Ethereum’s realized cap declines by 9%; Bitcoin reports ATH

Bitcoin’s market has been closely watched as it impacts most other cryptocurrencies. However, it has also been an important aspect of an economic system where cryptocurrencies have been represented using macroeconomic indicators. Coin Metrics’ new report highlighted the bullish wave Bitcoin is riding, closely followed by Ethereum [ETH].

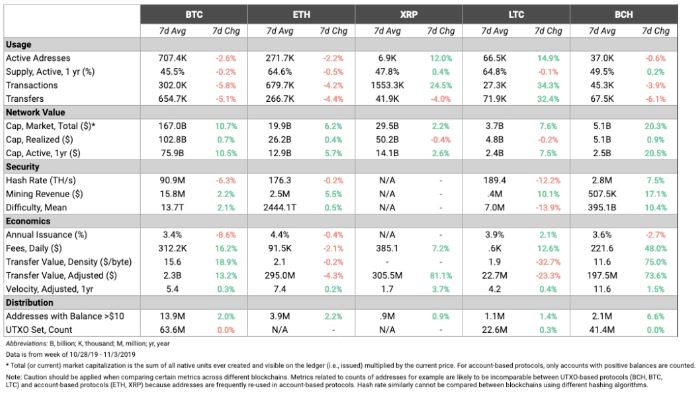

According to the report, Bitcoin and Bitcoin Cash noted a growth in the market cap for the second week, whereas Ethereum [ETH], XRP, and Litecoin [LTC] recovered from a falling market cap. Despite registering a positive market cap, Bitcoin and Ethereum reported a loss in their usage as:

“BTC and ETH active addresses were down over 2% week-to-week, and transaction and transfer counts are both down by over 4%.”

Bitcoin also noted a decrease in hash rate, after reporting an ATH in October. The reason for this drop had been speculated to be the end of China’s rainy season, which had forced many miners offline due to decreased capacity of hydropower station. However, another reason mentioned in the report was the lag between price and hash rate decline, after which the price of BTC dropped from $10k to $8k.

Source: Coin Metrics

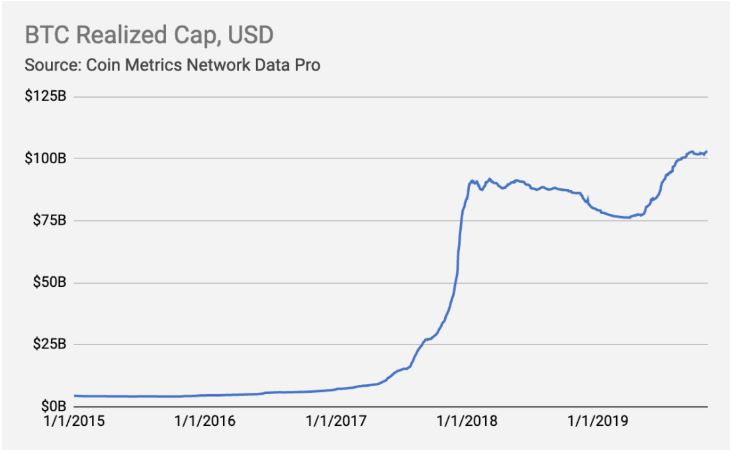

CoinMetrics recently introduced ‘realized capitalization,’ a metric that’s calculated by “valuing each unit of supply at the price it last moved” and could be thought of as the average cost basis for crypto-asset holders. Bitcoin’s realized cap has reflected a steady rise and hit a new all-time high on 3 November at $102,936,158,856.

Source: Coin Metrics

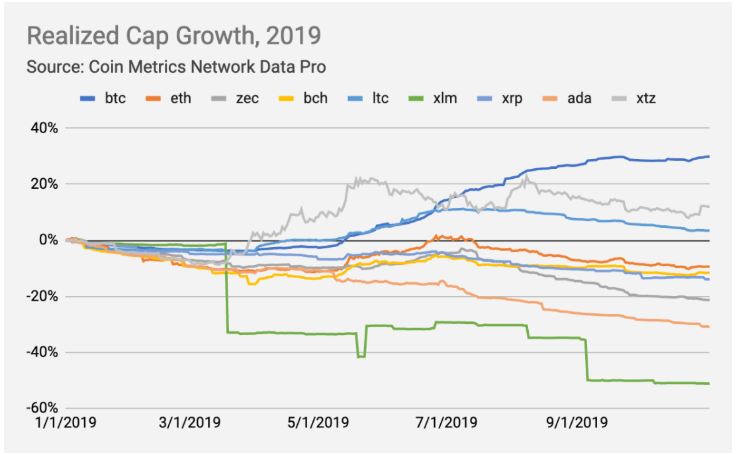

Bitcoin beat other cryptos by noting a 30% rise in its realized cap. Litecoin [LTC] and Tezos reported a growth of only 3% and 12%, respectively. Whereas the second-largest crypto, Ethereum [ETH] declined by 9%.

Source: Coin Metrics

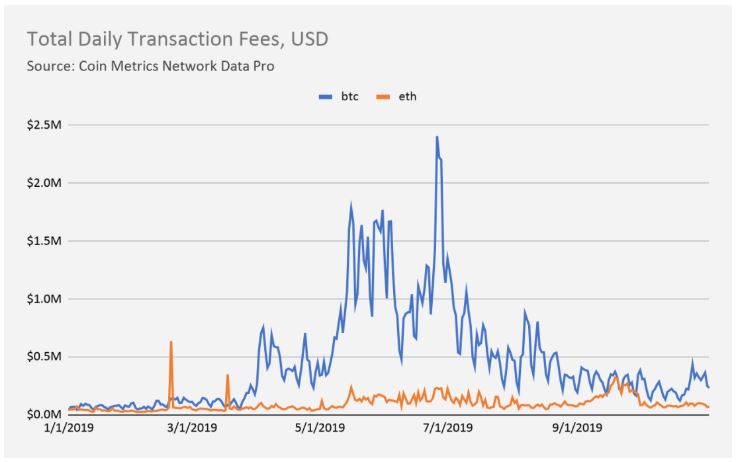

Bitcoin and Ethereum, however, have dominated the rest of the market in terms of overall fees. Ethereum’s transaction fees momentarily threatened to surpass BTC’s in September, but Bitcoin took the lead in no time.

“BTC fees surged to over $439,000 on October 26th, and have remained at $300,000 or more for most of the days since. ETH had a little over $100,000 daily fees on October 26th, and has not stopped more than $106,000 since.”

Source: Coin Metrics