Ethereum’s rally means this downside for DeFi tokens like CHZ, ENJ, MANA, FLOW, SUSHI

Post the accelerated price rally, even at the current price level, above $4000 and at a market capitalization of $478 Billion, Ethereum continues to be undervalued. The total market capitalization of Global cloud computing is anticipated to cross $1 Trillion by 2026 and owing to network effects, ETH is expected to capture over 80% of this market.

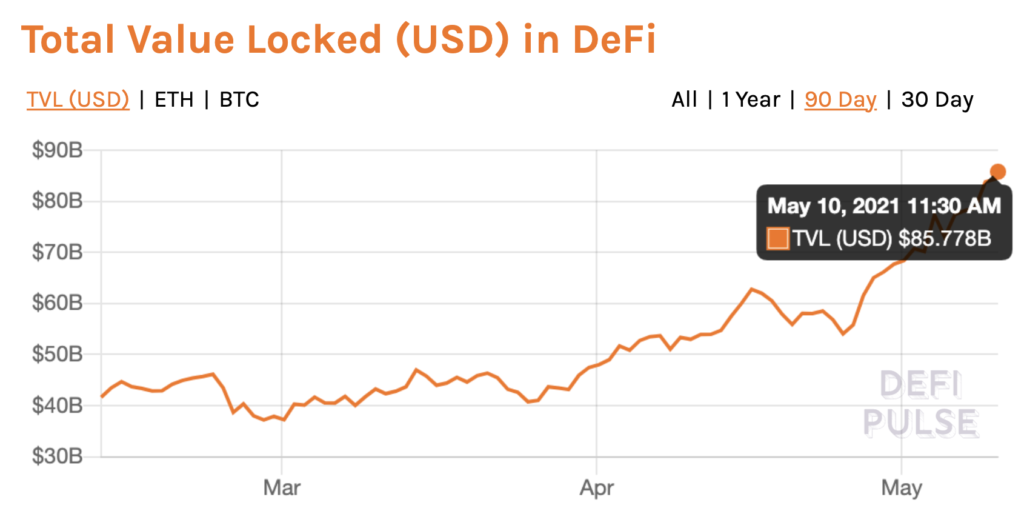

Though Ethereum’s rising market capitalization has been a key driver of the price rally, it is a factor that has stunted the growth of DeFi projects. The TVL of top DeFi projects has increased, however, it has not hit the level it takes for DeFi projects to have consistent demand.

DeFi TVL || Source: DeFiPulse

Though ETH’s rally is not the definitive factor, it is one of the few. At the current price level, DeFi tokens that are rallying rank in the top 500, are less popular and have low market capitalization, while volatility is high. Fantom FTM with a gain of 13%, Avalance AVAX with a gain of nearly 25% and LINK with a gain of nearly 20% in the past week are the top DeFi projects that are rallying.

Though inflow of investment in Ethereum has increased, it has not reduced the inflow to DeFi projects. The main issue lies with the HODLers; in the case of ETH, over 57% of HODLers have held the altcoin for over a year. However, this is not the case with DeFi projects. Owing to the short-term ROI cycle, there is a relatively low number of HODLers holding the altcoins for over 6 months. Institutional interest in ETH has increased consistently since the price started rallying and this is another key factor that differentiates ETH from top DeFi tokens.

Source: Twitter

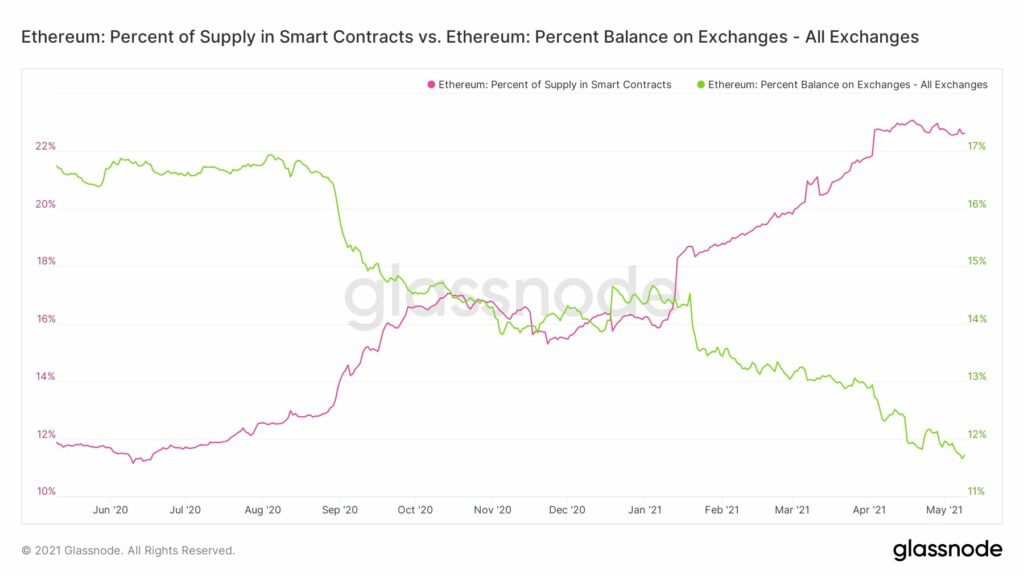

ETH’s percent supply in smart contracts has increased consistently. With the launch of L2, the network congestion has visibly reduced the percent balance on exchanges has continued dropping. This signals a bullish sentiment among traders for ETH, however, the balance has increased for DeFi projects.

The above chart and on-chain metrics show the rally of Ethereum is stunting interest in DeFi. Despite DeFi’s increasing popularity and price rally, the demand across spot exchanges has fluctuated for projects like CHZ, ENJ, MANA, FLOW, SUSHI and BAKE. DeFi’s price rally may continue following the anticipated correction in Ethereum’s price.