Fetch [FET] hits the obstacle at 61.8% Fib level – Are more gains unlikely?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- FET hit a key price rejection level

- Bulls can be hopeful because of rising Mean Coin Age and favorable sentiment

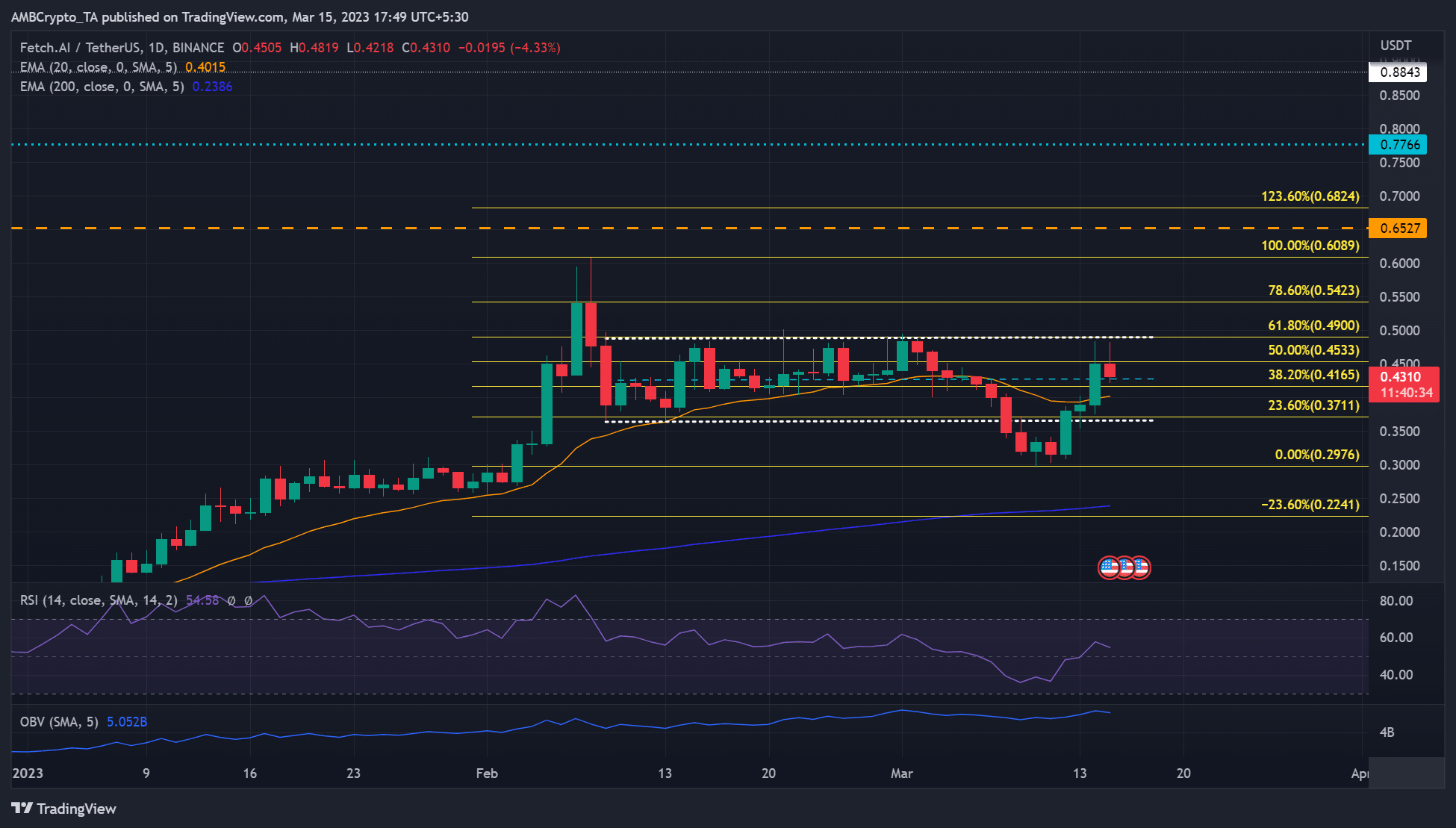

Fetch [FET] oscillated around $0.371 – $0.490 over the last few days before breaking below the range. However, bulls found steady ground at $0.298 on March 12, pushing the price back into its previous range only to face rejection at the range’s upper boundary.

Is your portfolio green? Check out the FET Profit Calculator

At press time, the AI-focused token’s value was $0.4310, down 10% in the last 24 hours. However, FET could benefit from a renewed AI narrative.

