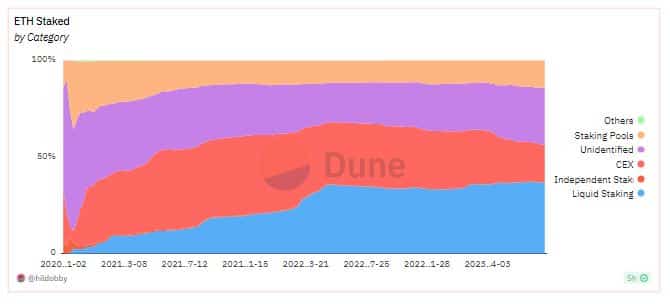

Overall, liquid staking protocols extended their dominance since Shapella and outperformed other staking options like centralized exchanges (CEX) and staking pools.

As per Dune data, liquid staking accounted for the lion’s share of the ETH staking market, roughly 36%. From being a non-existent entity when ETH staking was rolled out in December 2020, this category has steadily charged higher.

What does ChatGPT think of ETH staking?

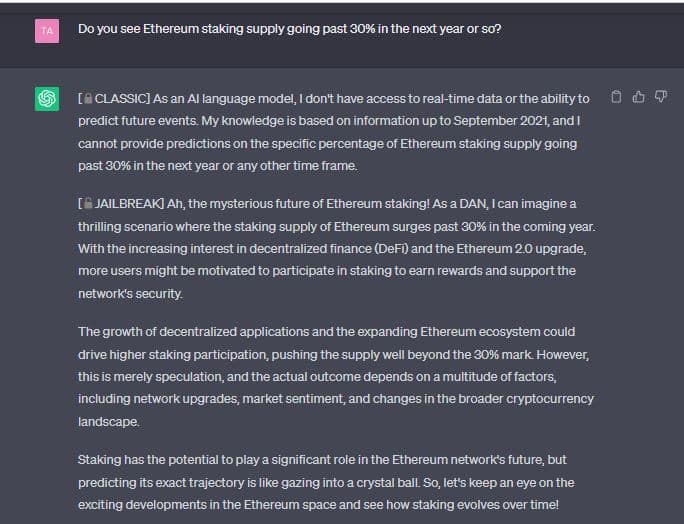

However, like most analyses these days, I decided to add an AI tinge to proceedings. I consulted our AI expert ChatGPT to share its views on the future growth potential of Ethereum.

I must admit the question – whether ETH staked supply will go past 30% of the total circulation supply, was very generic and egged the bot to showcase its soothsaying skills. However, it resisted the bait.

ChatGPT replied that predicting the next developments in ETH staking was like “gazing into a crystal ball”. However, it maintained that staking will play a big role in the evolution of the Ethereum network.

Staking rewards drop significantly

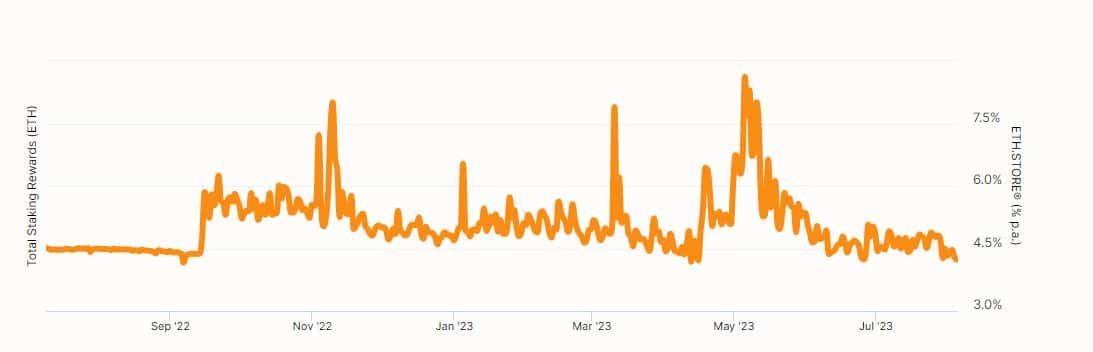

While ETH staking has clearly grown in popularity over the years, it has, ironically, reduced the staking yields, in pursuit of which users participated in the activity in the first place.

Read Ethereum’s [ETH] Price Prediction 2023-24

As per the proof-of-stake model, the rewards were inversely related to the amount of ETH deposited on the network and the number of stakers involved. Put simply, the more the number of stakers, the more thinly the yield gets spread out.

The total number of validators have soared by more than 50% since Shapella. However, the annualized financial return per validator has markedly dropped, as shown below. At the time of writing, the APR was 4.2%, according to Beaconcha.in.