Exploring how UNI v3 deployment could impact Binance Coin [BNB]

![Exploring how UNI v3 deployment could impact Binance Coin [BNB]](https://ambcrypto.com/wp-content/uploads/2023/02/sergey-shmidt-koy6FlCCy5s-unsplash-e1675951045455.jpg)

- Consensys and a16z are in different positions on UNI’s deployment on BNB.

- BNB could be impacted in the eventuality of deployment by UNI.

Voting is still happening to determine the best way to integrate Uniswap v3 into the BNB network. The voting process, however, has been anything but straightforward, with some venture capitalists (VCs) holding differing positions on the deployment.

But what effect would this deployment have on the BNB chain and the token should it happen at some point?

Read Binance Coin [BNB] Price Prediction 2023-24

Consensys and a16z go head-to-head on deployment

On 2 February, 0xPlasma Labs, acting on behalf of the Uniswap Community, presented a governance proposal. It was to have the most recent Uniswap version deployed on the BNB Chain.

After receiving 20 million yes votes (80.28%) and 4.9 million no votes (19.72%), the request was officially filed.

On 8 February, 7.03 million votes were cast in favor of the proposal. ConsenSys, the creator of the popular MetaMask digital wallet, led this.

ConsenSys has a stake in the underlying UNI tokens, which are now valued at approximately $47.5 million, and these votes are denominated in UNI. a16z, which reportedly controls 55 million UNI tokens, cast 15 million UNI votes against the proposal.

The deployment’s reliance on the Wormhole bridge was cited as the reason for the rejection, with LayerZero’s viability as an interoperability protocol being advocated. As of this writing, 77.56% of respondents favored the idea, while 22.07% were opposed.

How BNB chain benefits from UNI deployment

Uniswap’s goal is to increase protocol volume and traffic by joining various chains. On the other hand, the BNB chain will also benefit from the protocol’s ultimate implementation.

