Ethereum takes the brunt of bears as investments in 2022…

Ethereum is regarded as the biggest altcoins, but in the last few weeks, it has not been faring well at the hands of institutional investors.

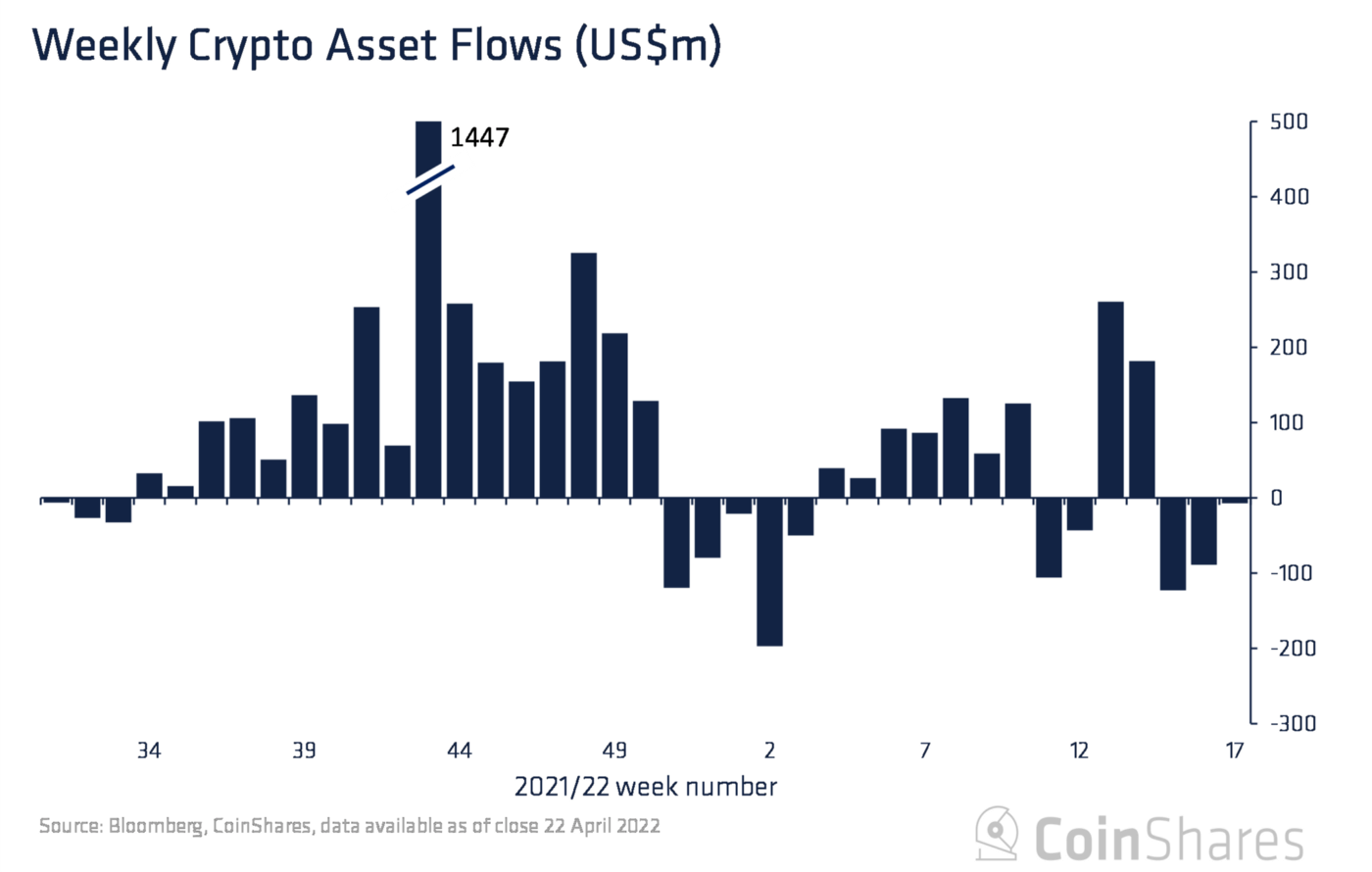

The week ending April 2022 was the best week of this month. Albeit investment products continued noting outflows this week as well, they declined to just $7 million, which is a massive improvement from the $97 million outflows from the week before.

As per CoinShares, the total number of investment product launched have come down from 24 in Q4 2021 to just 11 in Q1 2022.

Institutional investors continue pulling out of the market | Source: CoinShares

Regardless, Ethereum remained at the institutional investors’ crosshair this week as well and ended up observing almost $17 million worth of outflows.

