Evaluating SAND’s short-term reversal potential amidst market uncertainty

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- Sellers accelerated SAND’s depreciation in the past few days.

- The gaming token saw improved funding rates, but the long/short ratio could dent bulls’ hope.

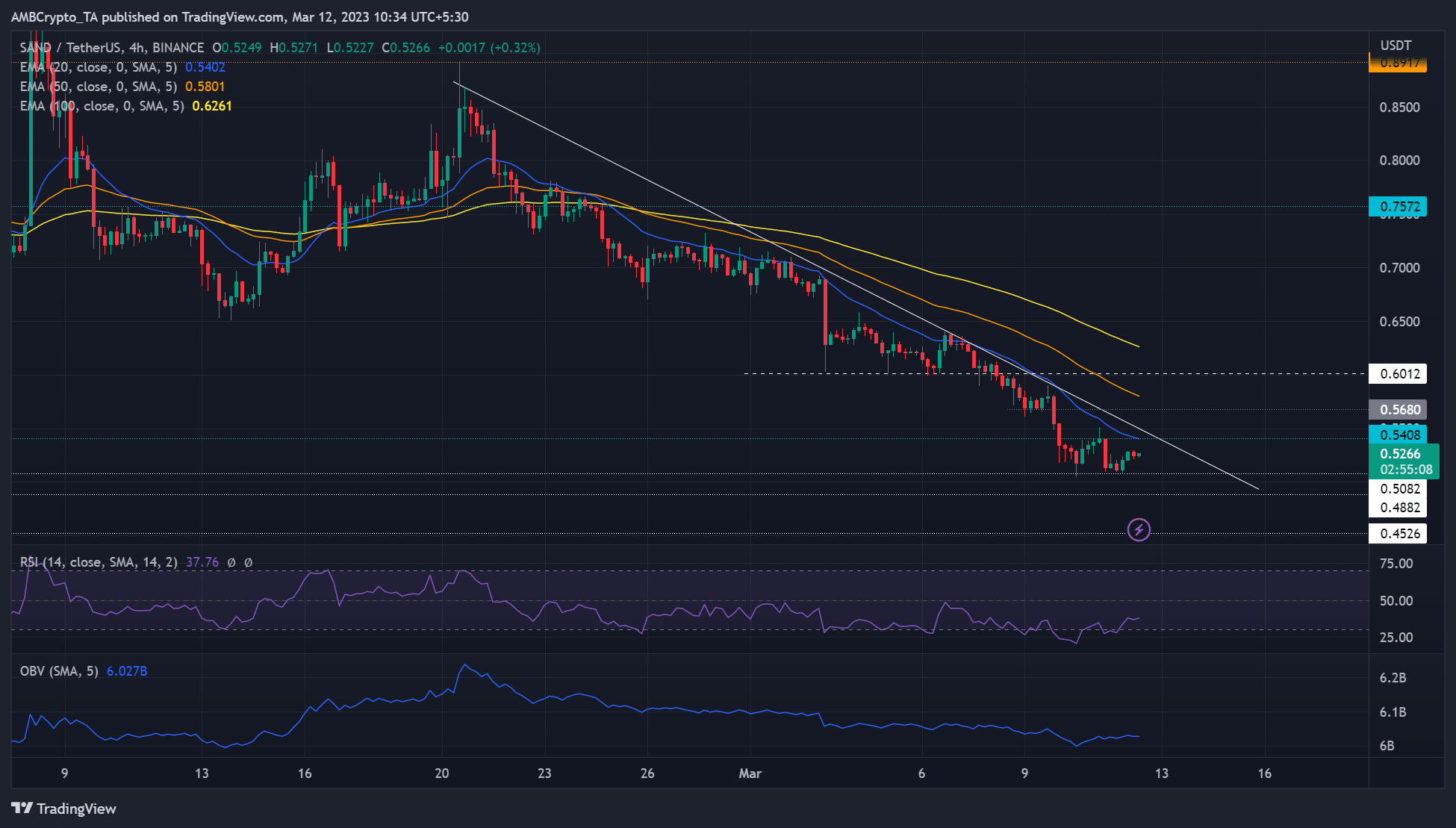

Amidst increased market uncertainty, bears fast-tracked the depreciation of The Sandbox [SAND] on the four-hour timeframe chart. However, the bearish efforts were subdued slightly at $0.5042 support forcing SAND into a consolidation range.

Read The Sandbox [SAND] Price Prediction 2023-24

A possibility of reversal could be imminent if the bulls continue to defend the $0.5042 support. It could boost their efforts to breach the descending line and the 20-period EMA. At the time of writing, SAND was trading at $0.5266.

Can the consolidation persist?

SAND managed to inflict a rally in mid-February, but the price rejection at $0.8917 invited bears into the market. The bearish 20 EMA crossover with 50/100 EMA on February 25 induced further intense selling sinking the gaming coin below $0.6012 as the price action toiled below the descending line (white).

At press time, the $0.5082 support had proved steady. The price action oscillated in the $0.5082 – $0.5408 range. A convincing close above $0.54 and the descending line could set SAND on a recovery path. The continued recovery efforts could face headwinds at $0.57 – $0.60 before a likely reversal.

