Ethereum: What’s lacking during this rally above $3000k

Ethereum is one of the few altcoins which managed to make some significant growth during the recent rally. At the time of this report, ETH was trading at $3,123, up by 75% in the last 20 days, even more than Bitcoin. So now that the price is here, why does it feel like something is lacking? When you look at on-chain metrics the answer becomes visible since the figures there have not been able to keep up with the numbers here. Is the investor’s bearish sentiment a cause for this fallback?

Is Ethereum running behind? Not with regard to the price action, but the data definitely is. Data here refers to the performance of investors and here it represents their sentiment and how it affects their decisions. The last time Ethereum touched $3k was back in May. If you compare the data from then to what it exhibits presently, the difference is significant.

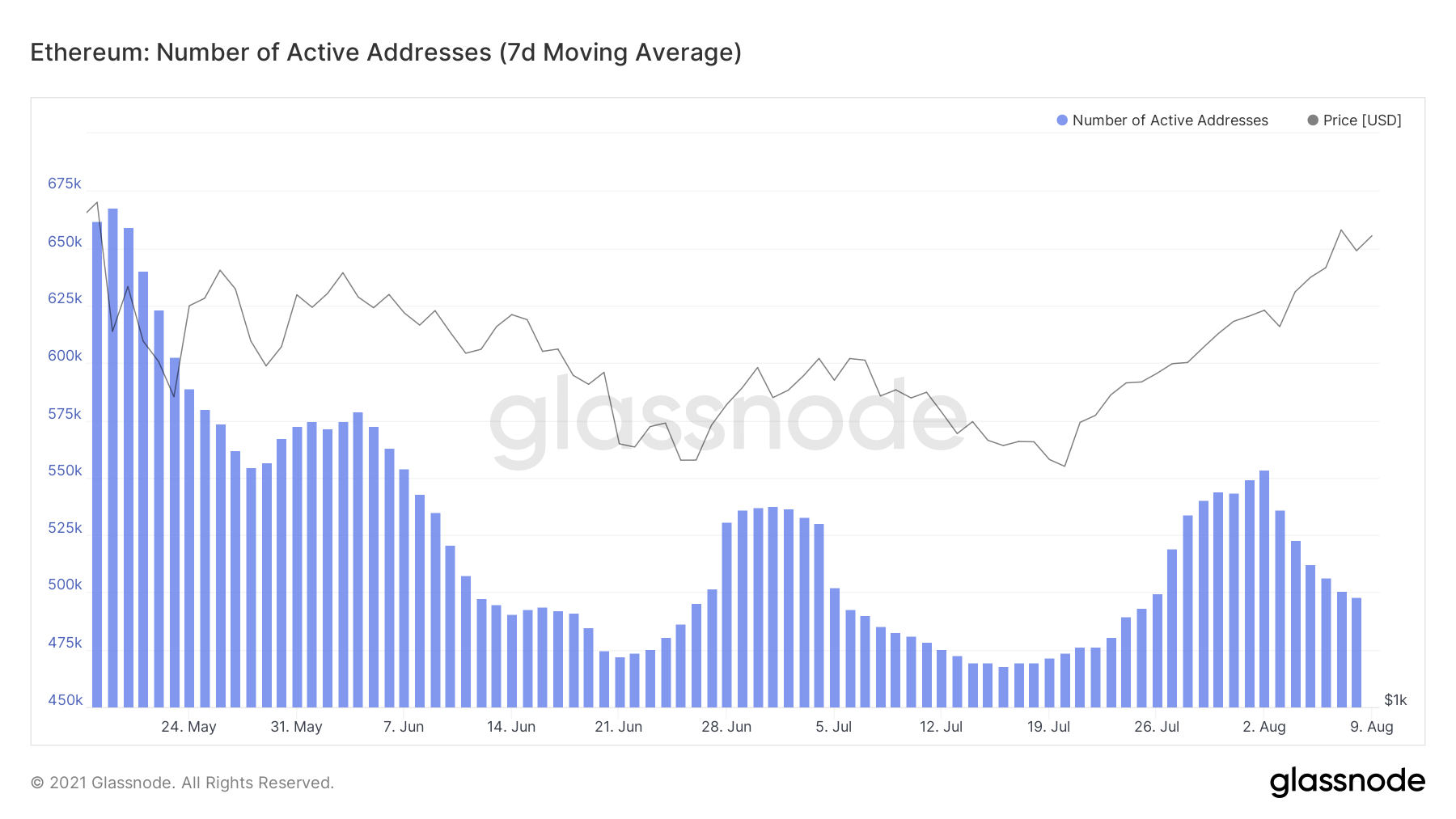

Active addresses back then were soaring above 650k and at the moment they are not even above 500k. A big cause for this is the investor’s exit during the price falls in June.

