Explaining why Stellar’s [XLM] price may be at the risk of a potential 30% dip

![Explaining why Stellar's [XLM] price may be at the risk of a potential 30% dip](https://ambcrypto.com/wp-content/uploads/2024/12/Chandan_11zon-1200x675.png)

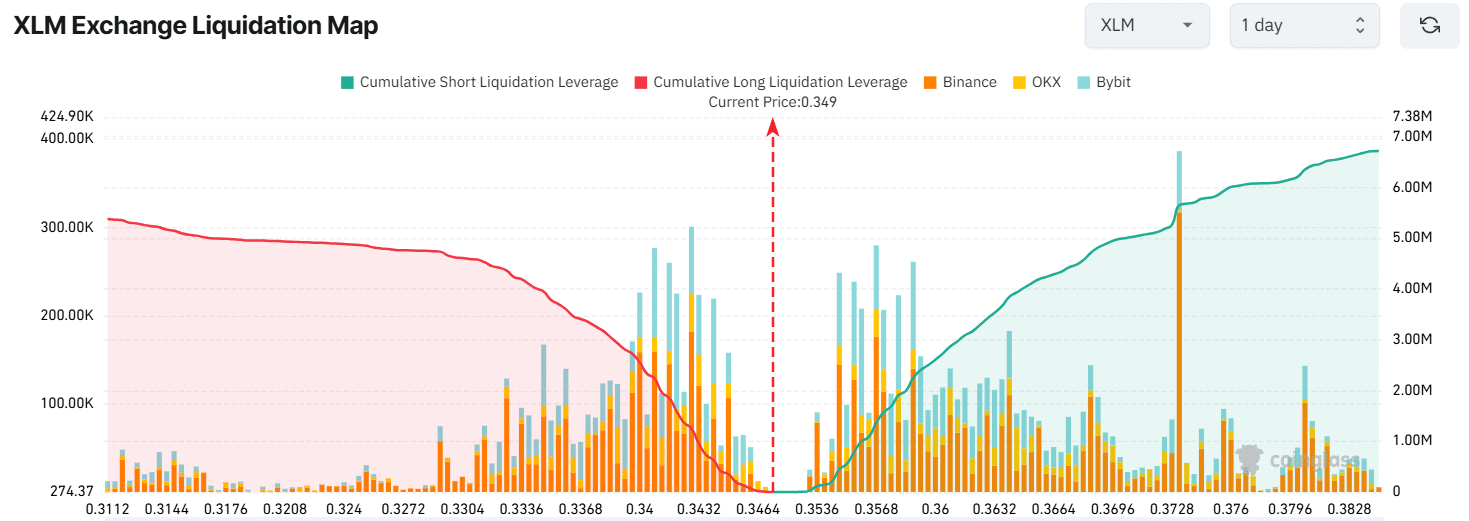

- At press time, traders seemed to be over-leveraged at $0.342 on the lower side and $0.373 on the upper side

- On-chain metrics revealed that exchanges have seen significant inflows of $3.9 million worth of XLM

Amid the ongoing market uncertainty, Stellar’s native token XLM is under attack from the market’s bears. In fact, at the time of writing, the altcoin seemed poised for a notable price decline in the coming days. Alongside XLM, other major assets such as Bitcoin (BTC), Ethereum (ETH), and XRP also appeared to be facing similar conditions at press time.

Right now, XLM is at a crucial support area. However, due to selling pressure, it might be losing its ability to maintain this level. This could lead to a price drop in the future.