However, should sellers continue to subdue bulls from any recovery, SAND could sink below $0.5082 and attract aggressive selling afterward. The first key support area in an extended drop is the $0.488 – $0.453 range.

The Relative Strength Index (RSI) recovered from the oversold territory, highlighting easing selling pressure. Similarly, the OBV exhibited an uptick, highlighting bulls’ hope for a reversal chance.

Improved funding rates

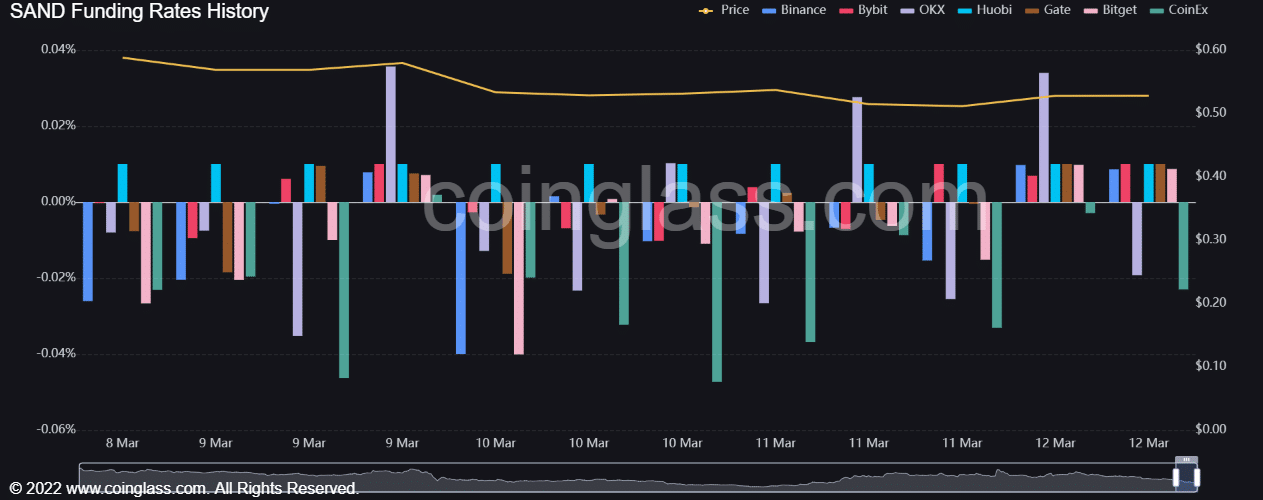

Despite the overbearing negative market sentiment, SAND saw a surge in funding rates across more than half of its exchanges. The positive funding rate reflected the mild rally seen on the spot market at press time.

Is your portfolio green? Check the SAND Profit Calculator

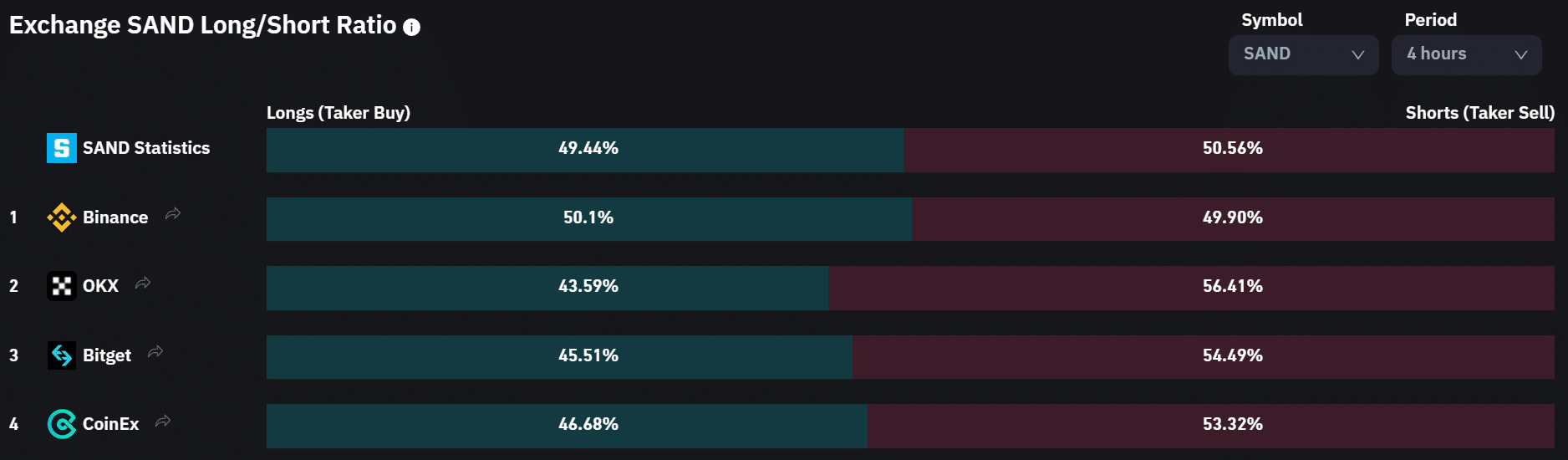

However, the past four hours’ SAND long/short ratio could undermine bulls’ recovery efforts. The ratio was slightly skewed toward the sellers, and buyers should track any improvement on this end before making moves.

In addition, investors should track BTC’s price action to make more profitable moves.