OpenAI released its latest and advanced ChatGPT-4 as a Google-backed Anthropic also rolled out a “safer” rival AI chatbot called Claude. This marked a renewal of the AI-wars that could boost AI-focused tokens like Fetch [FET], as seen in the past trend.

Will the price ceiling at 61.8% Fib level hold any longer?

After price rejection at $0.61, FET retraced and entered a consolidation range (white, dotted), but broke below it. The drop was checked by the $0.23-support, thrusting FET into a strong recovery. The 61.8% Fib level hurdle could be cleared as AI narrative floods socials in the next few hours.

Therefore, FET could surge to the bearish order block and 78.6% Fib level of $0.5423 or to overhead resistance at $0.6089 if it closes above the 50% Fib level ($0.4533). Such a move could offer two possible trades.

First, a risky approach targeting the 78.6% Fib level ($0.5423). The entry will be above $0.4533 with a stop loss at 23.6% Fib level ($0.3711). The second option is a $0.6089-target with similar entry and stop loss levels. Each will offer an RR of 1:2.5 and 1:4, respectively.

On the other hand, a close below 23.6% Fib level (($0.3711) would invalidate the bullish thesis. If the previous support holds again, the drop could offer new buying opportunities at $0.30. Short-sellers can short the asset if it closes below $0.3711 and repurchases it cheaply at $0.30.

The RSI (Relative Strength Index) rose, but was slightly above equilibrium, showing buying pressure reduced significantly. However, rising OBV (On Balance Volume) could boost further uptrend.

Read Fetch’s [FET] Price Prediction 2023-24

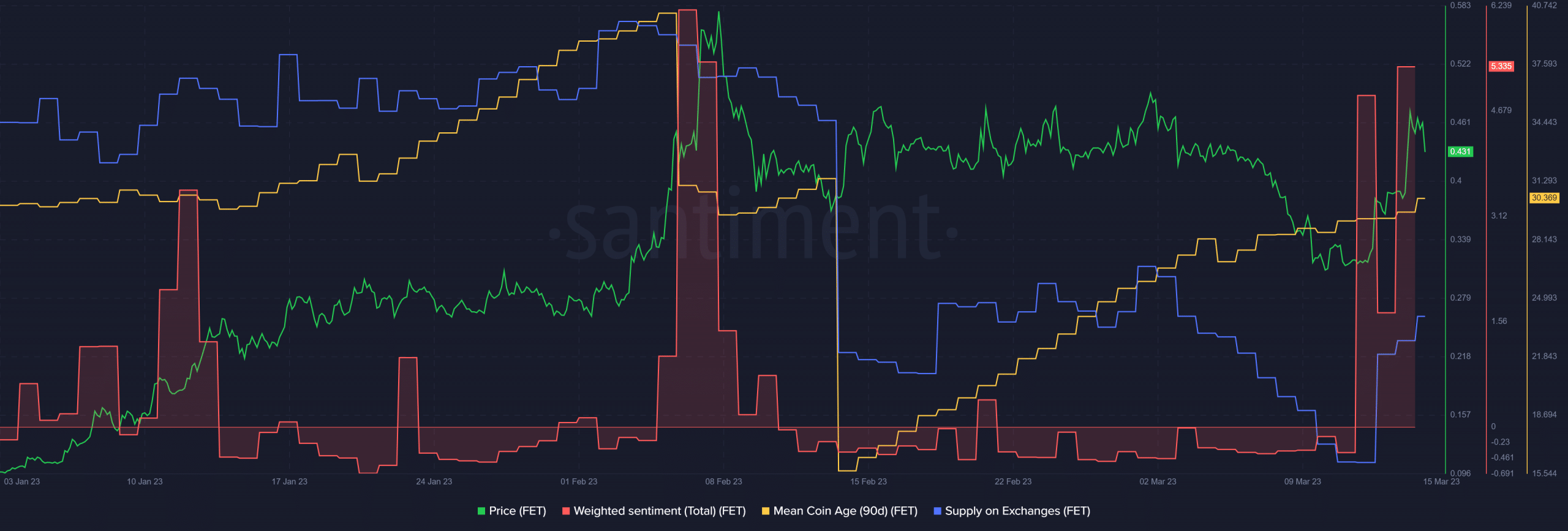

FET saw rising Mean Coin Age and greater positive sentiment

FET recorded a rising 90-day Mean Coin Age, indicating a wide-network accumulation – A potential rally signal. Similarly, the weighted sentiment exhibited a highly positive elevation, showing investors were bullish on the token.

Worth noting that the spike in supply on exchanges is a sign of short-term selling pressure. This, however, is unlikely to undermine a long-term recovery.