Explaining the sudden inflows into Ethereum Futures contracts

Ethereum, according to many, is a second-gen cryptocurrency because it brought some of the most needed functionalities to implement blockchain technology’s use cases. Now, with PoS incoming and on the back of greater retail and institutional adoption, ETH’s value is expected to hike exponentially going forward.

However, it would seem that Ethereum Futures are in a better position than Ethereum’s future. Here’s how –

Ethereum Futures’ future

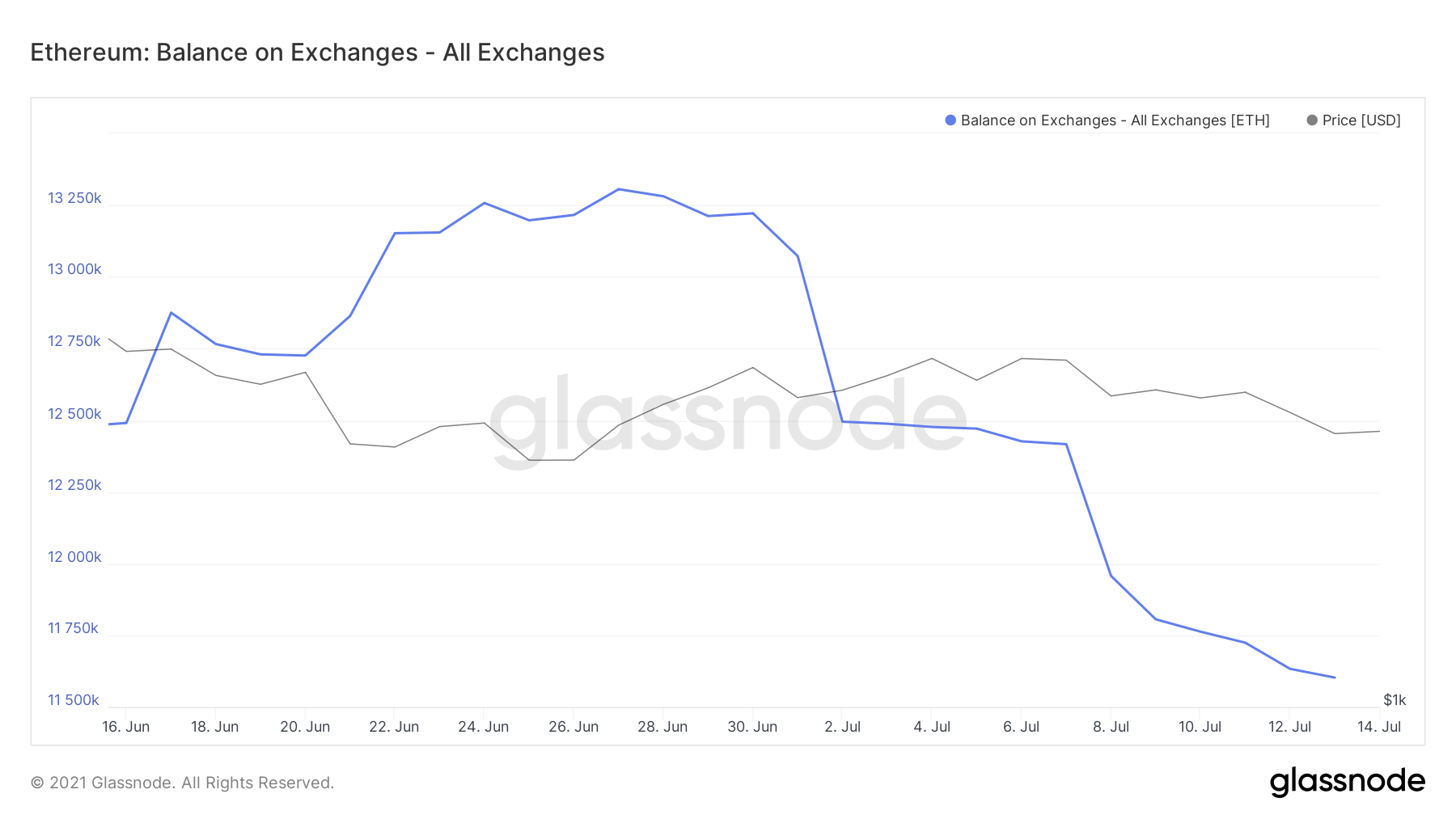

Over the last few days, money has been moving out of spot trading and into ETH Futures contracts. Observing the metrics reveal that a sudden drop in ETH exchange balances suspiciously coincided with the rise in Futures volume. This phenomenon could be observed across all exchanges.

Even though the ETH net balance on exchanges has been dropping for a while, the sudden drop over the last few days is what matched the spike on the derivatives chart.

