Filecoin [FIL] could breakout if BTC traverses this path, more inside

![Filecoin [FIL] could breakout if BTC traverses this path, more inside](https://ambcrypto.com/wp-content/uploads/2023/04/image-1200x800-36.png.webp)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- FIL consolidated in a narrow range.

- A declining open interest rate and the long/short ratio could give sellers more hope.

Since the end of March, Filecoin [FIL] has been consolidating in a narrow range of $5.345 – $6.000. The range trading followed Bitcoin’s [BTC] lead. BTC has been consolidating between $26.8k and $28.8k.

BTC’s failure to break above $30k has attracted some short pullbacks across several altcoins, FIL included. This shows traders were not vacating their positions as they expected an upswing.

Read Filecoin’s [FIL] Price Prediction 2023-24

Will consolidation persist, or is a retracement likely?

On the daily chart, the 200-day MA (Moving Average) and 20-day EMA (exponential moving average) were moving parallel and chalked straight lines – suggesting a likely extended consolidation in the short and mid-term.

In addition, the RSI fluctuated near the equilibrium level, as did the OBV (On Balance Volume). Moreover, the Average Directional Index (ADX) declined further, reinforcing a likely retracement or consolidation.

As such, FIL could attempt to retest the range lower boundary of $5.345 if sellers clear the hurdles at the mid-level of $5.657 and the ascending trendline (white). A further drop below the parallel channel (orange) could slow at the 200-day MA (blue line).

But a bullish breakout above $6.000 may occur if BTC reclaims $29k and surges into the $30k zone. The immediate bullish targets for such an upswing are $6.50 and $7.26.

Open interest rates dipped

How much are 1,10,100 FILs worth today?

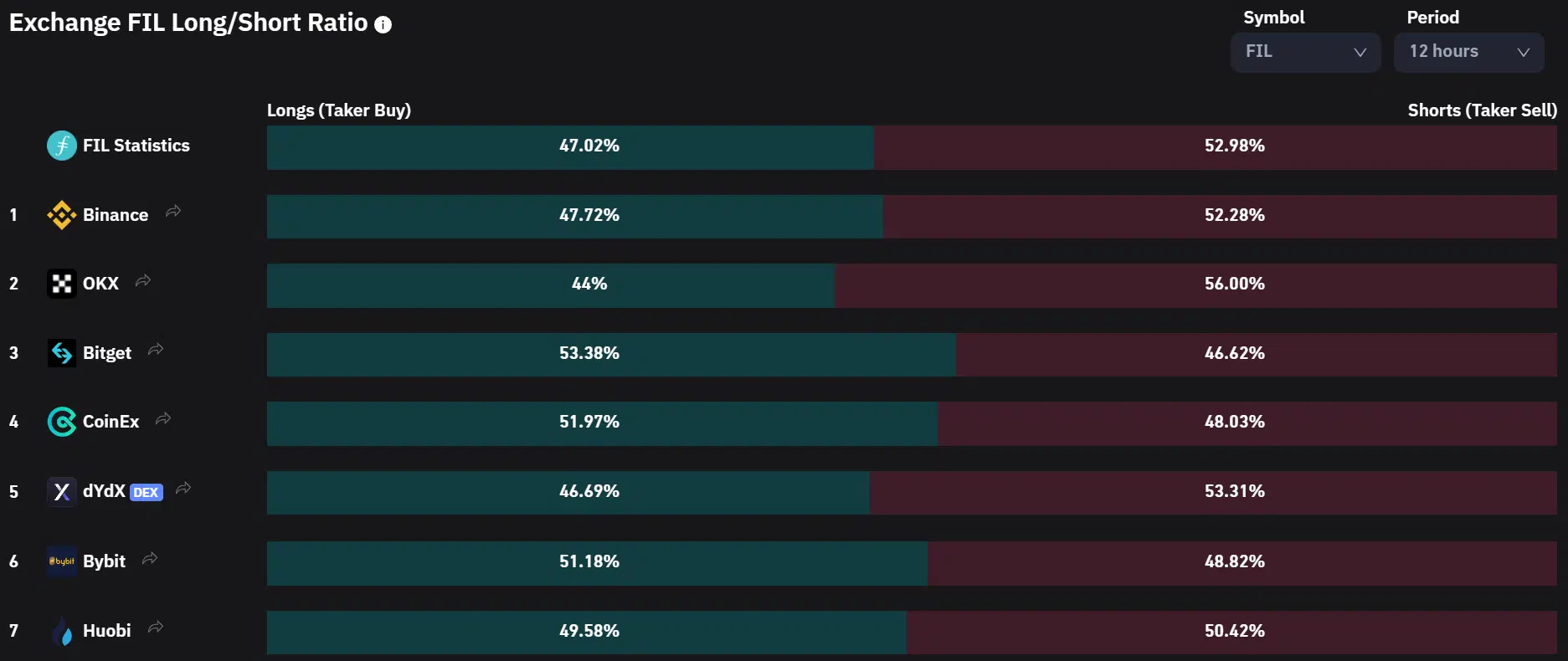

According to Coinglass, the exchange FIL long/short ratio in the 12-hour frame showed sellers had the upper hand. It suggested a bearish outlook for the asset in the mid-term, which could tip sellers to overcome the mid-range level of $5.657 and ascending line.

In addition, the open interest rate has declined slightly since 8 April, indicating a significant outflow of money from FIL’s futures market – capturing the underlying bearish sentiment. However, investors should track BTC’s price action before making moves.