The inflows noted on all the other assets managed to negate Ethereum’s bearishness somewhat, resulting in total outflows sitting at just $7.2 million.

Ethereum continues to note outflows for the third week in a row | Source: CoinShares

While the volatility of the market isn’t sparing any asset, ETH, in particular, is observing a negative response from investors due to its inability to mark a sustainable rise.

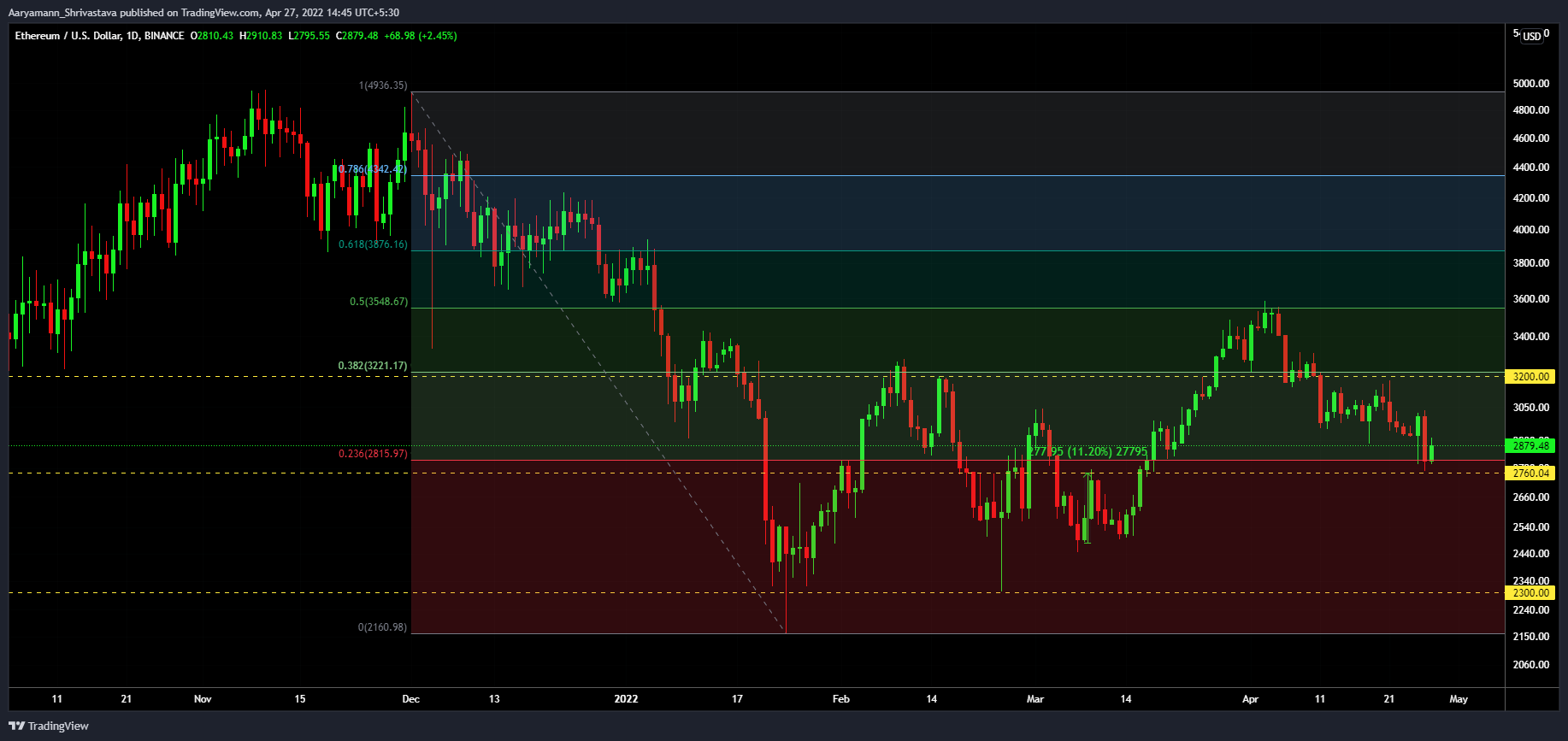

After the March to April rally sent the price up to $3600, it bounced back from the 50% Fibonacci level resistance.

Furthermore, it tested the $3200 level, coinciding with the 38.2% Fib level, and ended up falling to the critical 23.6% level at $2,815 on 26 April after a 6.5% drop in price. Fortunately, it only tested it as support and did not fall through.

