Everything you need to know about this Bitcoin phase coming to an end

As Bitcoin’s price went on a downtrend over the past month, Twitter was flooded with analysts asking the crypto-community to “buy the dip.” Implicitly, the crypto’s price recorded a consistent horizontal movement, with the crypto-asset’s volatility substantially falling on the charts as well.

As a matter of fact, the accumulation phase is a period of downtrend but usually precedes an uptrend. Looking back, Bitcoin’s price was hovering in the $50k bracket during mid-May, before it crashed on the charts. Most notably, post the drop, the accumulation phase has been going on in full swing.

However, will the accumulation phase extend itself further, or has it come to an end already? Well, looking at the ongoing market trend, one can argue that the aforementioned phase has almost concluded, for the short term at least.

Commenting on similar lines, Pomp Investments’ Anthony Pompliano recently said,

“This week the big theme is that the re-accumulation phase is nearing an end.”

Until recently, market players were busy filling their bags with Bitcoin. Consequentially, the rate at which short-term holders have been selling has decreased while the rate at which long-term holders have been are buying has increased. Interestingly, over the week, the buying rate has been outweighed by the selling rate. Now, things are changing and profit-taking has nearly reset across all time frames.

Source: Twitter

What’s more, the illiquidity supply change witnessed a steep drop in May but it has gradually been inching in the other direction of late. Now, according to on-chain technical analyst William Clemente,

“This metric flipped from strong accumulation to distribution quite rapidly at the end of May/early June as a lot of coins that appeared to be in strong hands were sold off amidst the price drop.”

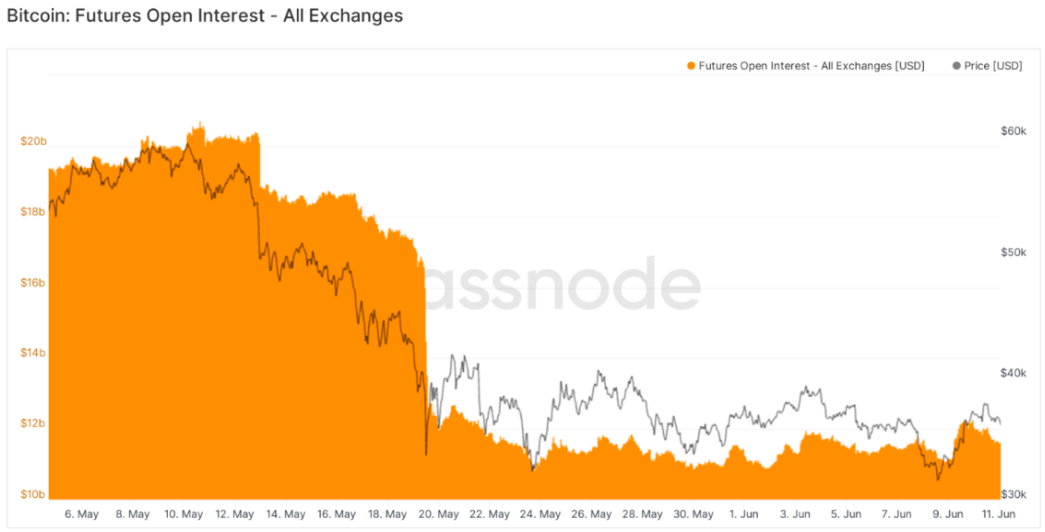

Another interesting trend has been set up in the Futures market by the Open Interest. As indicated by the chart above, the OI has started to “creep back up” and this elevation will exert even more influence on the market. Commenting on what to further expect from this metric, the analyst added,

“Would expect that to come back in a big way if we get a strong move to either the up or downside.”

Additionally, miners have also been selling off throughout the week, and this comes after the strong accumulation last month.

“From what I can tell it appears to be a lot of selling coming from Chinese miners mostly. This is not a large portion of supply, they’ve only sold about 4K BTC in the last week, just a change in trend to keep in mind.”

The analyst concluded his analysis by asserting,

“Volatility has been trending down, but once we break out of the consolidation pattern and get a strong move, I think that volatility comes back and you’re going to see traders come back in… In conclusion, the accumulation and profit-taking process we’ve been tracking is nearly complete.”