Ethereum: The road to $3500 is clear but…

With the cumulative market cap back above $2 trillion, all eyes are on the top two cryptos. Bitcoin’s breakout from its recent consolidation has created room for the king coin and altcoins to move higher.

Ethereum was quick to follow BTC’s uptrend as it retested the $3,300-mark on 20 August and then again, at the time of writing. But, the important question remains the same – Will ETH sustain this rally and breach $3500?

A hike in inflows

Even though Ethereum was down 0.92% since last week, it registered 2.33% gains in the last 24 hours. However, even with these price gains, trade volumes for ETH showed no new peaks. In fact, they decreased by almost 50% this week, compared to the last week.

Nonetheless, a hike in inflows was identified by the uptick in RSI at press time.

Source: ETH/USDT Trading View

ETH’s RSI has just entered the overbought zone again and if it oscillated there over the coming weekend, chances of the altcoin rallying to $3500 will be high. After Ethereum broke out of its bullish trend mid-week, sell-offs were stemmed as its price candle tested the 20-day SMA.

With ETH seeing gains at press time, the SMA is back as support. Ethereum could continue its uptrend if the aforementioned metrics hold over the weekend.

The way up looks clear

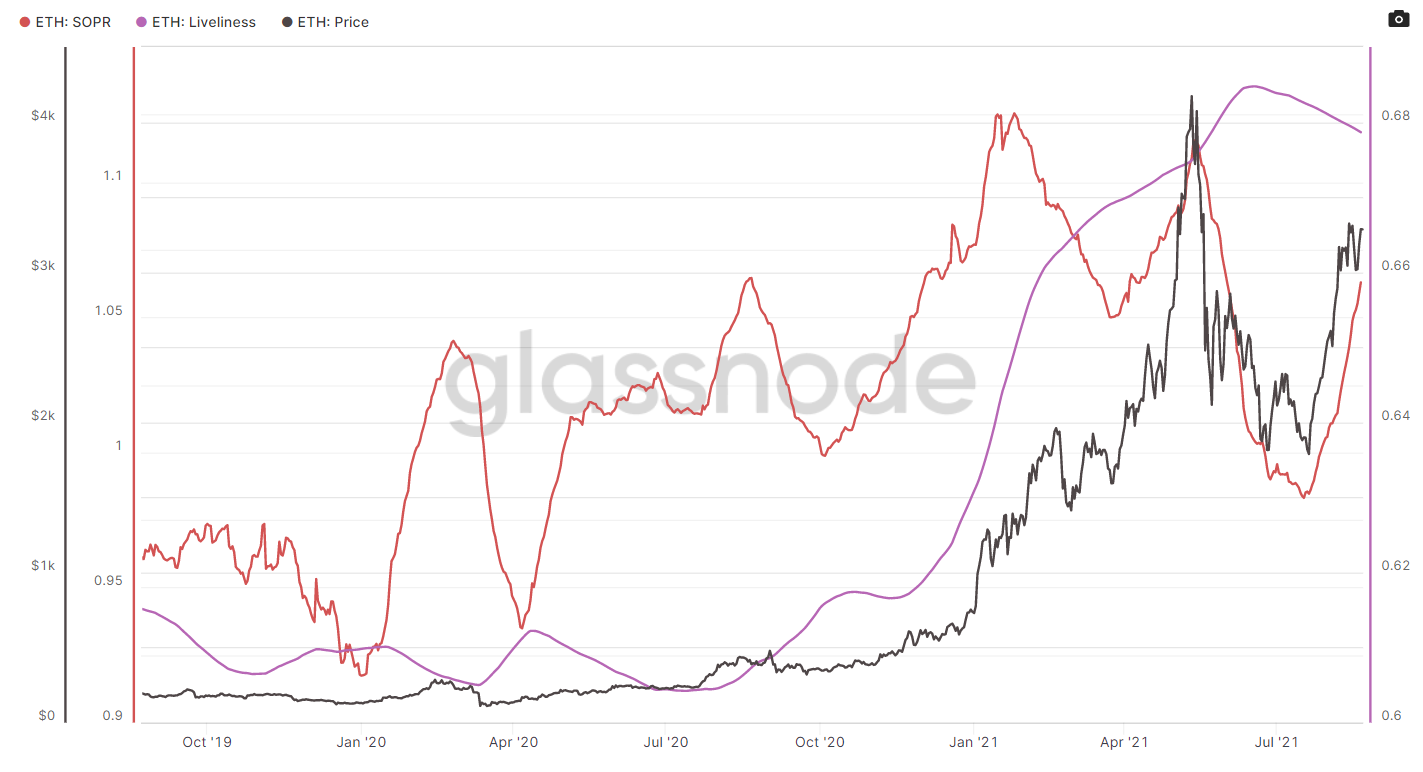

The Spent Output Profit Ratio (SOPR) (30d Moving Average) for Ethereum has been on an upward journey since 20 July. At the time of writing, the indicator was in line with ETH’s bullish trajectory and its value matched levels seen during the April rally. While the SOPR helps identify reversal, historically, a steep rise in the same has been ideal for a rally.

Source: Glassnode

Additionally, Ethereum’s Livelinesss was equivalent to its 18 May levels, showing increased accumulation which was good for the alt’s price trajectory. This meant that a high proportion of coin supply is dormant, implying an increase in HODLing behavior. It also suggested that global Coin Day Accumulation has been outpacing Coin Days Destroyed for Ethereum. With more push from the bulls, $3500 for Ethereum wouldn’t be too far.

Additionally, the average level of gas fees per transaction has been fading back down.

As noted by Santiment, “…it is a nice sign that traders won’t be stagnant in the circulation of $ETH from added costs.”

Source: Santiment

Finally, in spite of all the bullishness at the moment, it is best to take everything with a grain of salt. Moreover, since this rally involved fewer participants due to a steady decline in daily active addresses (DAA), ETH would need more crowds for a sustained rally.

A downward slope in the DAA meant that unlike the May rally, this rally isn’t backed by as many participants. Whether it will hold well and push Ethereum to new ATHs will only become clearer with time.