ETH’s price reacts to FOMC meeting; will bears stick around?

- The Federal Reserve’s decision caused a significant decline in Ethereum’s [ETH] prices.

- Retail investors showed interest while whales and network growth declined, leaving ETH’s recovery uncertain.

On 14 June, the Federal Reserve opted not to proceed with an 11th consecutive interest rate hike. This was done as it assessed the consequences of the previous ten increases. The decision was made by the Federal Open Market Committee (FOMC) during their two-day meeting.

However, the committee projected that two additional quarter percentage point rate increases will likely take place before the year concludes.

Read Ethereum’s [ETH] Price Prediction 2023-2024

FOMC causes FUD

The FOMC’s choice to halt interest rate hikes had an immediate effect on the price of Ethereum. CoinMarketCap‘s data revealed a 6.49% drop in ETH’s value within the past 24 hours.

The decisions made by the FOMC often carry significant weight in the market due to multiple factors. When the FOMC hints at potential interest rate increases, it alters investor sentiment.

Higher interest rates make traditional investments more appealing, diminishing demand for cryptocurrencies. Additionally, market sentiment and risk perception come into play. If the FOMC expresses caution or concerns about economic stability, investors tend to become more risk-averse, resulting in a sell-off in cryptocurrencies.

Furthermore, regulatory concerns and potential policy measures discussed during FOMC announcements can adversely impact the crypto markets.

The panic among investors was evident through the behavior of the whales. Data from Glassnode highlighted a considerable reduction in the number of addresses holding more than 10,000 ETH in recent months.

However, retail investors continued to exhibit interest in ETH, perceiving the price decline as an opportunity to purchase the coin at a discounted rate. While retail investors’ interest may offer temporary support to ETH’s price, it leaves them vulnerable to whale behavior in the long term, considering that the majority of ETH was still held by ETH holders.

? #Ethereum $ETH Number of Addresses Holding 0.01+ Coins just reached an ATH of 24,343,133

Previous ATH of 24,343,031 was observed on 11 June 2023

View metric:https://t.co/XXb0u19ouH pic.twitter.com/u7rzmRqXcz

— glassnode alerts (@glassnodealerts) June 15, 2023

Some traders remain hopeful

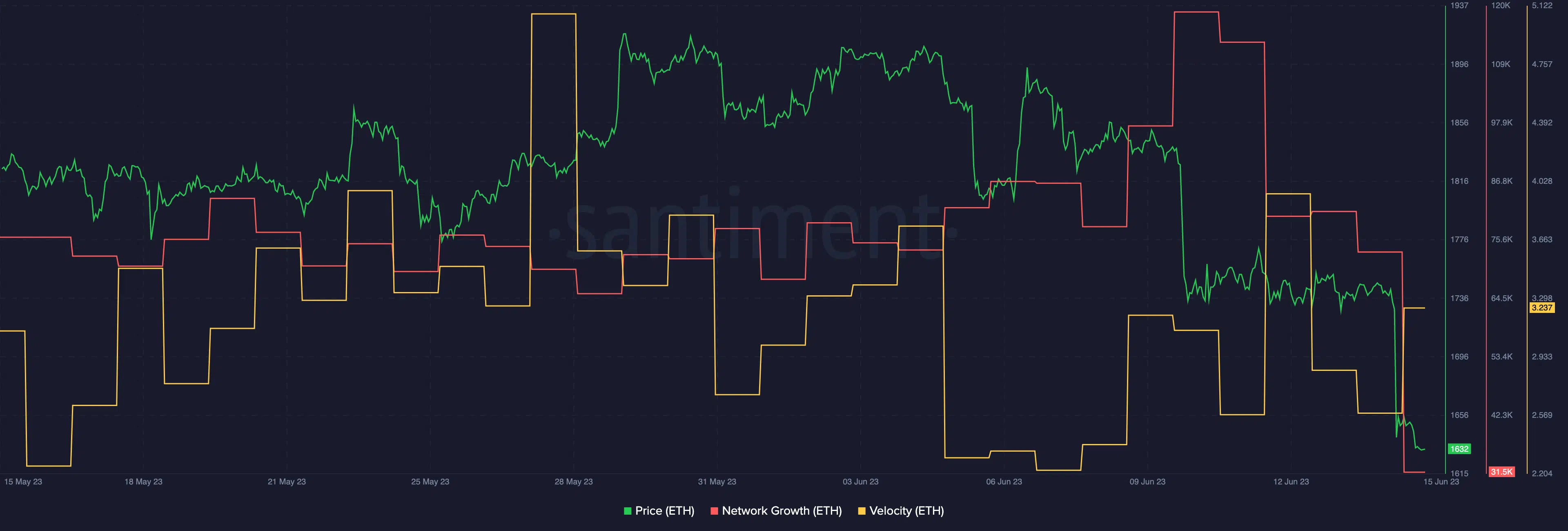

Recent data also suggested a decline in Ethereum’s network growth alongside its price. This indicated a waning interest from new addresses. Moreover, the velocity of Ethereum also decreased. This was an indication of the substantial reduction in the number of ETH transactions occurring on the network.

Is your portfolio green? Check out the Ethereum Profit Calculator

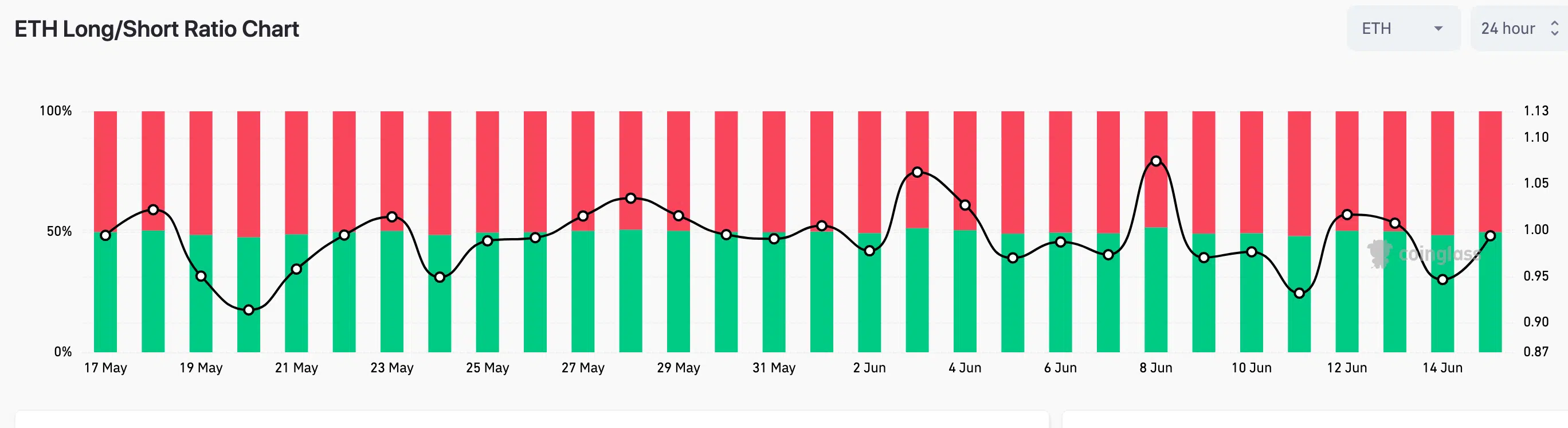

Despite these factors, data from Coinglass revealed an increase in the number of long positions taken against ETH in the past few days. This suggested that investors remained hopeful and optimistic about Ethereum’s future prospects.