Ethereum: This confirms the dominance of long-term holders

Ethereum has been doing fairly well lately and continues to surprise investors. ETH rose 7.5% in the last 24 hours, and many believe that it could have been a “relief rally” since the issue of a bug having afflicted the blockchain appears to have been resolved. Now, looking at the metrics, the article further delves into ETH’s performance.

The whole story

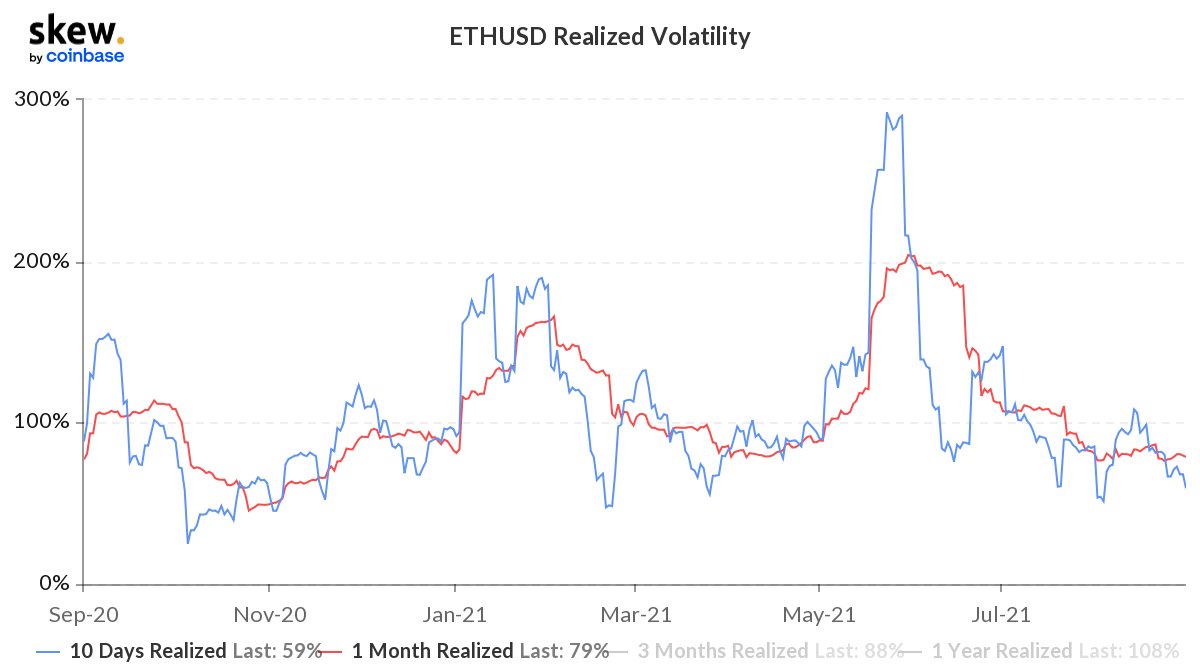

As seen in the chart below, Realized Volatility has reached yearly lows, and yet prices have not consolidated.