Ethereum price action | Source: TradingView – AMBCrypto

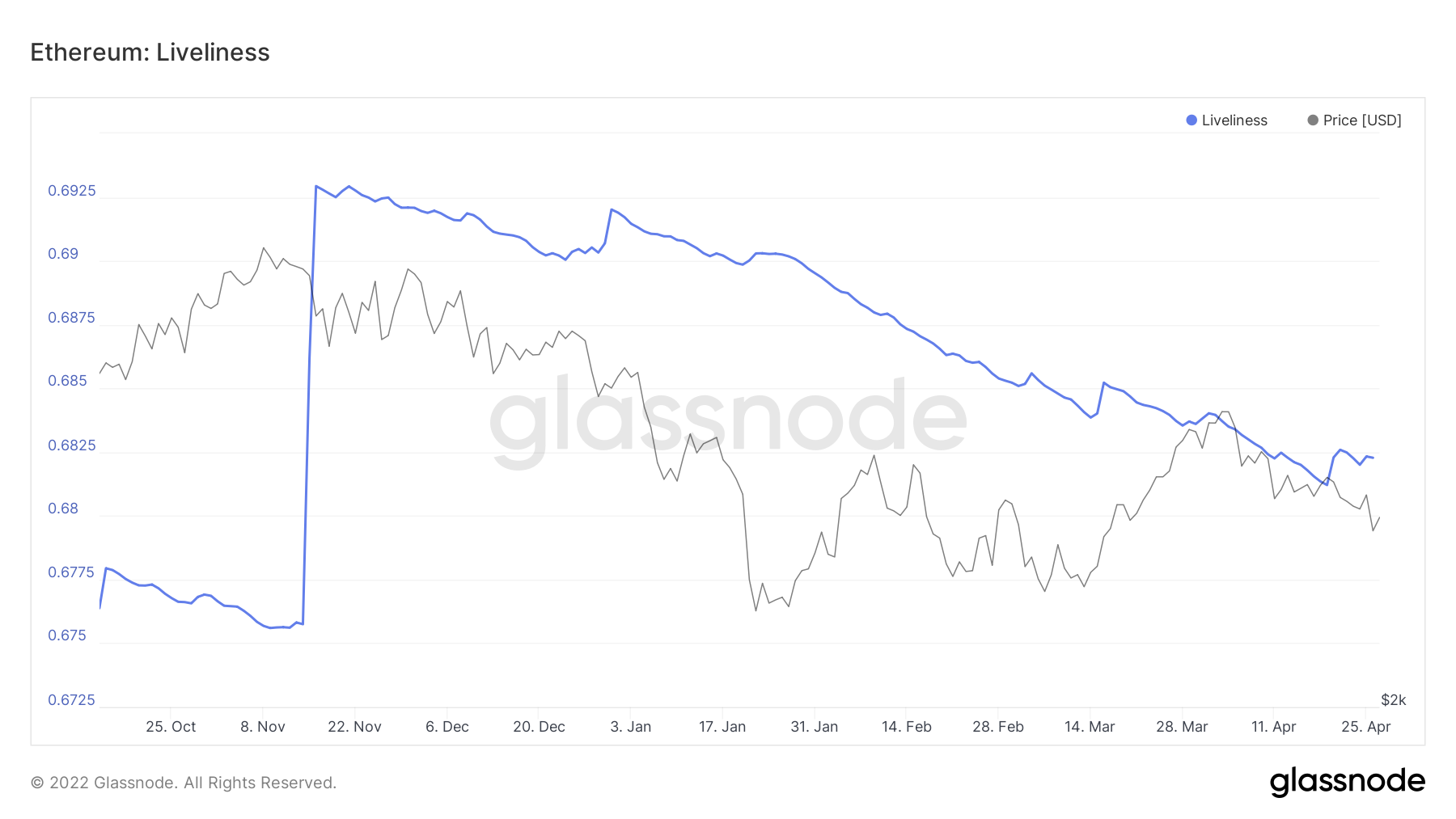

However, the price fall did invalidate the recovery that Ethereum’s supply made with the earlier rally, and the supply in profit fell by 21% within a month. Now, this might be keeping investors wary of investing.

Ethereum’s supply in profit | Source: Glassnode – AMBCrypto

Regardless, Ethereum is bound to get up since, despite their fears, retail investors are still in support of the coin, which is why on a larger timeframe, the sentiment of accumulation or HODLing continues to dominate the market.

There was a slight bump in mid-April when ETH holders sought to liquidate their holding, but with time this conviction will make a push for a quicker recovery.

Ethereum’s liveliness | Source: Glassnode