Examining Bitcoin’s $100K price predictions – Do they still hold up?

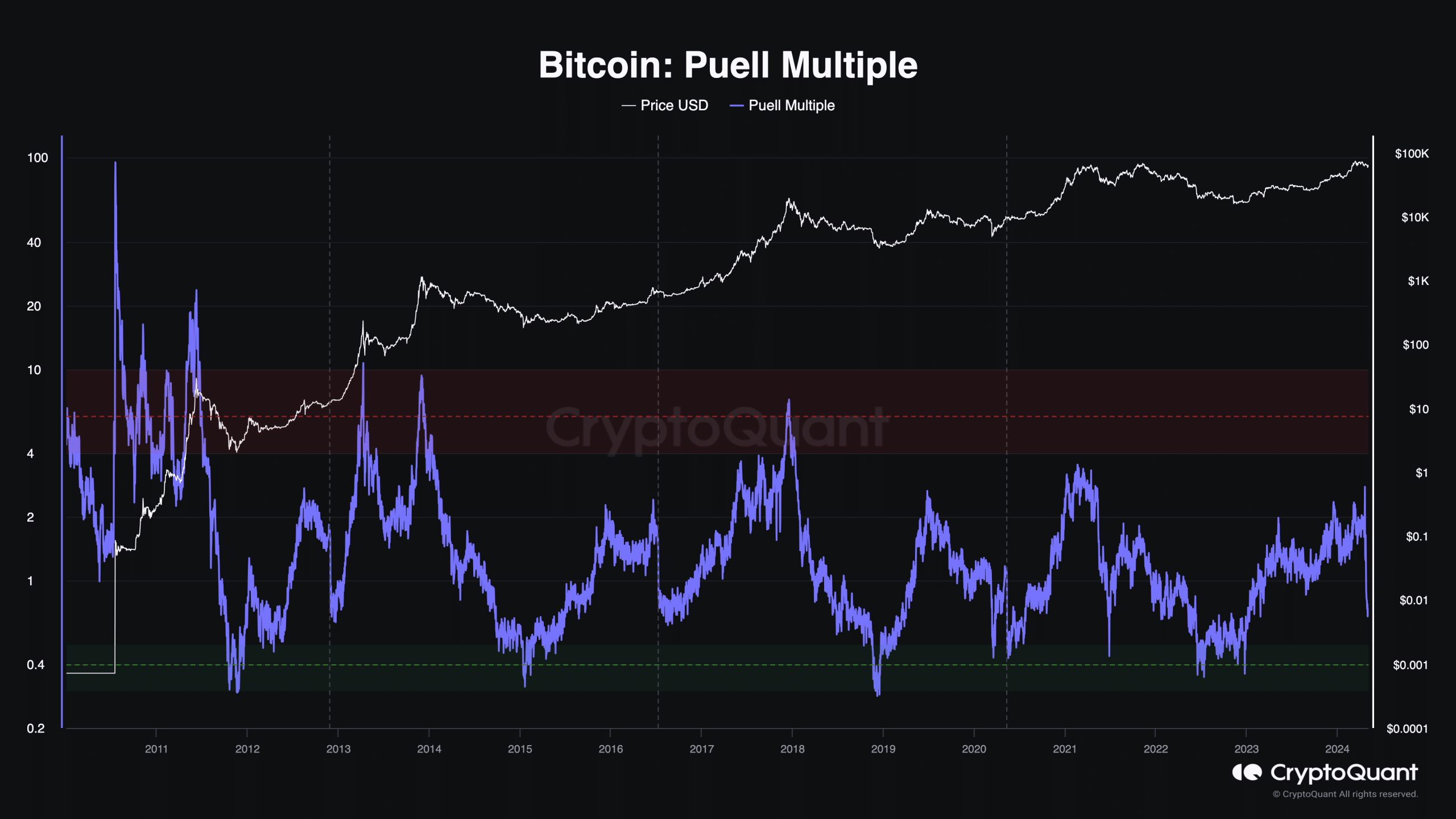

- The Puell Multiple closed in on a historical accumulation point

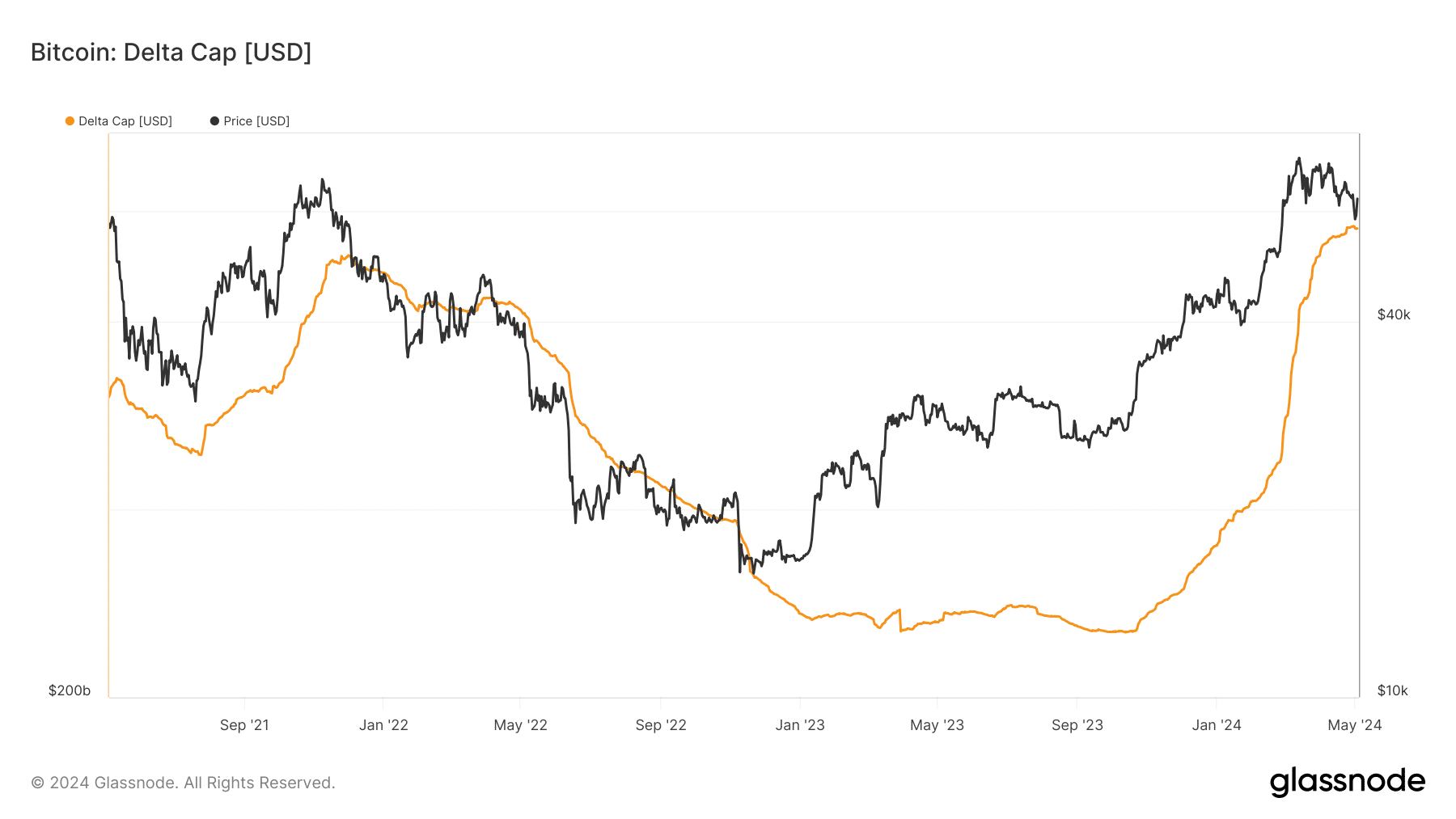

- Bitcoin’s Delta Cap surged, suggesting that the price might not hit $100,000 this cycle

In what is a major development, for the first time since December 2022, Bitcoin’s [BTC] Puell Multiple has dropped to 0.56 on the charts.

Puell Multiple measures the ratio between the daily coin issuance and the yearly average. With this metric, market participants can identify potential bottoms and tops. When the reading is greater than 6, it means miners are earning more than the average of the previous year. In terms of the price, this could be a sign that Bitcoin is close to its top.

Bitcoin to $87,593?

On the other hand, if the Puell Multiple is less than 0.5, it means that miners are making less than they should. In other words, it implies that BTC might be close to its bottom on the price charts.

Therefore, this metric’s position at press time indicated that the coin might soon hit a buying area. Hence, it’s worth looking at what happened back in 2022.

As per the aforementioned chart, Bitcoin’s price was around $16,832 when the Puell Multiple was last at its press time reading. Within just four months, however, the price soon recorded a +39% hike. What this means is that there is likely a very strong correlation between this metric and the cryptocurrency’s price.