Ethereum’s balance on Exchanges continue to fall | Source: Glassnode – AMBCrypto

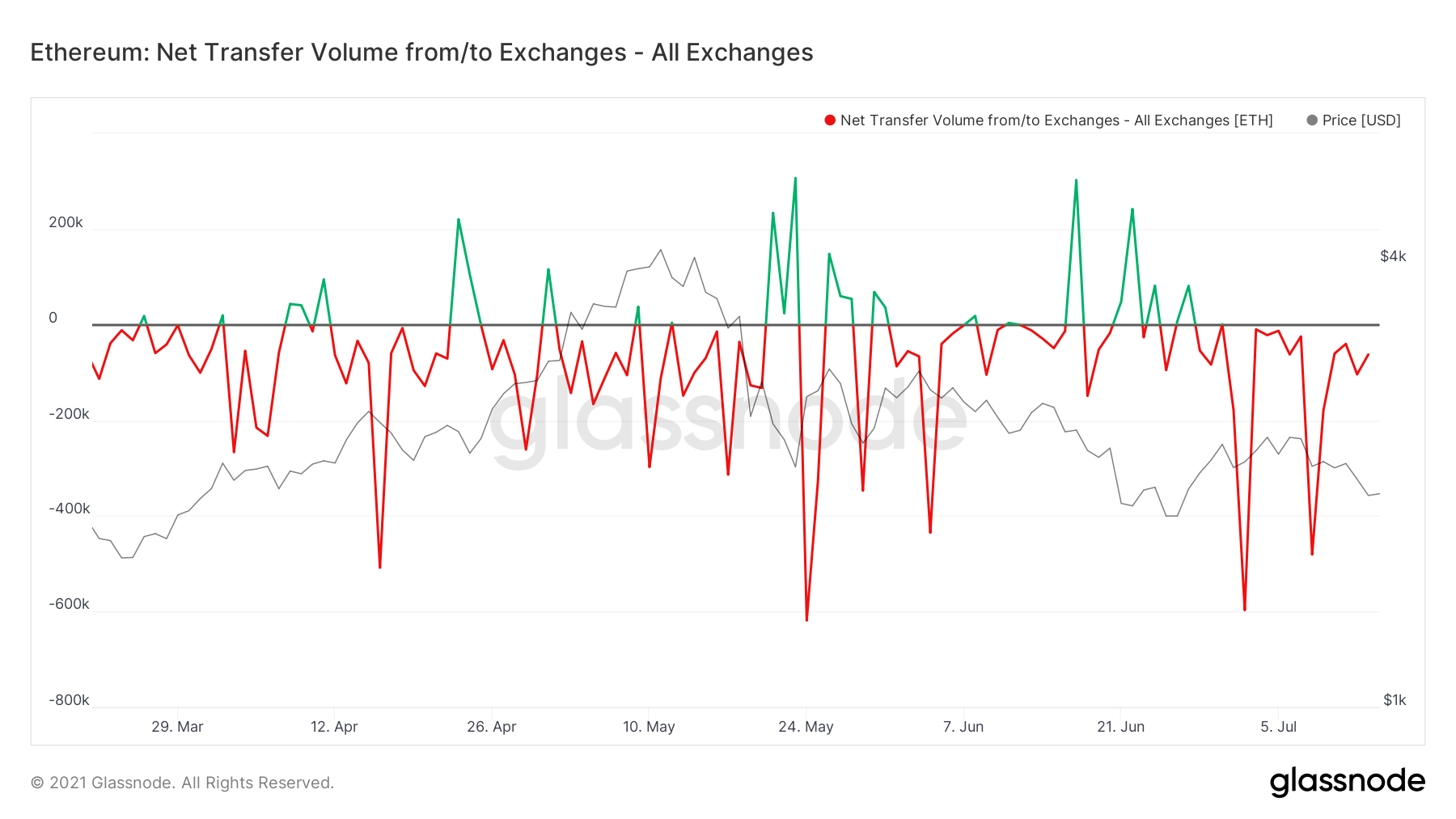

This can be verified by the net transfer volume from/to Exchanges indicator, which despite a solid recovery, pictured a slight dip. Movement under the 0 line is an indication of money exiting the exchanges. But, it was the sudden surge in the Futures indicators which showed where this money went.