XLM technical analysis and key levels

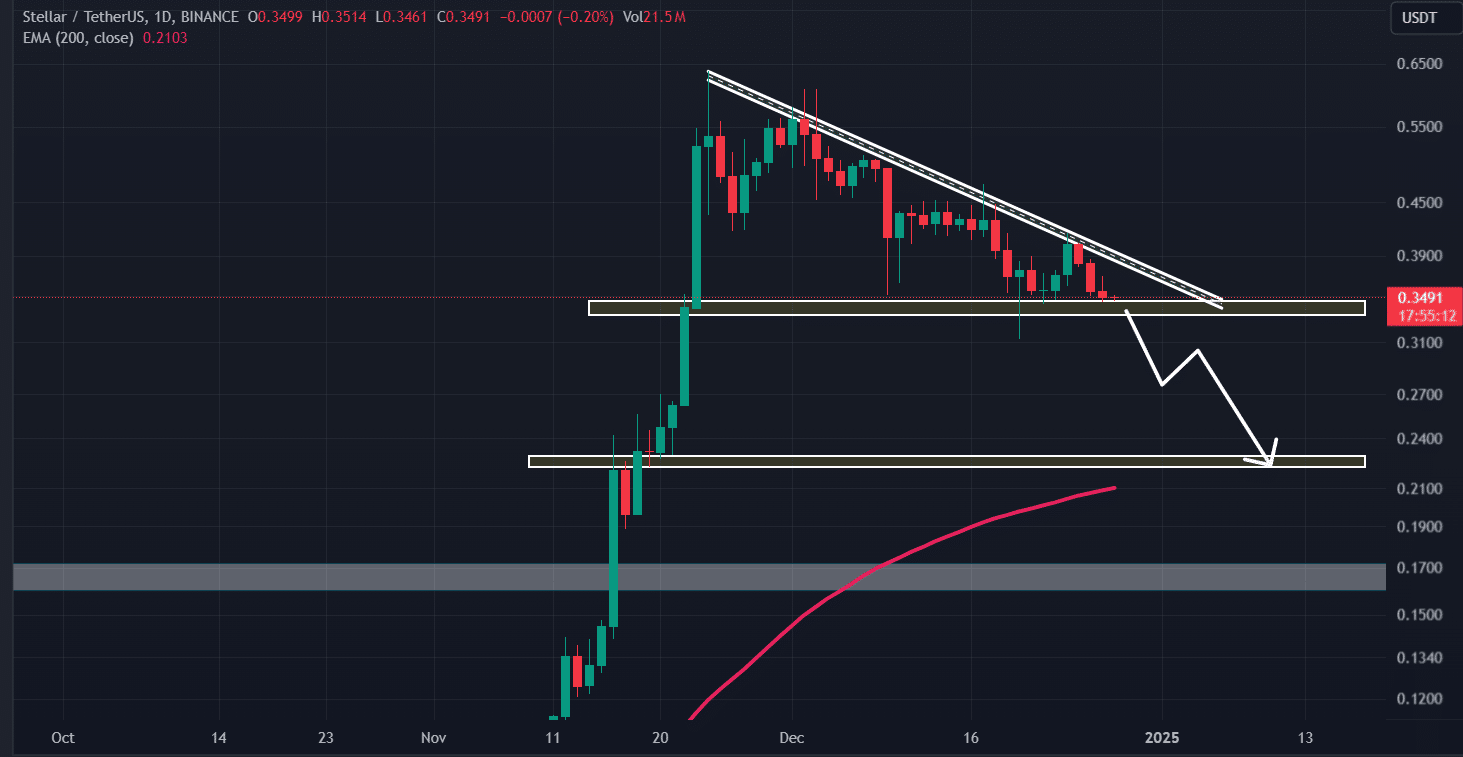

According to AMBCrypto’s technical analysis, XLM formed a descending triangle price action pattern on the daily timeframe and appeared to be breaching its support area.

In fact, this is the third time this month that XLM has tested the $0.334-support level. Each time the altcoin hit this level, the support level appeared to weaken even further.

Based on its recent price action and historical momentum, if XLM fails to hold this support area and closes a daily candle below the $0.325-level, there is a strong possibility that the asset could drop by 30%. By doing so, it could potentially hit the $0.225-level in the future.

Bearish on-chain metrics

Worth noting, however, that this bearish outlook for XLM also seemed to be supported by traders and long-term holders, as reported by the on-chain analytics firm Coinglass. Data from XLM’s spot inflow/outflow revealed that exchanges across the crypto landscape witnessed a significant inflow of $3.9 million worth of XLM – A sign of potential selling pressure.

In cryptocurrency, “inflow” refers to the movement of assets from long-term holders’ wallets to exchanges, indicating a potential price decline and an ideal selling opportunity.

Falling Open Interest and major liquidation areas

In addition to the activity of long-term holders, traders have also been liquidating their open positions over the last 24 hours. During the same period, XLM’s Open Interest dropped by 4.5%, indicating traders’ reluctance to build new positions due to prevailing market fear.

At press time, traders were over-leveraged at $0.342 on the lower side, with $1.25 million worth of long positions built, which could face liquidation if the price falls below this level. Conversely, $0.373 is the level where short sellers have built $5.65 million worth of short positions, anticipating that the price will not rise beyond this point.