Ethereum’s YTD turns profits despite price fluctuations

- ETH has witnessed over 7% rise in price only three times YTD.

- YTD, ETH has gained over 66% in value.

Ethereum [ETH] and other alternative cryptocurrencies experienced a thrilling surge not too long ago, driven by the uplifting victory of Ripple. The surge proved transient, as a decline has now set in.

Is your portfolio green? Check out the Ethereum Profit Calculator

But how has Ethereum performed throughout the year amidst the ebbs and flows of its price trends?

Ethereum value YTD increases

The Ethereum price has witnessed a rollercoaster of fluctuations, and amidst recent ups and downs, it’s easy to lose sight of its overall trajectory. However, according to a recent post by Artemis, ETH has achieved a noteworthy 66.7% year-to-date (YTD) increase while not appearing overwhelmingly impressive.

This statistic revealed that those who acquired the asset at the beginning of the year and held onto it have managed to secure profitable positions.

Examining Ethereum’s price trend

Ethereum embarked on an upward trajectory on the daily timeframe chart, beginning around the $1,200 price level. Remarkably, it sustained this upward momentum for a remarkable stretch of nine consecutive days.

Its price surged from around $1,200 throughout this bullish phase to approximately $1,600. Notably, during this uptrend, a significant event known as a golden cross occurred, symbolized by the yellow line crossing over the blue line.

Since then, the yellow line has remained consistently above the blue line.

As of this writing, Ethereum was trading at around $1,940, displaying a slight price increase. However, on 13 July, it experienced a notable gain of over 7%, only to lose over 3%.

A broader analysis of the chart revealed that this rise on 13 July was only the third instance this year where Ethereum witnessed a surge of over 7% in value. Additionally, the Relative Strength Index indicated that Ethereum was bullish at press time.

Long-term holders stay profitable

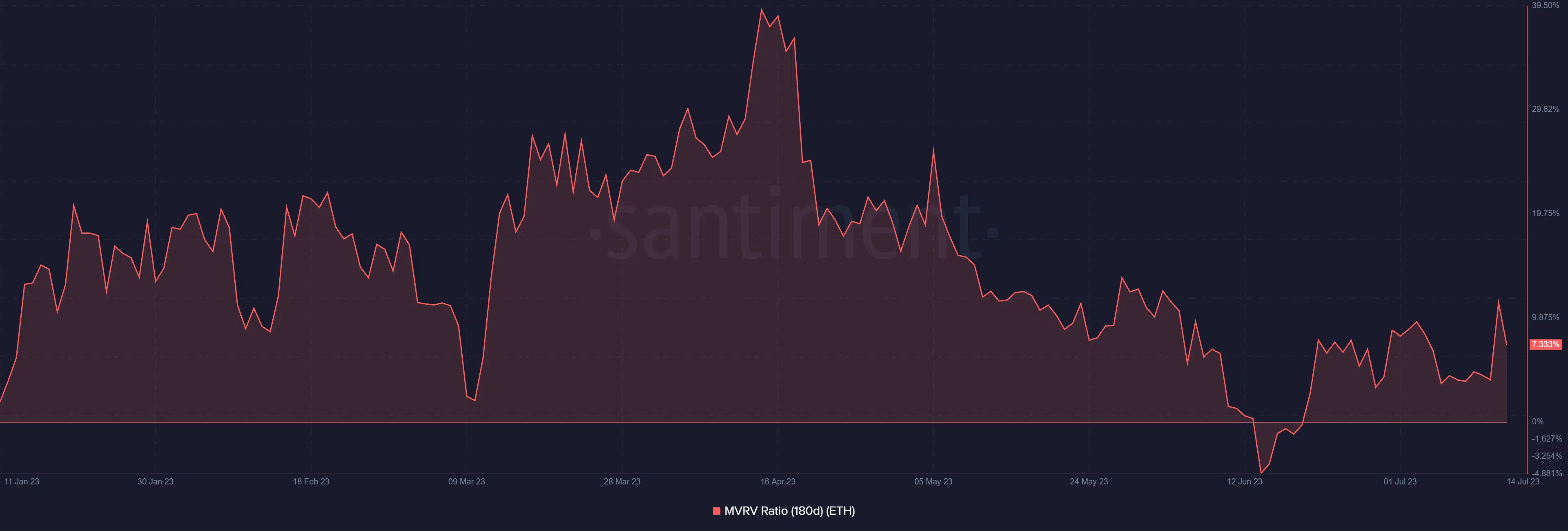

The 180-day Market Value to Realized Value (MVRV) ratio of Ethereum revealed that long-term holders have generally remained profitable. This suggested that despite the volatility witnessed by the asset year-to-date, holders have avoided being at a loss.

How much are 1,10,100 ETHs worth today?

As of this writing, the MVRV ratio was 7.3%, indicating profitability and the potential for more growth.

Furthermore, the chart demonstrated that back in April, the MVRV ratio exceeded 39%, affirming the possibility of an increase in the value of holdings.