Evaluating how Curve Finance [CRV] performed in the last month

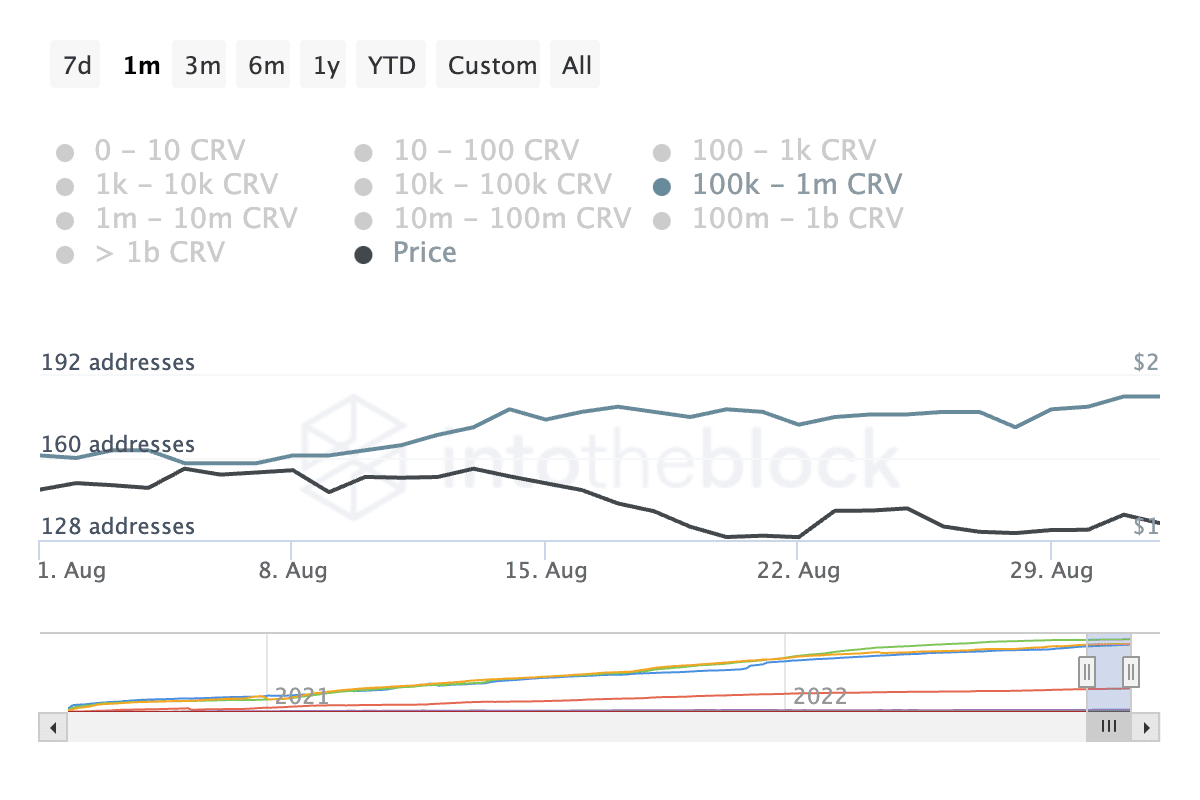

Data from IntoTheBlock, a blockchain analytics platform, revealed that CRV, the native token of leading decentralized exchange, Curve Finance, enjoyed significant whale accumulation in the last month.

According to IntoTheBlock, whale addresses holding between 100k to one million CRV added about 10.2 million CRV tokens to their portfolios. In the past four days alone, this category of whales added four million CRV tokens to their portfolio.

Their holdings have climbed by 13% in the last 30 days. For addresses holding between 10k to 100k, they increased their holdings by 9% within the same period.

With this growth in whale accumulation in the last 30 days, was there any impact on the token’s price?