Ethereum realized volatility at a yearly low | Source: Skew

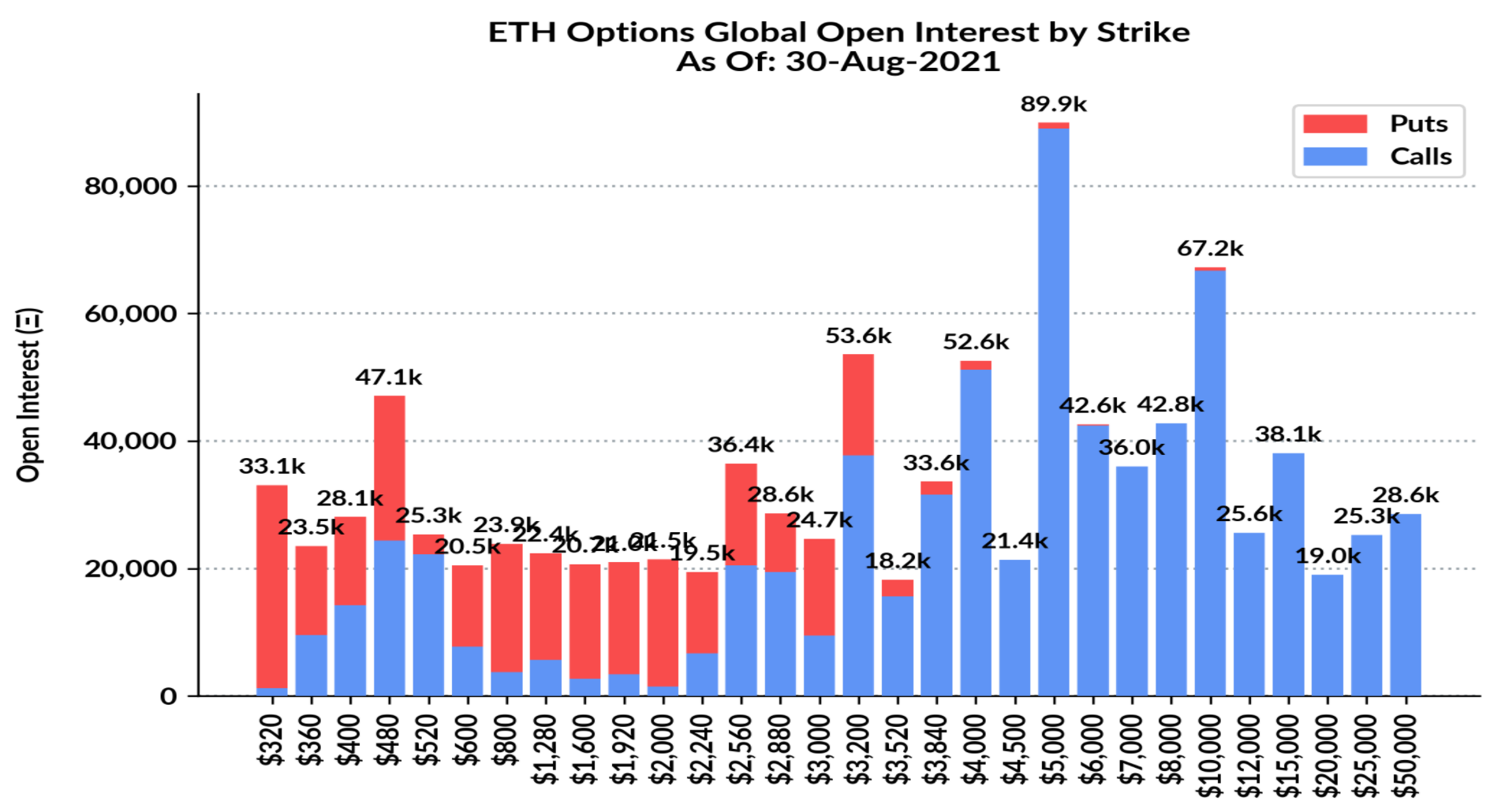

In fact, Ethereum just reached a 3-month high of $3431, creating a local top at the time of this report. A huge reason behind this rise could be investors’ own bullishness. As their sentiment and transactions continue to pump the prices. Options Interest by Strike shows a severely high demand for ETH to reach $5k by the end of year.

Ethereum OI by strike | Source: Skew – AMBCrypto

Will ETH make it to $5K?

