Exploring what fueled Floki Inu’s 111% hike and the road ahead

- FLOKI’s open interest has risen to a one-month high

- Negative CMF trailing the memecoin hinted at the possibility of a price decline on the charts

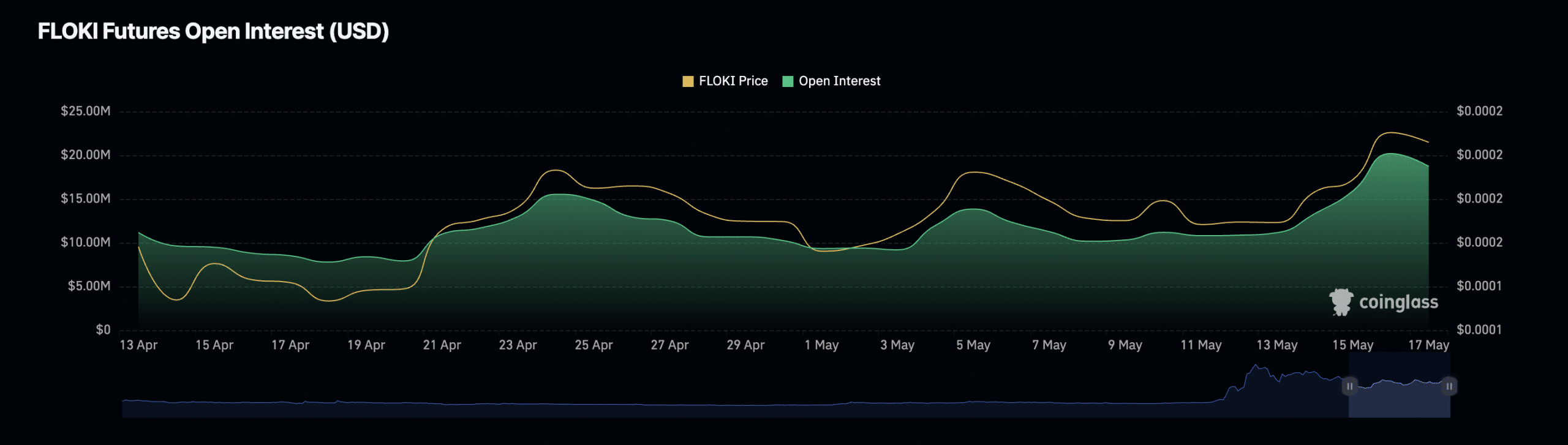

Dog-themed memecoin Floki Inu’s [FLOKI] Futures open interest has climbed to a 30-day high. In fact, according to Coinglass’ data, the same recorded figures of $19 million at press time, having risen by 111% since the beginning of May.

FLOKI’s Futures open interest refers to the number of Futures contracts that are yet to be settled or closed. When it rises in this manner, it indicates an increase in market participants entering new positions.

FLOKI and its growing “demand”