CRV said no

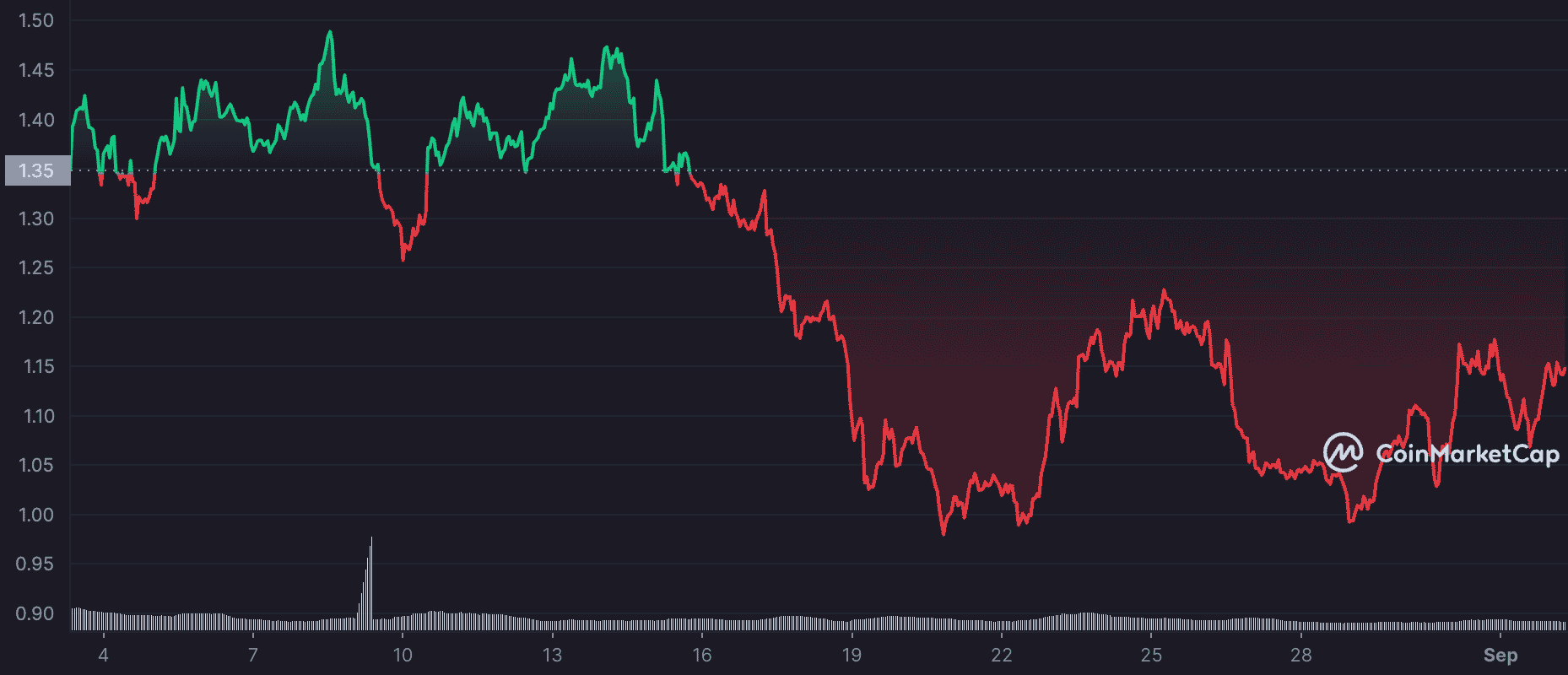

According to data from CoinMarketCap, CRV traded at $1.15 at press time. Reeling under the impact of the downturn that has plagued the general market in the last month, the price per CRV declined by 14% within that period.

This decline came after a 41% price growth logged during the token’s four-week price rally in July.

In the last 24 hours, CRV’s price grew by 6%. The daily Relative Strength Index (RSI) stood at 48 following its failure to hold on to the neutral 50 support in the middle of August.

The token’s Money Flow Index (MFI) was positioned in an uptrend at 66. Thus, indicating a gradual build-up in buying pressure for the token.

A look at the position of the Moving Average Convergence Divergence (MACD) confirmed this. A bullish crossover occurred on 31 August, thus, increasing the possibility of a northward breakout in the short term.

Curve Finance in the last month

According to data from Dune Analytics, monthly trading volume on Curve Finance has declined consistently since May. Closing August with a trading volume of $5.8 billion; trading volume on the DEX dropped by over 75% in just three months.

