ETH’s correlation to S&P 500 and ‘climbing’ whale transaction hint at…

The crypto market persisted in following the stock market closely over the years. In February, Ether, the second-largest cryptocurrency, moved in tandem with U.S. stocks like never before. Consequently, a 40-day correlation coefficient for the token and the S&P 500 topped at 0.65.

Continuing the trend, here’s the latest relationship status.

Match made in heaven?

Ethereum showcased a prominent (+ve) correlation with the S&P 500 index as per data from the crypto market behavior analysis platform, Santiment. ETH’s price witnessed a 3% surge following a 1.8% pull in the S&P 500 index’s statistics.

Source: Santiment

The 29 April tweet added,

“Aided by a +1.8% day in the SP500, Ethereum has jumped back above $2,930 with its tight correlation to equities markets.”

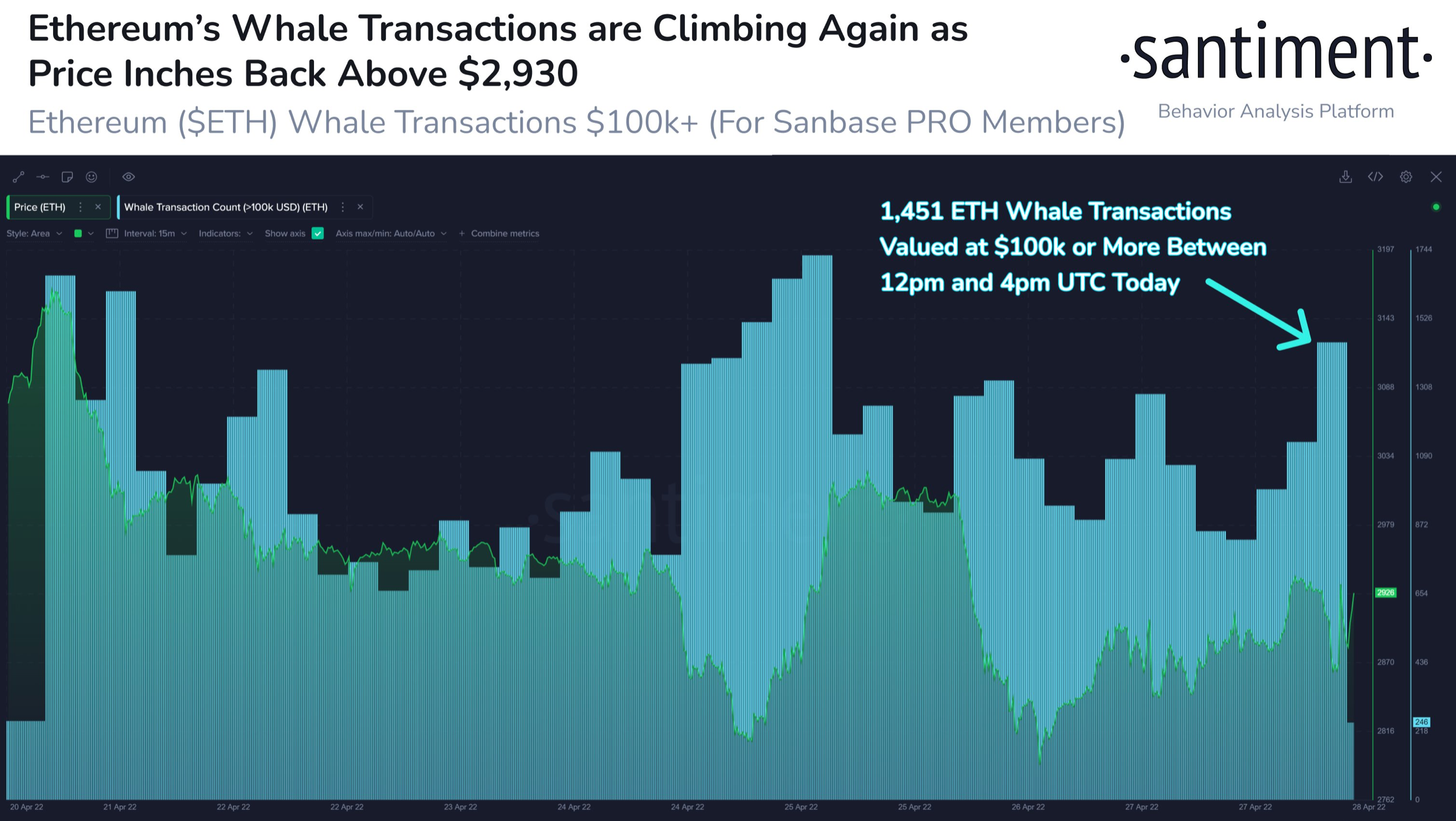

Now as seen in the graph above, ETH’s dominant buyers whales, reciprocated the same bullishness by acquiring more of ETH. The number of whale transactions exceeding a value of $100,000 increased significantly on the day.

Around 1,451 such transactions got recorded in a 4-hour period. Santiment opined that the spike indicated that key stakeholders took notice of the price climb.

Needless to say, these dominant buyers have stood by the flagship coin’s side. As per the latest spree, Ethereum whales moved over 85,000 ETH in a single day.

Furthermore, according to IntoTheBlock, 70% of ETH HODLers witnessed massive gains- one of the highest shares within the cryptocurrency market.

At the same time, ETH’s ecosystem saw an increase in the number of unique interactions.

? #Ethereum's address activity really picked up this week, with Wednesday's 592k addresses being the highest number of unique interactions in over a month. Meanwhile, social discussion for $ETH has hit its highest levels in over two months. ? https://t.co/4xsQLD8VaN pic.twitter.com/2pwlN1lXUa

— Santiment (@santimentfeed) April 22, 2022

This wasn’t the first time that ETH showed this emerging relationship with the equity market side. As reported three weeks ago, the two dipped together on 31 March but started rising again post 1 April. As the SP500 rallied from mid-March, so did Ether.

Is high correlation good or bad?

Every positive scenario within the crypto-verse remains countered by a negative side. Well, that’s a fact. This case is no different. Notably, crypto’s close relationship with equities could do miracles. However, different renowned entities have censored cautionary scenarios for the same.

In this case, Arthur Hayes, the former CEO of BitMex, raised red flags considering this relationship. Curiously, the stock market looks poised to crash massively through 2022 as the Fed tightens monetary policy to combat inflation. Now, this could have a bearish impact on the largest altcoin.