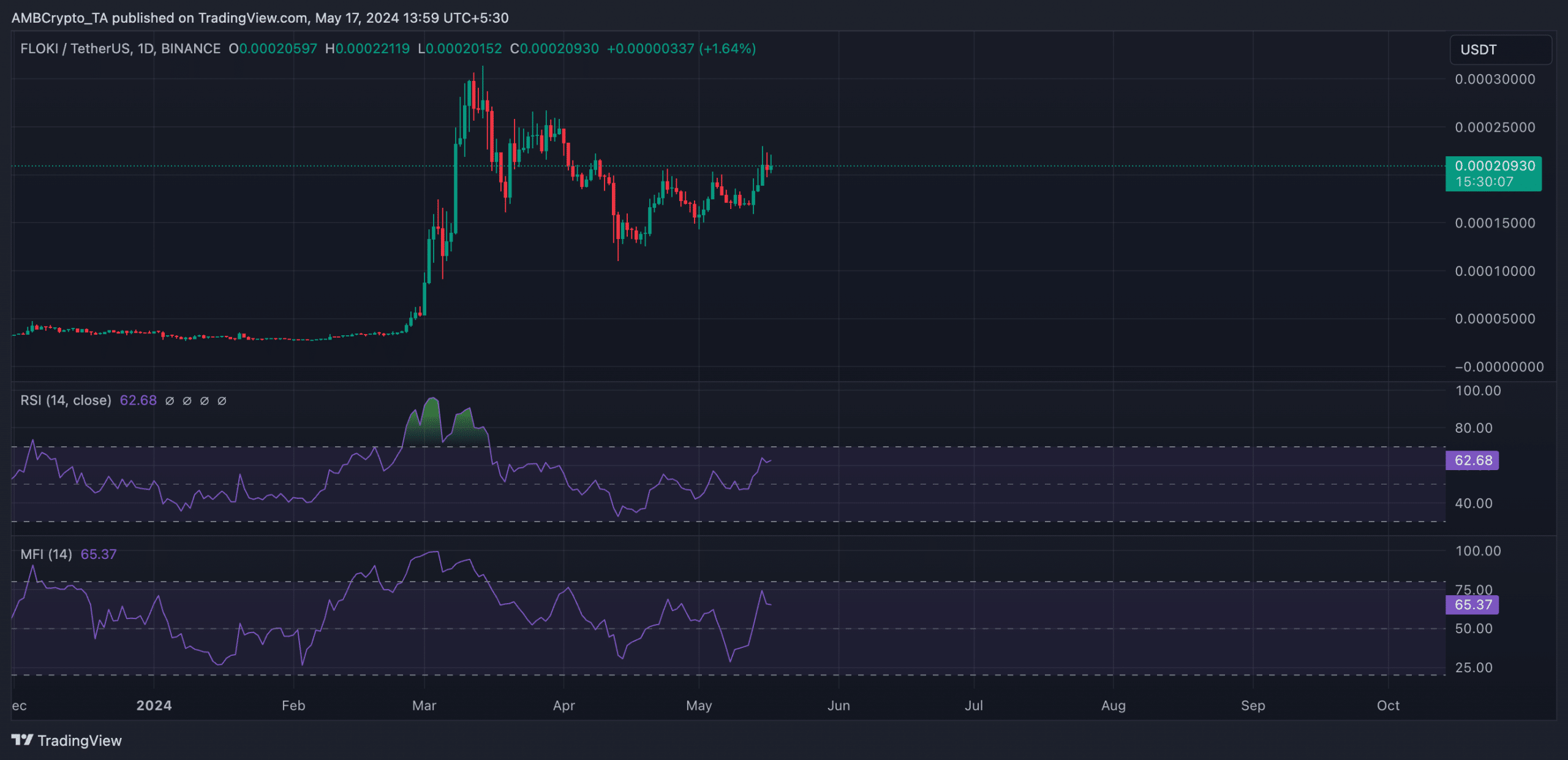

At press time, FLOKI was valued at $0.0002123 on the charts. Rallying by almost 20% in the last seven days, it has emerged as one of the market’s top gainers, according to CoinMarketCap.

The said hike was accompanied by a surge in the token’s daily trading volume. According to Santiment, FLOKI’s daily trading volume amounted to $1.06 billion on 15 May, representing its highest levels since 28 March.

Confirming the spike in demand for FLOKI, its key momentum indicators lay above their respective neutral lines. At press time, FLOKI’s Relative Strength Index (RSI) was on an uptrend at 62.68, while its Money Flow Index (MFI) returned a value of 65.37.

Look before you leap

Despite the latest rally in FLOKI’s value and attempts to break above the upper line of its ascending channel, the bears continue to wield significant control.

This was gleaned from the token’s Chaikin Money Flow, which remained negative throughout the aforementioned period. Here, this indicator measures the flow of money into and out of an asset. When an asset’s CMF declines while its price climbs, a negative divergence is formed.

Is your portfolio green? Check out the FLOKI Profit Calculator

This divergence is a sign that the market’s buying pressure is weakening, even though the asset’s price is appreciating. Hence, it can be argued that short-term speculation drove the price rally, rather than strong fundamentals or long-term investor interest.

At press time, FLOKI’s CMF was below zero at -0.11.

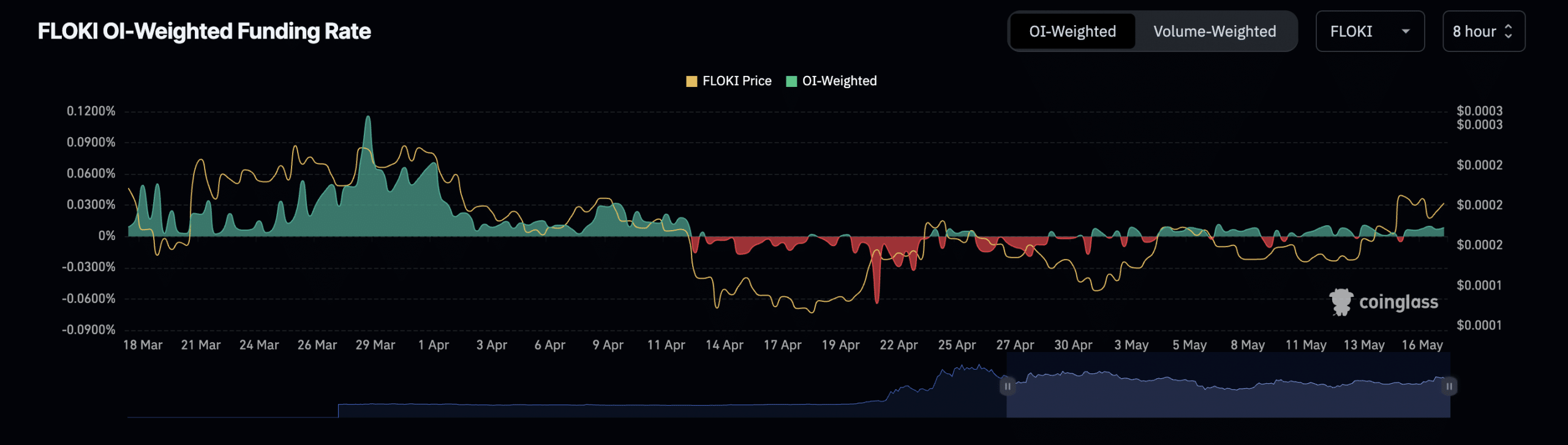

Finally, the token’s daily funding rate across crypto-exchanges has been mixed between positive and negative values since the beginning of May.

This signifies that the price of FLOKI’s perpetual swap contracts has fluctuated around its spot price – Usually a sign of the market being undecided about an asset’s price in the future.