At the time of writing, Bitcoin was valued at $63,017. Now, though history does not exactly repeat itself, trends tend to be similar. Ergo, if we go by its previous cycles, we can predict that Bitcoin’s price might trade at around $87,593 before the end of October.

Top is not here, but it may be close

While this might be possible, the coin might face correction along the way. AMBCrypto also looked at the Delta Cap to assess how far Bitcoin is from the top of this cycle.

Delta Cap is the difference between the Realized Cap and the life-to-date moving average of the Market Cap. With this metric, participants can spot major market bottoms and tops.

In 2021, when the Delta Cap hit $340.93 billion, the price of Bitcoin began to fall. At the time of writing, the value of the Delta Cap was $355.86 billion.

Since this figure is higher than the one seen in the previous bull market, one would assume that BTC’s top this cycle is close. However, that might not be the case because Bitcoin’s latest all-time high has already surpassed its 2021 high.

Thus, it is expected that the Delta Cap would be higher. While Bitcoin’s price might hike towards $85,000 or $90,000, the $100,000 predictions might be challenging.

Is your portfolio green? Check the Bitcoin Profit Calculator

If history is anything to go by, while BTC might come close to six figures, it could face rejection as it approaches the milestone.

Failure to break past the possible resistance might trigger sell-offs, and the crypto might end up trading lower than its very optimistic prediction.