Ethereum Active Addresses | Source: Glassnode – AMBCrypto

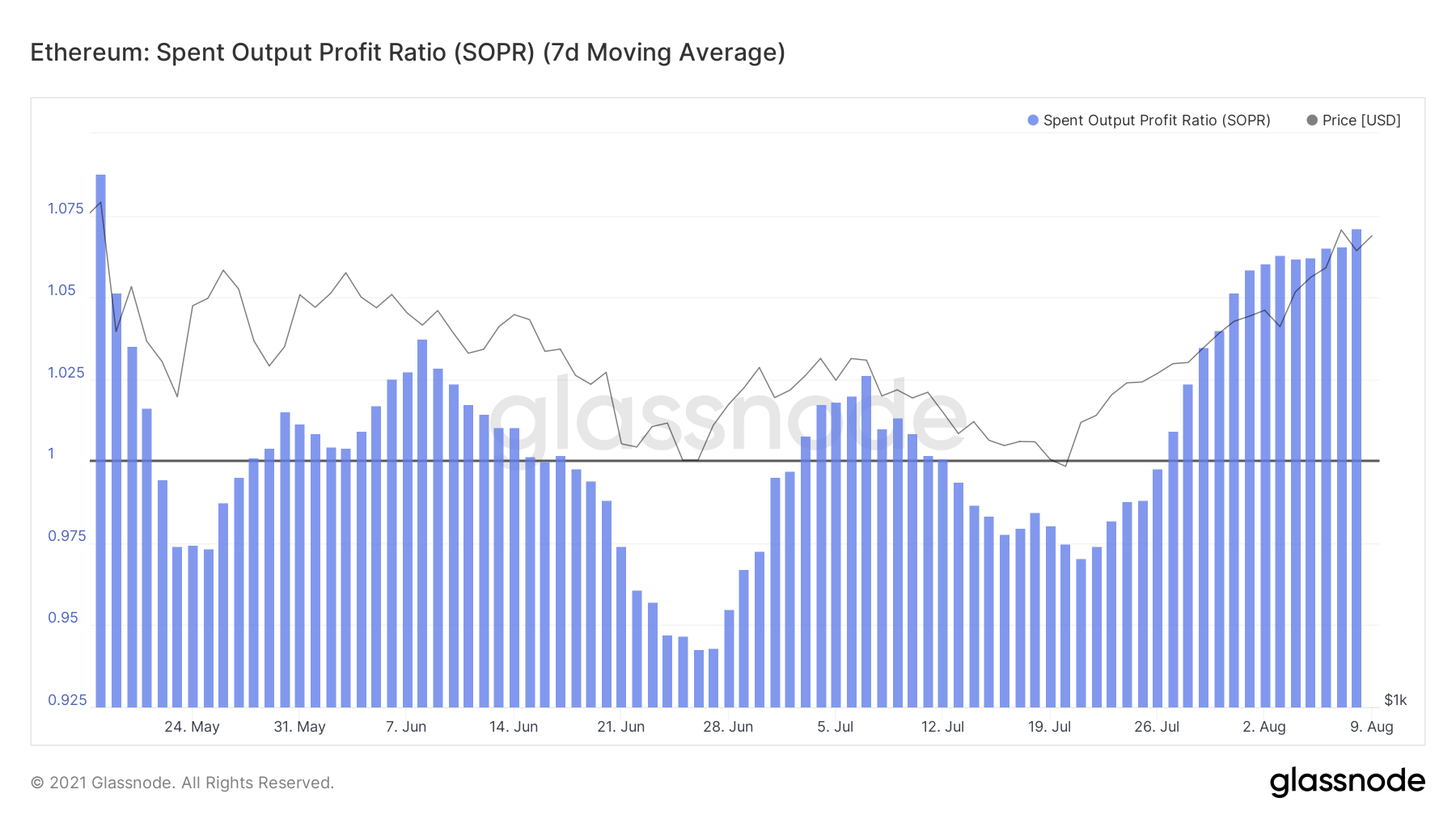

As a consequence of the investors’ exit, the transaction count fell as well. Down by 200k, this loss of transaction also affected daily volumes. However, one good reason why Ethereum is still preferable by the community is due to its value. Spent Output Profit Ratio shows if or not the coin has a fair value. And currently, ETH is as valuable as it was back in May, keeping up with the price. But the one thing which comes to mind seeing low metric figures is – Are people selling?

Ethereum SOPR | Source: Glassnode – AMBCrypto

No more HODLing?

Actually, that is not the case. At present, there is minimal selling in the market as exchanges’ indicators show that Ethereum holders are not selling. Active Deposits show that deposits to exchange wallets have declined considerably when compared to May. This shows that the selling pressure is pretty low on the network.

Ethereum Active Deposits | Source: Santiment

Additionally, Balance on exchanges is down by 2 million ETH. That’s about $6 billion worth of Ethereum either sitting in investors’ wallets and/or in yield apps. This is a good thing as low selling will keep the price up as much as possible. However, this also shows that investors have become cautious about their money.

So as the aforementioned data grows, their bullishness could grow as well. Thus, it’s always best to watch the markets.