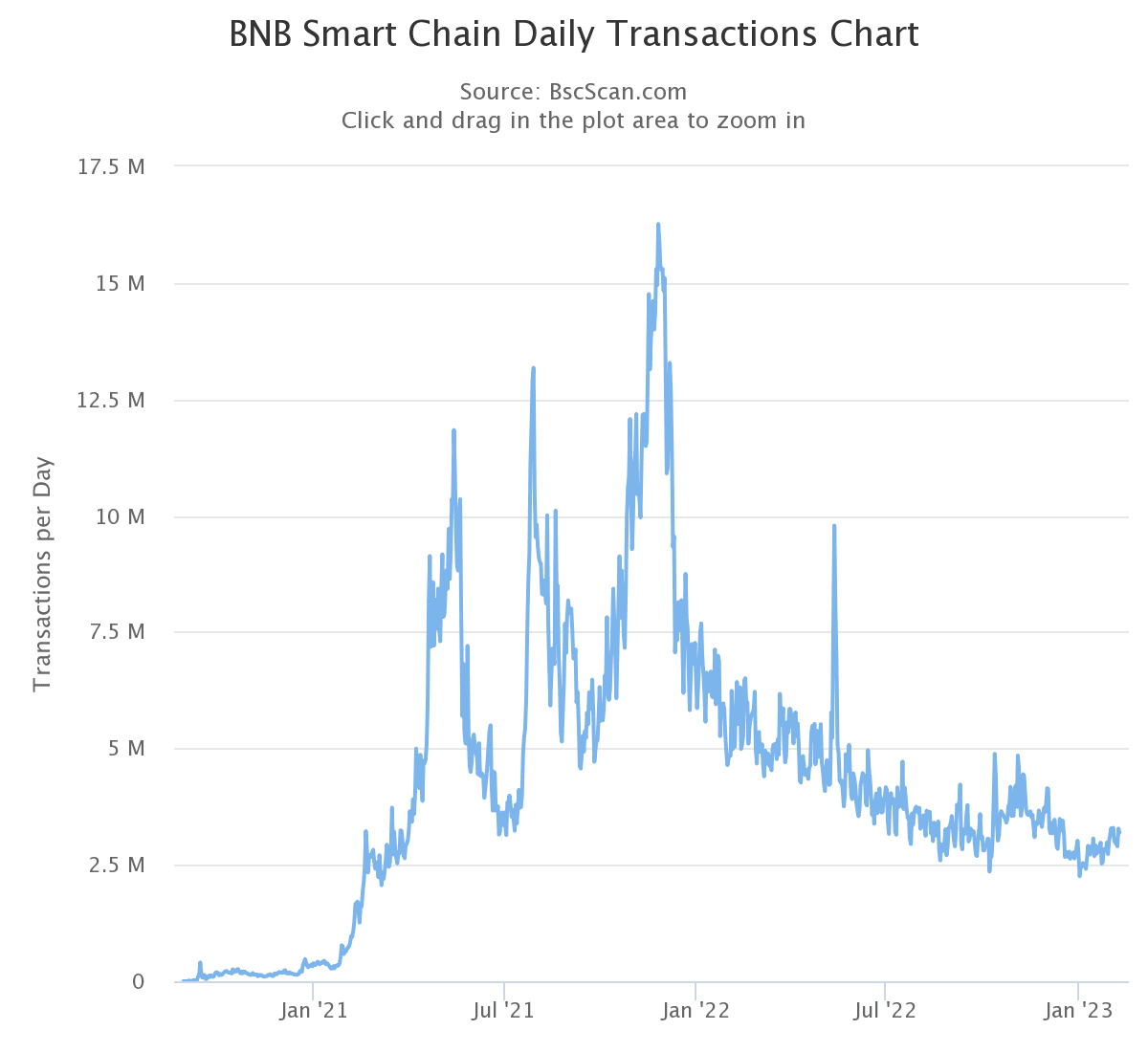

The BNB chain’s record transaction volume was over $16,000,000 in November of 2021. However, there has been a dramatic decrease; the most recent count was a little over 3 million as of this writing. The figure may rise after UNI’s rollout.

In addition, Total Value Locked (TVL) is another measure of BNB that should improve with the UNI rollout. Its TVL was $5 billion as of this writing, a significant decrease from its peak.

UNI has the potential to make significant contributions to BNB due to its status as one of the largest Decentralized Finance protocols.

Daily timeframe BNB

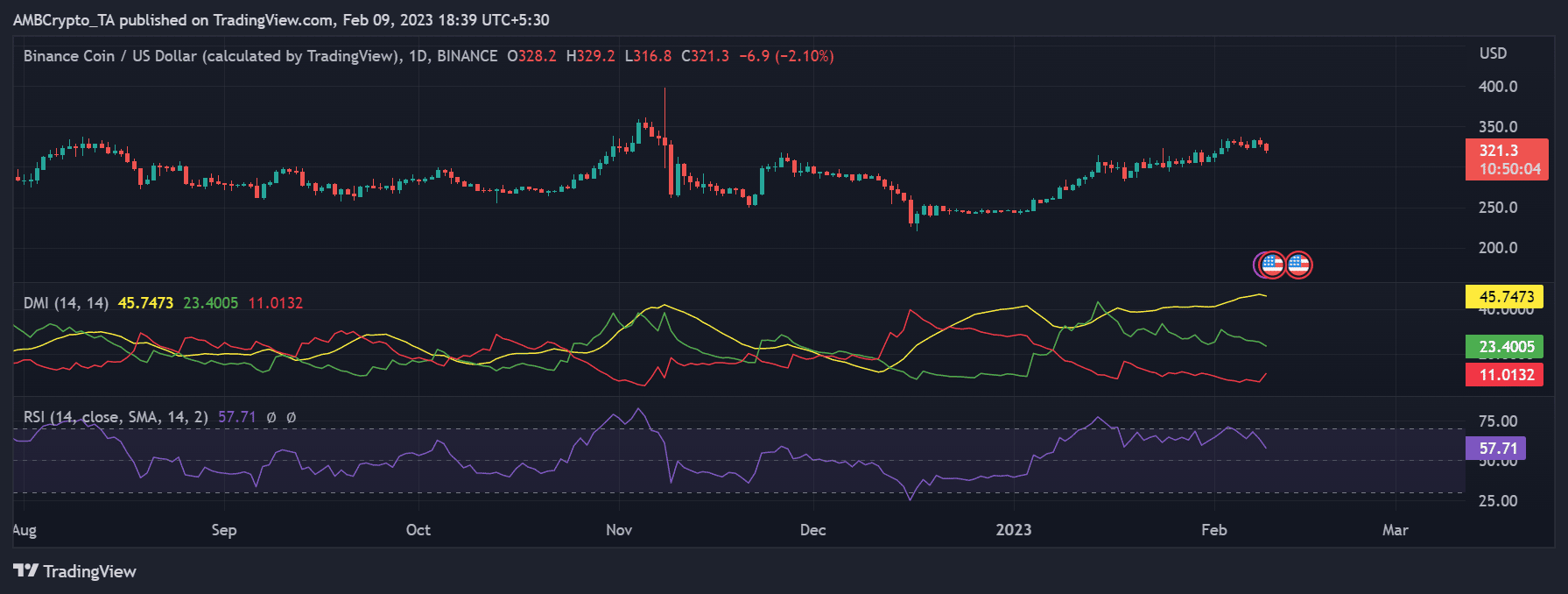

Given the current state of the market, Binance’s [BNB] price activity has not been as thrilling as one may have anticipated.

It was selling at roughly $319 as of this writing, with a value decline of more than 2% also noted.

However, the Relative Strength Index showed that it was still moving in a bullish direction. The RSI line was visible at 56, with the bullish trend diminishing at this point.

Is your portfolio green? Check out the BNB Profit Calculator

Being the native coin of the BNB ecosystem, a successful UNI deployment could have a favorable effect on the price movement of BNB.