Ethereum: What’s the reason behind ETH facing the brunt of this recent crash

Ethereum has dropped to its lowest point since July 2021 in the aftermath of the latest crypto crash. Standing at $1750 at press time, Ethereum has plunged severely recently suffering a near 25% dip in last 24 hours. Experts regard the LFG sell-off as the major factor for this debacle.

The latest drawdown in the crypto market has indefinitely left a mark on the Ethereum price charts. At the start of 2022, the Ethereum community expected the launch of the Merge by now. They are instead, dealing with historically low prices in these economical uncertainties.

ETH falls off a cliff

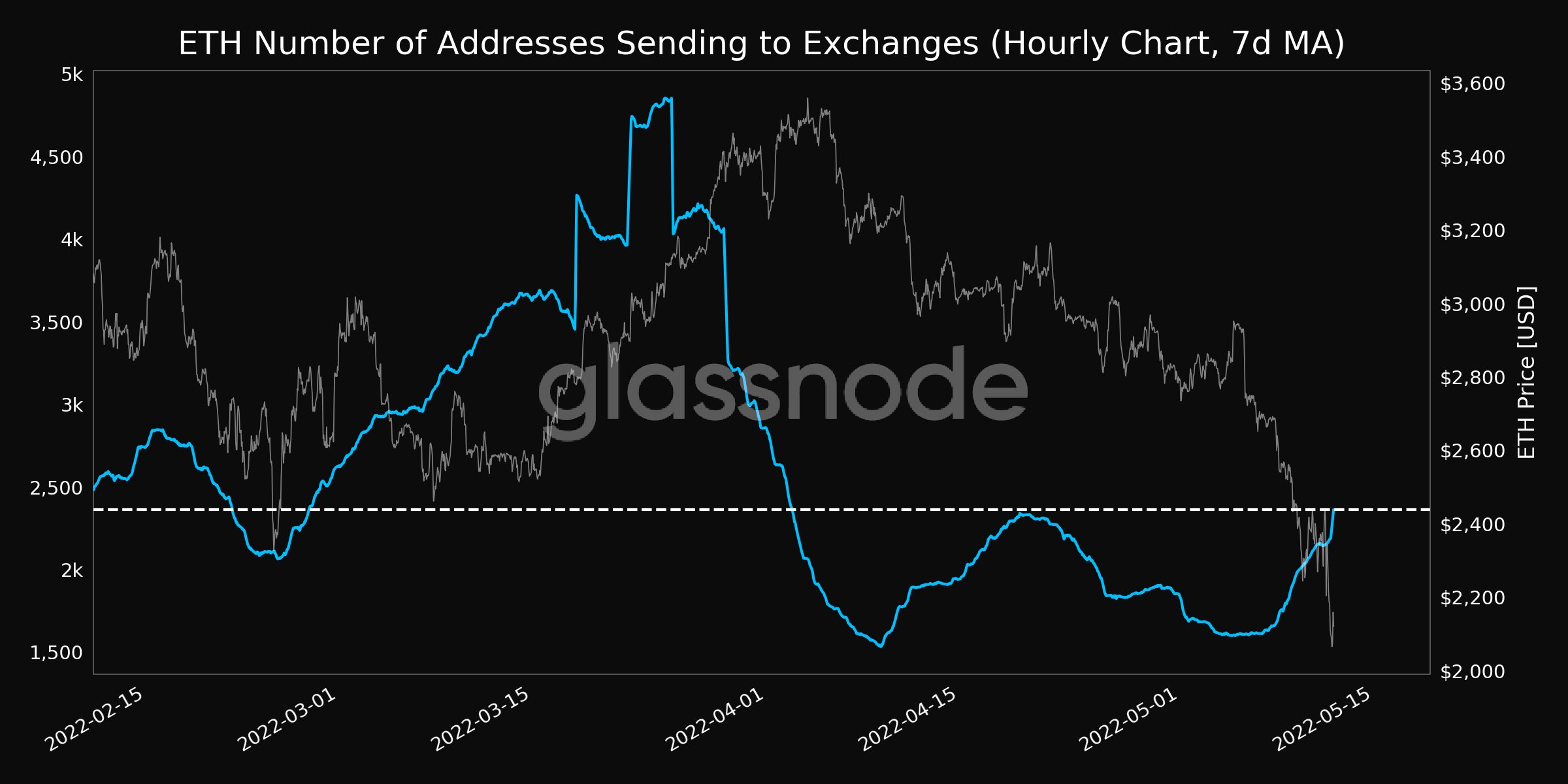

In the latest sell-off, ETH transaction volume has skyrocketed in recent days. Investors are pulling out of their investments after observing bear signals across the market. The number of addresses sending to exchanges reached a 1-month high today of 2,362.