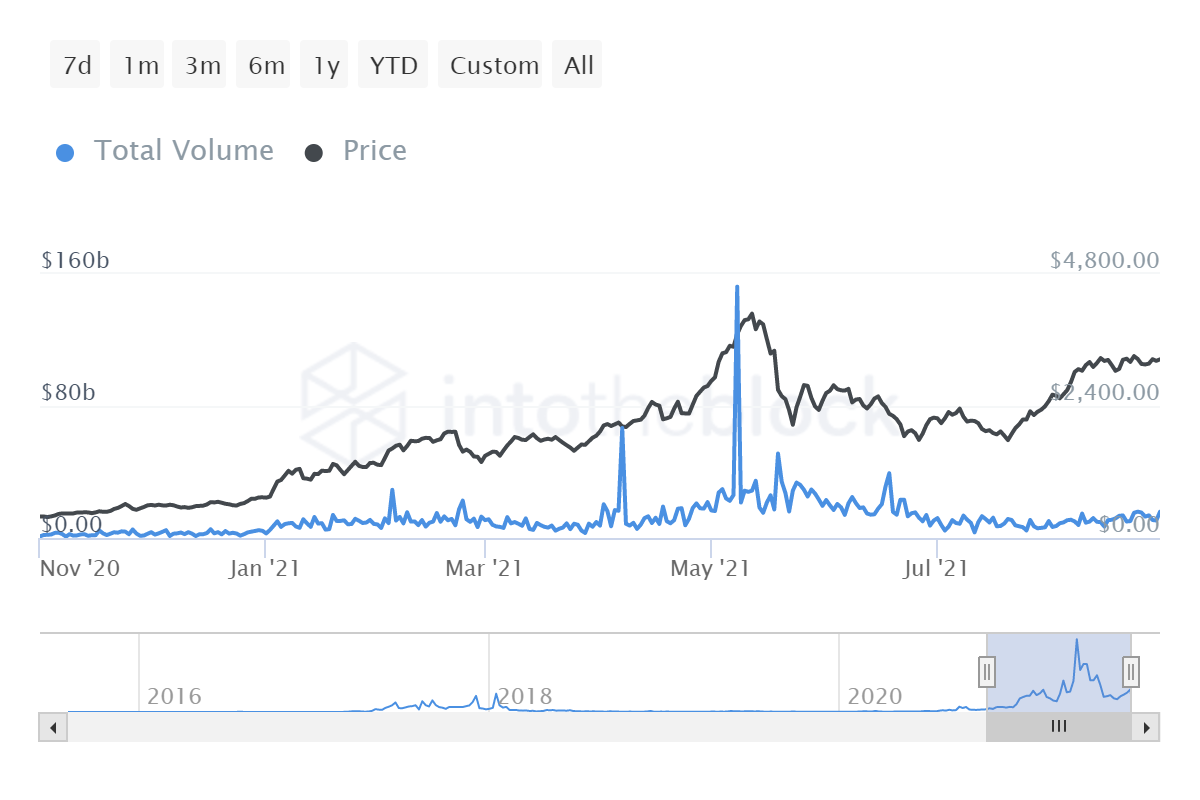

There is some chance it could, since the recent rally during which ETH rose by 91% has been primarily led by retail investors. This can be verified by looking at large transaction volumes which have been as low as they were 3 months ago, confirming the absence of whales.

