Everything you need to know about the current state of the Bitcoin rally

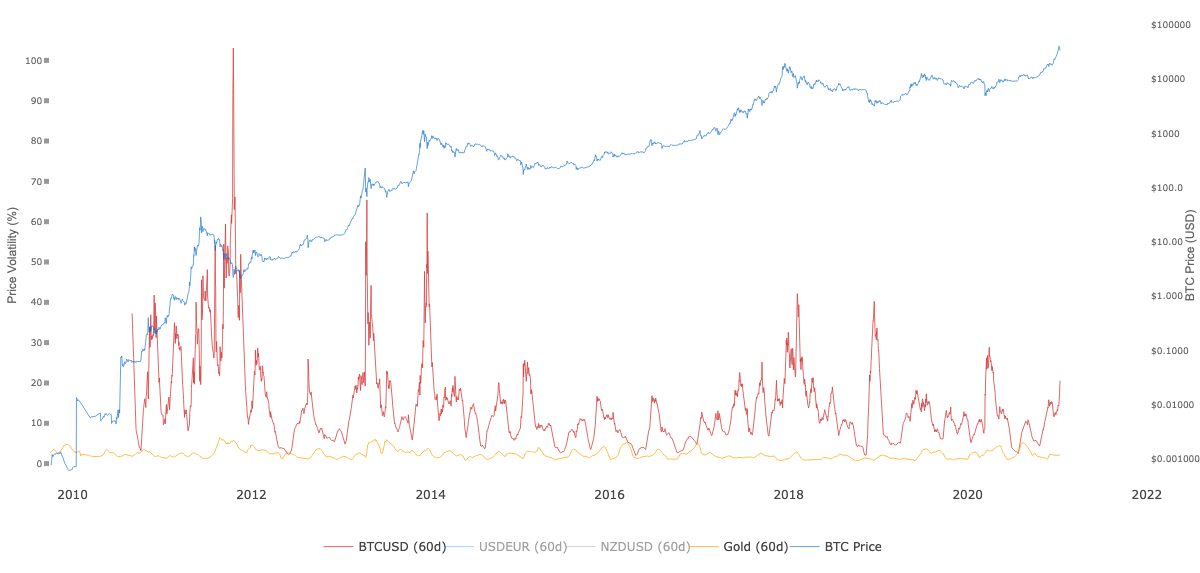

Bitcoin’s rally to $41000 and price discovery beyond it has been mostly straightforward. Most predictions made before the end of 2020 are looking conservative when compared to the price chart. Further price discovery is probable since the asset is trading at the $38000 level and the weekly change in price is 1.58 percent. The 24-hour change in price is nearly 4 percent and this may be a challenge for price discovery, however, based on Willy Woo’s Bitcoin Volatility chart, Bitcoin’s volatility has hit over 20% in the past 60 days.

Bitcoin’s volatility || Source: Woobull Charts

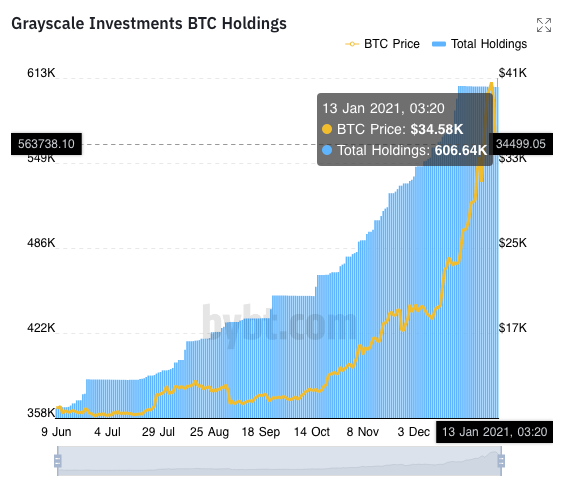

The rise in price that fueled the Bitcoin price rally was driven primarily by Grayscale and the likes. Against the rising Bitcoin price, Grayscale added more Bitcoin to their holdings. Earlier this week, when the price observed a bit of a free fall, Grayscale added some more.

Grayscale BTC holdings || Source: bybt

The chart that shows Grayscale’s Bitcoin Holdings shows incremental Bitcoin reserves. In the current phase of Bitcoin’s market cycle, there is more volatility than in the past year. Though it hasn’t registered a spike as a bull run, the volatility is relatively high. The other factors driving the volatility are the post halving price rally from May 2020 and the institutional acceptance of Bitcoin.

Institutions and whales have continued buying at all price levels, above $30000 as well, and this has added to the volatility. Despite the mass liquidation that occurred when Bitcoin’s price dropped from $35000 to $30000 level, the recovery was quick owing to the volatility. At the time of writing the price is at the $34000 level based on data from CoinMarketCap.

In the current state of the Bitcoin rally, investment is flowing into altcoins and DeFi as well. The current market conditions are similar to that of 2017 and the previous cycles. Any further corrections in Bitcoin’s price may lead to consolidation after a period of growth in price and market capitalization. The focus of the price rally has shifted from growth to sustaining price above critical levels and this fact makes it clear that the alt season may be fueled by investment flow from Bitcoin, in case the volatility or momentum drops.

![Tron [TRX]](https://ambcrypto.com/wp-content/uploads/2025/08/Tron-TRX-400x240.webp)