Filecoin bulls show signs of weakness and April can see FIL drop below…

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

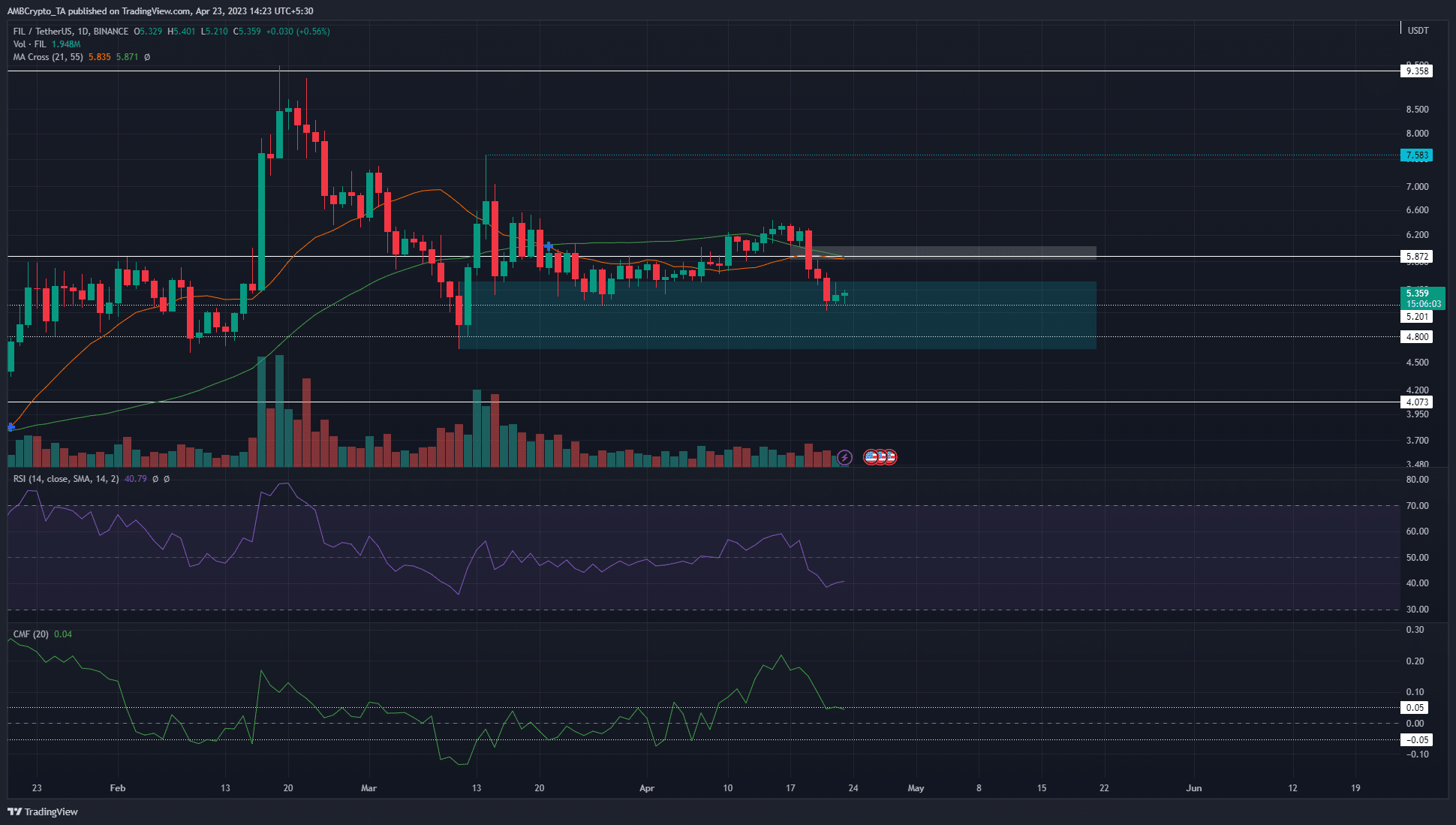

- The daily market structure flipped bearish after the drop beneath $5.6.

- The swift losses left an imbalance that could be filled in the coming days.