This high came after a similar peak of 2,341 was seen on 19 April, 2022. Signalling bearish intent of larger number of addresses, this is a particularly worrying sentiment in the Ethereum community.

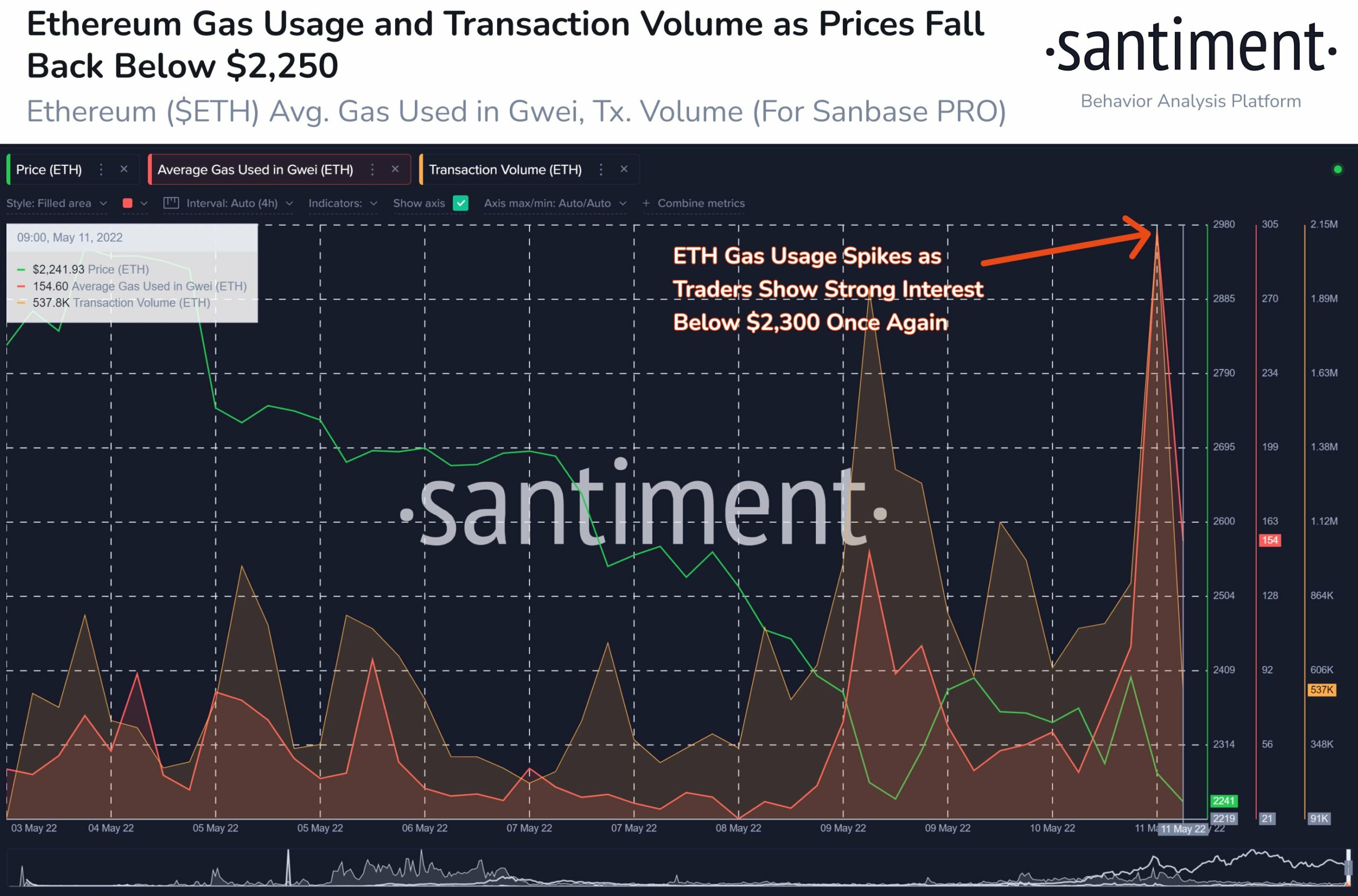

After the free fall from $2300, ETH has shown an uptick in trader engagement, according to data from Santiment. Along with that, there has been an increase in gas usage – which has been creating new highs everyday.

Interestingly, the last gas rise culminated Ethereum to a short-term bottom giving investors another headache. More bad news could be set to follow as the prices have hit $1750 already today.

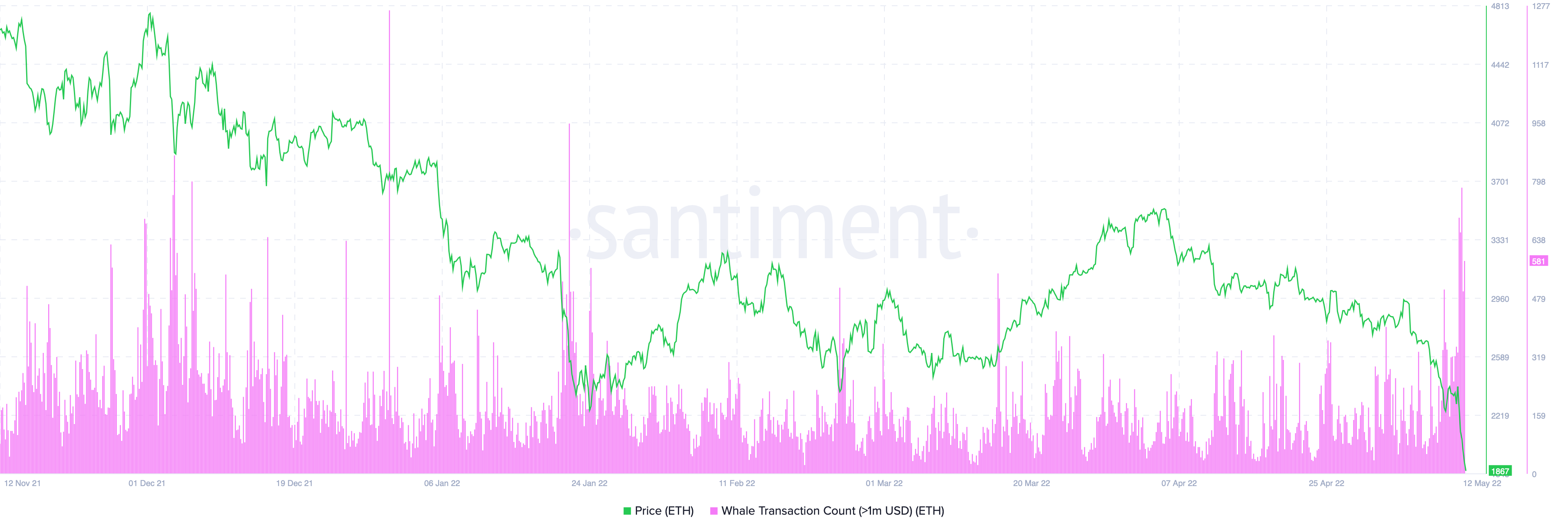

It seems the misery just keeps on piling here for the Ethereum community. The whales seem to be cutting off their losses after showing large activity today. Today, whale transactions valued at $1 million or more peaked for the first time since January. With around 3,650 transactions, another metric is signalling a bearish run for the following days.

From the experts

Armando Aguilar, Head of Alternative Strategies for financial services firm Ledn, stated his concerns on the situation. He noted that,

“An increase in treasury rates, macroeconomic forces and a strengthening U.S dollar contributed in part to the decline in the overall crypto market. The LFG sell off added additional selling pressure and contributed to additional fear on investors.”

The crash has resulted in huge losses across the market. Almost certainly, it will take time for investor to renew their trust in crypto investments.