Expanding on AAVE investors’ return to this particular trend

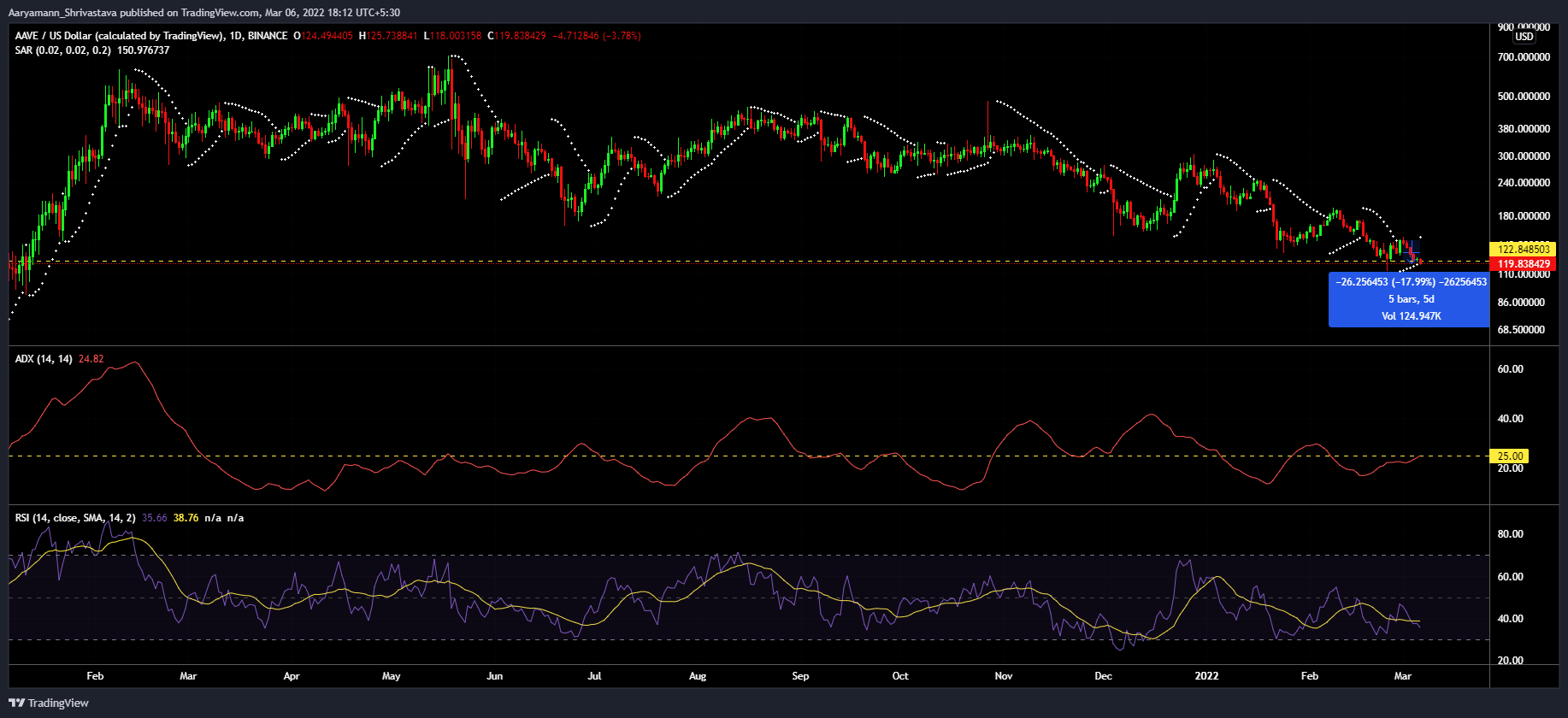

Continuing its streak of losses, AAVE fell by another 18% in the first week of March. It also lost the critical support of $122. Consequently, AAVE, at press time, was at a new 13-month low. At the time of writing, it was trading at $119.