The rejection at $6.43 on 15 April was an alarming development for Filecoin. A recent report highlighted how the fall below $6 reinforced bearish pressure. At the time of writing, an imbalance on the charts could offer sellers an opportunity to short FIL upon a bounce.

Is your portfolio green? Check the Filecoin Profit Calculator

The metrics were not encouraging for Filecoin either. There were many issues that the network faced, and the selling pressure across the market did not help FIL bulls. The $5 support would likely not withstand a bearish assault.

The retest of a bullish order block noted underwhelming buying pressure

A bullish order block on the daily timeframe was highlighted in cyan. It saw a sharp break in the previous market structure and flipped it to bullish on 13 March. The buyers were unable to sustain that pressure in the weeks since.

Instead, when the price ventured into the order block and as deep as the $5.2 support, the bulls were able to come up with only a meek response. They were unable to drive the rally past $6.4, and the market structure was bearish once more.

The RSI was at 40 showing downward momentum, and the 21 and 55-period moving averages showed bearishness as well. Surprisingly the CMF revealed strong capital inflow to FIL markets over the past ten days. It remained uncertain if this can fuel a rally.

Realistic or not, here’s FIL’s market cap in BTC terms

A fair value gap was spotted in the $5.87 area. A retest of this region could see the downtrend continue. Therefore short sellers can look to re-enter after a bearish reaction from the $5.82-$6.02 area.

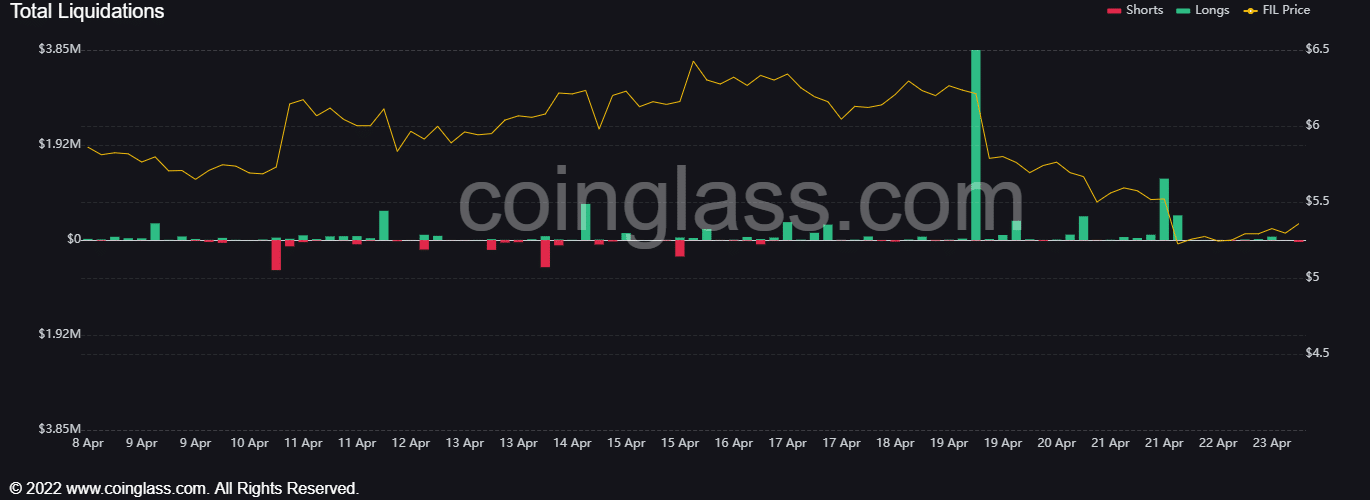

Liquidation data showed bulls severely hurt, short-term sentiment in bearish favor

Source: Coinglass

According to Coinglass data, long positions worth $3.85 million were liquidated within a 4-hour timespan on 19 April. Since then, long positions continued to suffer much more than the sellers. Over the past 24 hours, the long/short ratio showed 51% of market participants were shorting the asset.

