Stablecoins see increase in on-chain volume and transactions this year

2018 was touted as the year of stablecoins. In 2019, despite being flagged as ‘risk’ to the existing financial system by the US Feds, stablecoins continued to evolve at a rapid pace. While most of the latest negative commentaries were directed towards Facebook’s proposed Libra global coin, industry players were positive about the future of the overall stablecoin industry.

Rafael Cosman, Co-Founder, and Head of Engineering of TrustToken said,

“Well, I think that stablecoins are going to find more and more use cases and it’s going to become more used in the conventional market as well and not just in crypto markets.”

Cosman, in conversation with Abra Founder and CEO Bill Barhydt, in the latest edition of Abra Money 3.0, was asked about the stablecoin scene in the next couple of years, to which he responded:

“I also think that stablecoins may start to be used under the hood in more places, let’s say in payment apps, that are international payments using stablecoins and the user might not even realize they are using stablecoin. There’s a lot of growth ahead of stablecoins and the growth in the stablecoins market in the last couple of years has been tremendous.”

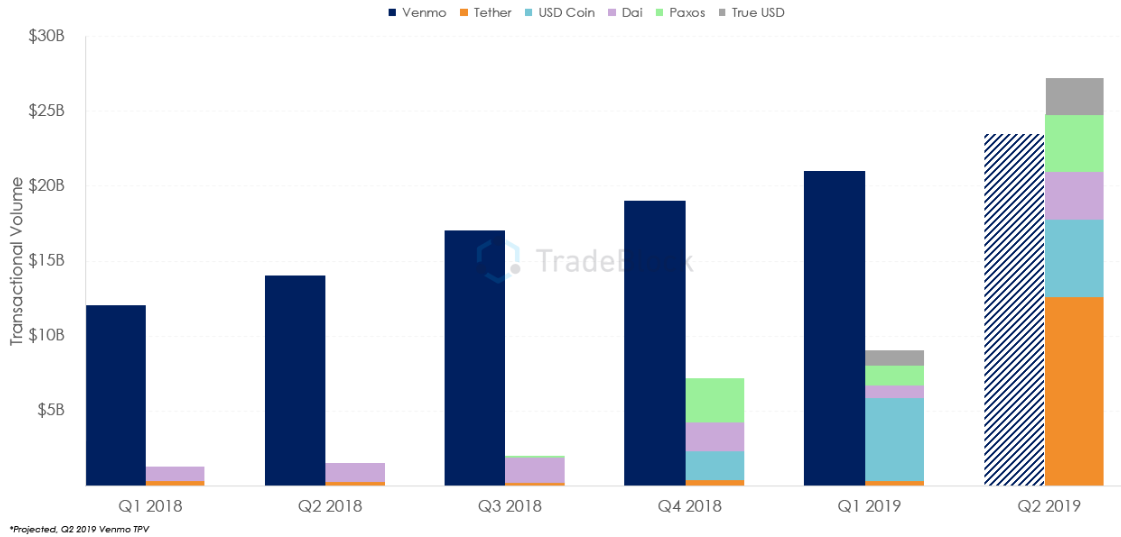

A recent study by TradeBlock suggested a rise in the interest of stablecoins in the second quarter of 2019 as large corporations were eyeing to rollout their own stable digital currencies. Nearly all stablecoins saw an increase in not only their on-chain volumes but also the number of on-chain transactions. In terms of on-chain transactions, Tether [USDT] managed to outpace other large stablecoins.

Source: TradeBlock | Total Payment Volume over time

The digital asset space has presented conundrums on the regulatory front and the stablecoin sector is just a part of it. According to Cosman, Facebook’s Libra, despite facing strong headwinds from the regulators, has opened “all kinds of doors” with many notable centralized variants of the stablecoin business model looking for opportunities.

![Horizen [ZEN] crypto price hits a 32-month high: More gains in store?](https://ambcrypto.com/wp-content/uploads/2024/12/zen-400x240.webp)