AAVE bamboozles investors

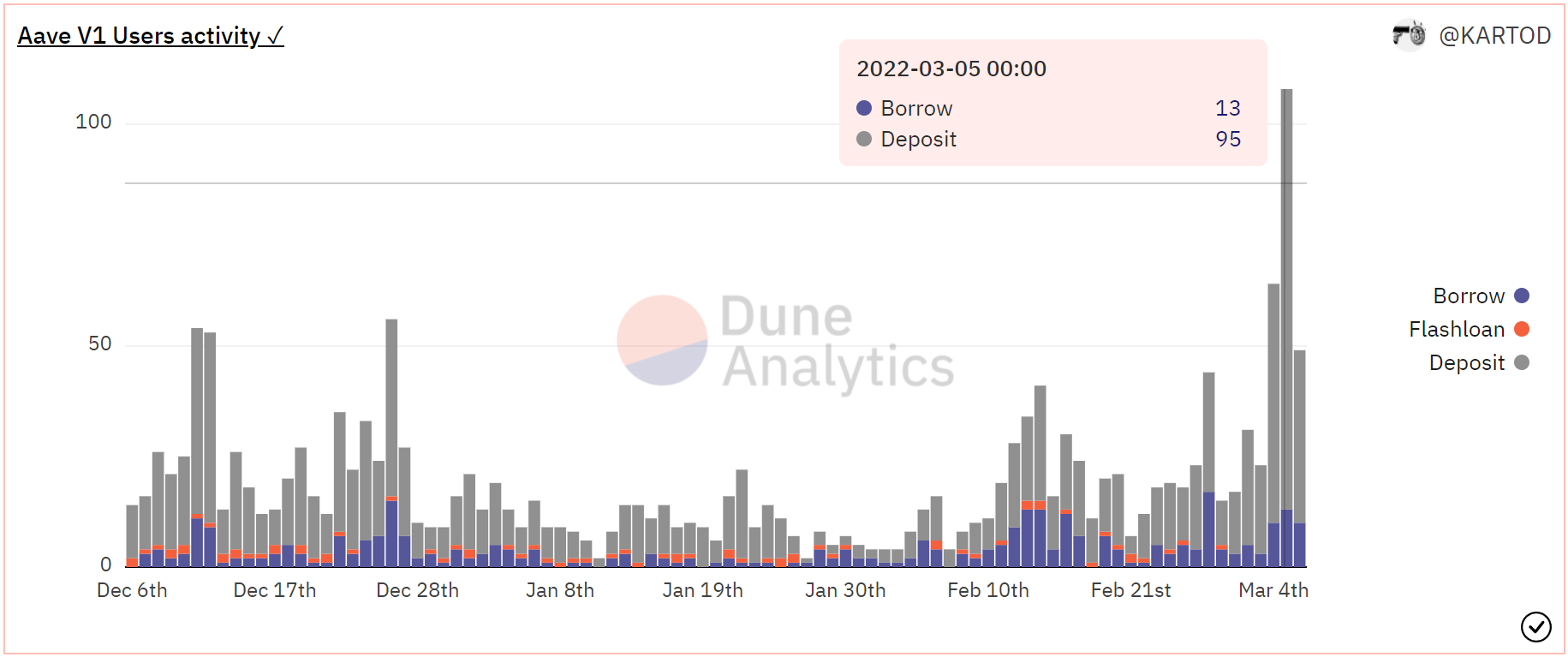

On 5 March, AAVE managed to save itself from a red candle and closed in the green. Even so, many investors bought AAVE at this level, considering it as the current market bottom.

On-chain data supports this thesis since on 5 March, the protocol saw the most number of new users in over nine months. Similarly, a sudden spike in deposits was also recorded.

In fact, within just two days, deposits on AAVE rose by 375% on the charts.

AAVE Price Action | Source: TradingView – AMBCrypto

On the contrary, investors who were expecting a sudden price hike were left disheartened. At the time of writing, AAVE was down by another 4.33%. Furthermore, it is difficult to ascertain if things will get better for AAVE anytime soon.

First of all, the Parabolic SAR pointed to the beginning of another downtrend as the white dots of the indicator changed their position and moved above the candlesticks.