Ethereum large transactions’ volume | Source: Intotheblock – AMBCrypto

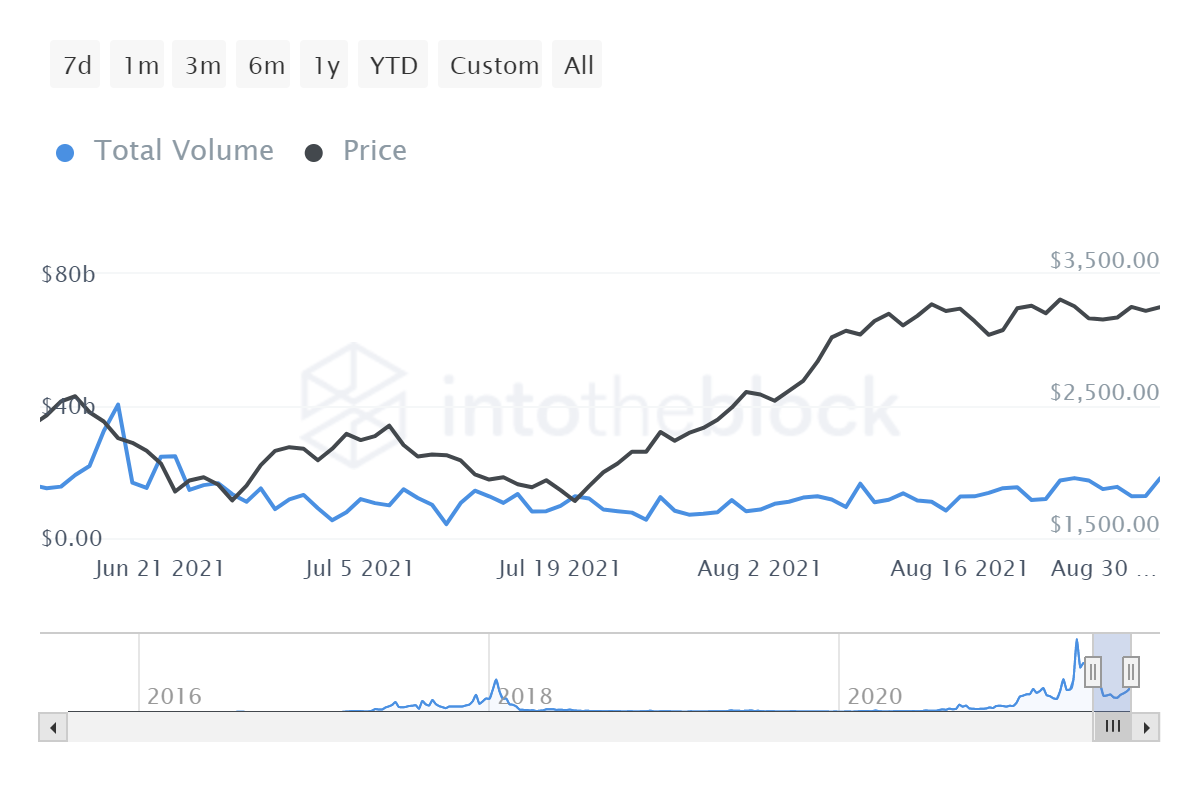

Spot volumes, on the other hand, saw a rise. Figures reached a 2 month high as ETH went back to $18 billion, putting the market in a healthy spot.

Ethereum spot transactions’ volume | Source: Intotheblock – AMBCrypto

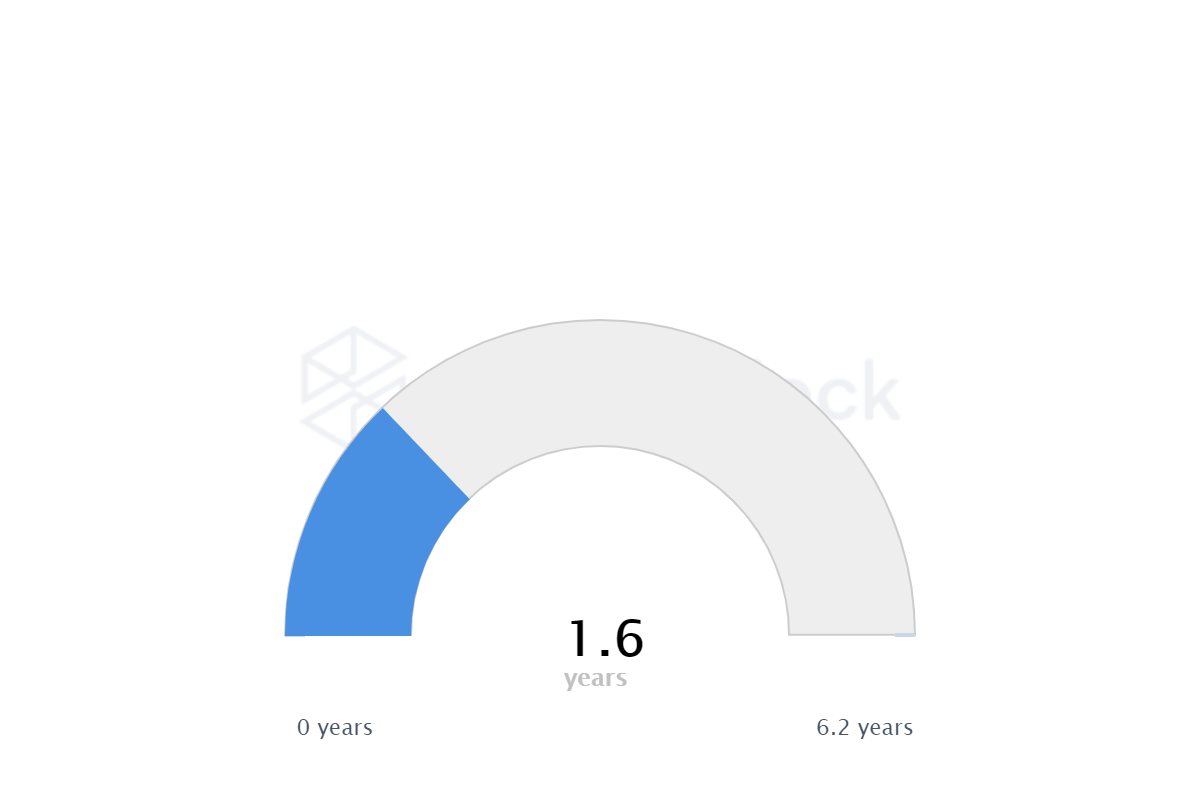

And at the same time, short-term and long-term traders have seen an equal increase in terms of participation. However, with the average time of ETH being held, remaining at 1.6 years as seen in the chart below, long-term holders’ dominance can be confirmed. This can actually help keep prices in check and protect ETH from immediate selling unlike with short-term traders.

Average time Ethereum is held | Source: Intotheblock – AMBCrypto