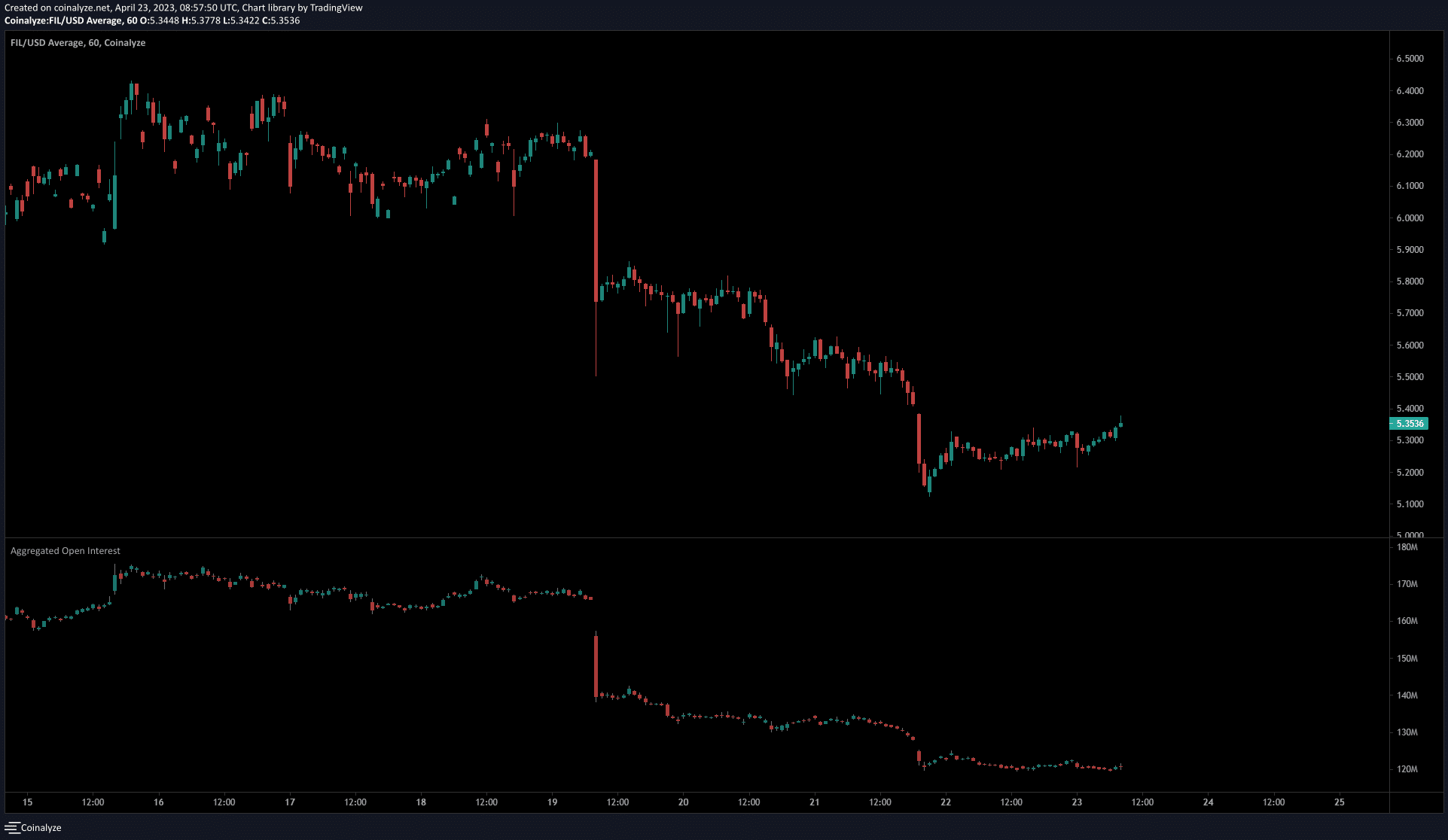

Source: Coinalyze

The Open Interest data showed discouraged bulls as well. The OI had been falling almost as rapidly as the price. FIL saw a bounce from $5.1 to $5.35 in the past 36 hours.

The OI continued to stay at the $120 million mark during this time, therefore we can conclude that bullish speculators remained sidelined.