Another concern in addition to the SAR was the Average Directional Index (ADX) which stood at 24.82, at press time. Should it cross 25.0 and continue rising, the downtrend will gain strength. And, it will definitely be against AAVE’s positive recovery.

AAVE deposits | Source: Dune – AMBCrypto

In fact, the Relative Strength Index failed to recover from the bearish zone as it remained stuck below the 40-mark. Investors seem to be disappointed with the token’s performance. It is therefore needed that AAVE invites demand and goes for a ride up.

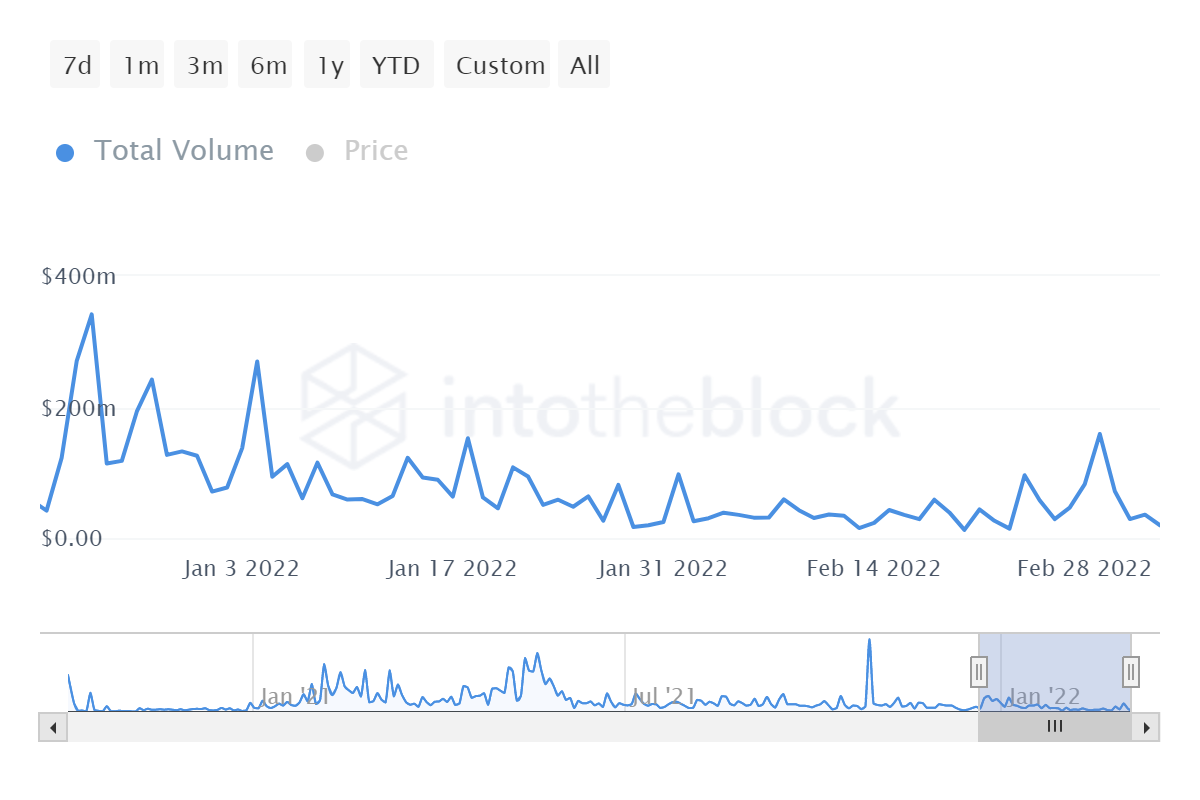

Interestingly, after the DeFi coin rallied by 11% on 28 February, transactions rose to hit $158 million. Although this wasn’t a big deal in comparative terms, it was a feat unseen in almost two months.

AAVE transaction volumes | Source: Intotheblock – AMBCrypto

Whether or not this will lure in new investors to “buy the dip” remains a mystery since the risk-adjusted returns of negative 2.40 were flashing a clear “no sign.”

Even so, investors’ behaviour in the near-term cannot be predicted. By extension, neither can the price action.

AAVE Sharpe ratio | Source: Messari – AMBCrypto