Fidelity’s Timmer: Bitcoin wallet growth stalls – A warning for crypto adoption?

- Bitcoin rebounds to $88K after a major slump, but wallet growth remains stagnant.

- Fidelity analysts question Bitcoin’s risk-adjusted returns compared to the S&P 500.

Bitcoin [BTC] is regaining its bullish momentum after a significant downturn that saw its price plummet to a low of $78K following a peak of $109K.

As the leading cryptocurrency makes a strong recovery, concerns remain about its underlying network growth.

Jurrien Timmer weighs in

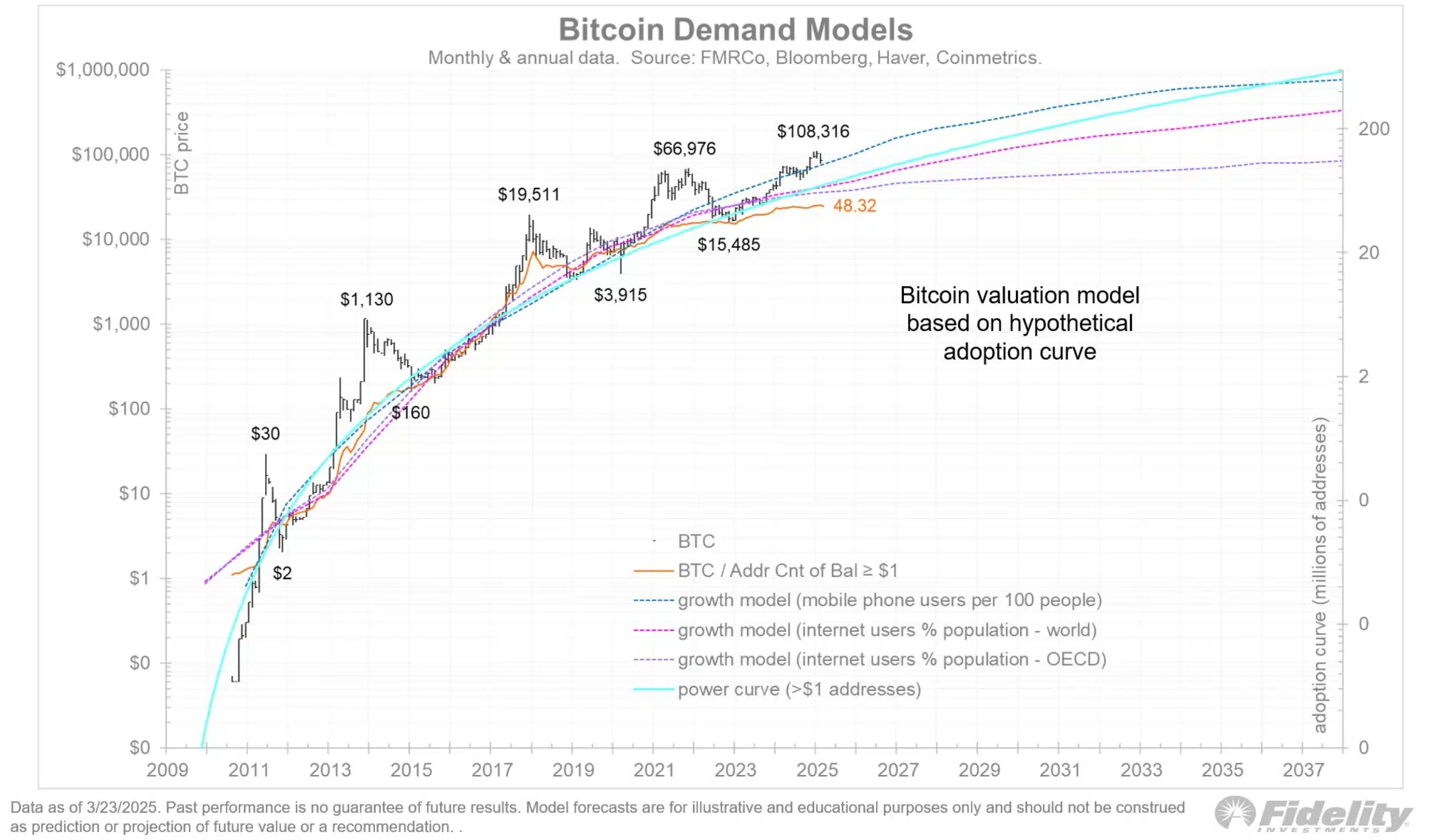

Jurrien Timmer, Director of Global Macro at Fidelity Investments, pointed out that BTC’s wallet count has shown minimal expansion over the past year.

This raises questions about whether the latest price surge is fueled by organic adoption or short-term market speculation.

Timmer attributes Bitcoin’s stagnant wallet growth to the approval of U.S.-based spot exchange-traded funds (ETFs) and MicroStrategy’s aggressive accumulation strategy.

He explains that institutional buyers, unlike retail investors, require only a few wallets to manage substantial holdings, limiting the apparent expansion of the network.

Despite this, Timmer remains confident in BTC’s long-term trajectory, noting that its adoption follows the S-curve seen in other exponential technologies.

The power law model

Additionally, Bitcoin’s valuation adheres to the power law model, where its value increases as more participants engage with the network, reinforcing its long-term potential.

Taking to X, Timer added,

“Unfortunately, this will make it more difficult to track the adoption curve going forward.”

Adding to the fray, Sina, co-founder at 21stCapital, noted,

“Good take. Wallet addresses are deviating from the decade-long trend.”

Bitcoin vs. stocks

Additionally, Chris Kuiper, director of research at Fidelity Digital Assets, also highlighted Bitcoin’s underwhelming performance compared to traditional markets over the past four years.

While Bitcoin has recorded a 17% compound annual growth rate (CAGR), the S&P 500 is not far behind at 13%.

However, when factoring in risk-adjusted returns, BTC falls short, as investors have faced nearly four times the volatility for only a marginally higher return.

This further raised concerns about Bitcoin’s risk-reward profile, especially for institutional investors seeking more stable yet competitive investment opportunities.

Kuiper said,

“So this particular 4-year period has so far underperformed the previous cycles. If we really did peak earlier this year, then this will be quite the disappointing cycle.”

Kuiper acknowledges the possibility of an extended market cycle, suggesting that BTC’s trajectory may not follow past patterns rigidly.

Bitcoin’s current price action

Trading at $88,036.11 at press time after a 0.64% daily increase, Bitcoin has also recorded a solid 4.90% weekly gain, according to CoinMarketCap.

Notably, its recent breakout above the $86,800 resistance on 24th March signals renewed bullish momentum.

Therefore, as Bitcoin continues to navigate market fluctuations, investors remain watchful for signs of a sustained rally or potential corrections in the coming weeks.