Ethereum volume transferring out of Exchanges | Source: Glassnode – AMBCrypto

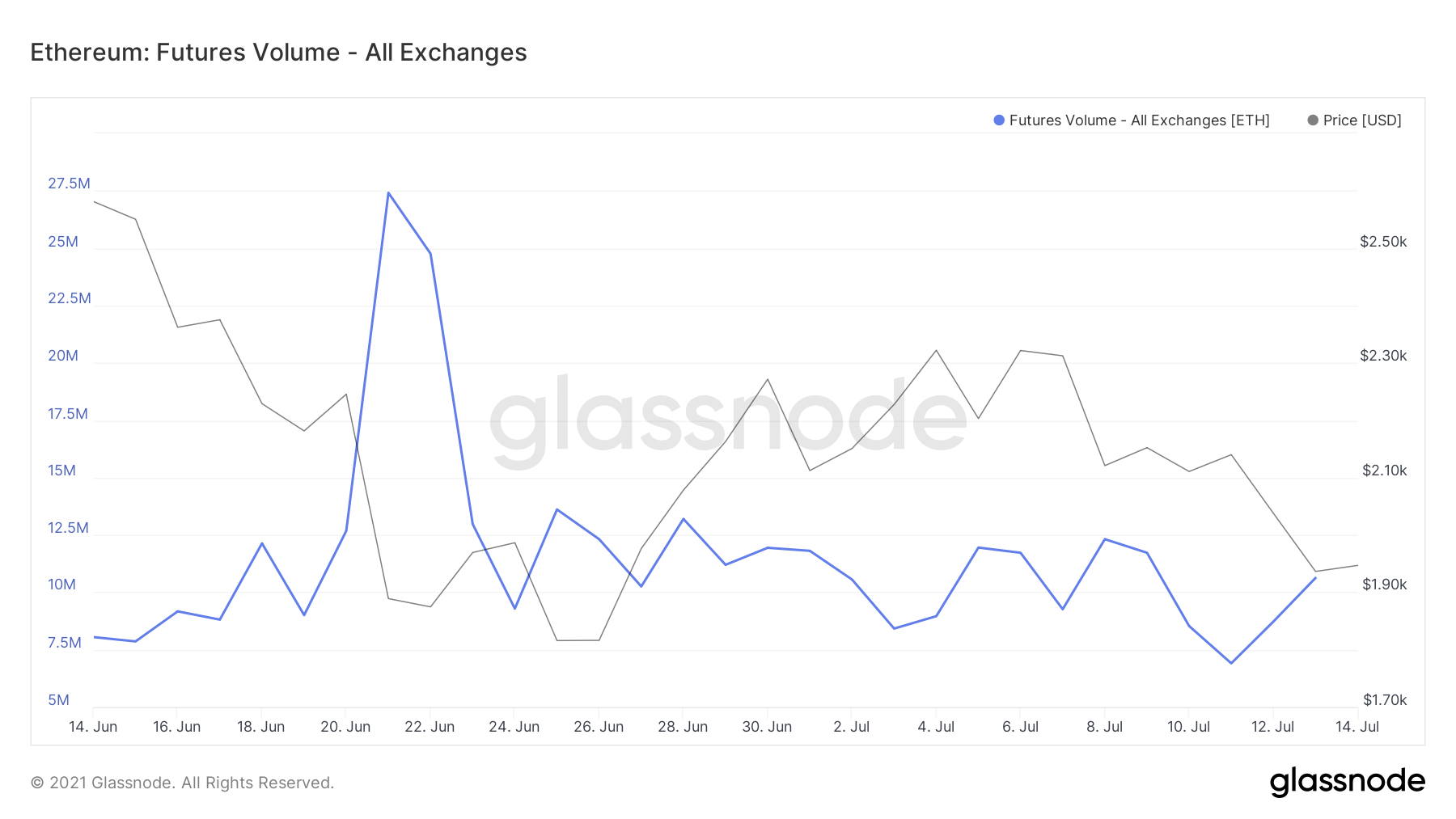

On observing the Futures Volume across exchanges, this becomes clear.

Despite the price drop, Futures volume was up, a sign that at the moment, people are probably hedging for the market. Furthermore, over the last 24 hours, these volumes have risen by almost $12 billion on Binance alone. The figures have been up for Ethereum across every other major exchange as well. And if that is the case, this could be rather advantageous for Ethereum as the altcoin has been making some major headlines recently.

Sudden rise in ETH Futures volume | Source: Glassnode – AMBCrypto

What explains the rise?

The sudden hike in Futures contracts could be the result of multiple big movements that have taken place in the case of Ethereum. First and foremost is Goldman Sachs’ announcement pertaining to the offering of Options and Futures trading for Ether.

The bank also recently said in a note that,

“Currently [Ether] looks like the cryptocurrency with the highest real use potential as Ethereum, the platform on which it is the native digital currency, is the most popular development platform for smart contract applications”

Fuel to this fire was the announcement of Brazil approving Latin America’s first Ethereum ETF in the form of QETH11. These reasons must have upped people’s interest in the coin’s future, more than its present state.