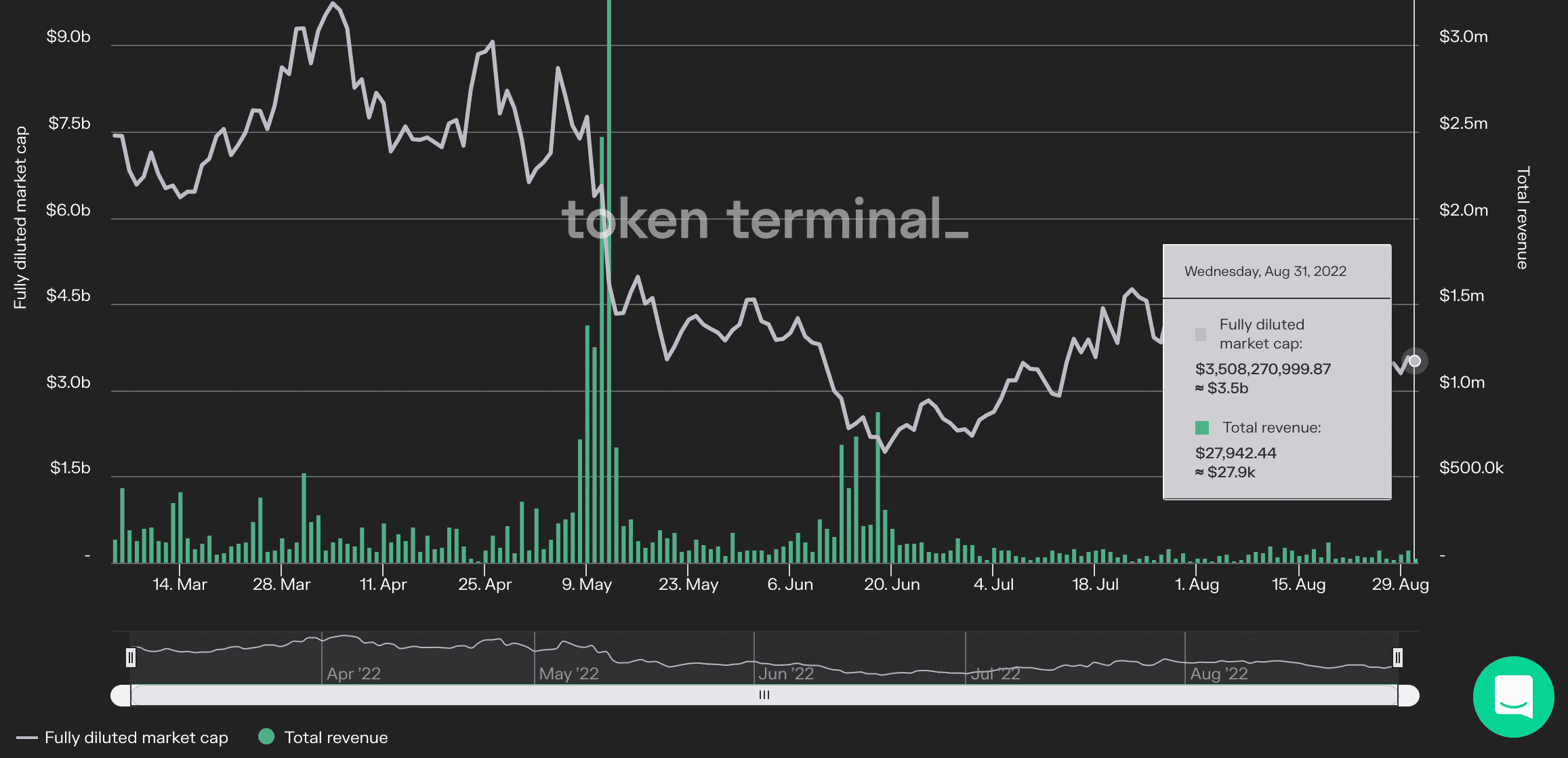

Furthermore, according to data from Token Terminal, daily revenue on the network has declined steadily since May. In the last 180 days, daily revenue on the network went down by 57%, in the last 90 days by 59%, and in the last 30 days by 2%.

Daily revenue on Curve Finance as of 31 August stood at $27,000.

With $1,113,327,789 recorded in sales volume in the last seven days, Curve Finance ranked as the second DEX with the highest volume after Uniswap.