Filecoin: Protocol Labs reduces staff by 21%: FIL gears up for price reversal

- The company behind Filecoin will reduce its workforce by 21%.

- FIL may be due to a reversal as buying pressure weakens.

In a press release published on 3 February, Protocol Labs, the company behind decentralized file storage network Filecoin [FIL], announced that it would layoff 21% of its workforce.

Citing “extremely challenging economic downturn” as the reason behind its move, CEO Juan Benet noted that the cuts were made imperative so that the company could weather the prolonged economic downturn and ensure future sustainability.

Read Filecoin’s [FIL] Price Prediction 2023-24

Per the press release, the intended layoffs will lead to the reduction of Protocol Labs workforce by 89 roles and will impact individuals across:

“PL Corp, PL Member Services, Network Goods, PL Outercore, and PL Starfleet.”

It was not stated if the layoffs impacted the Filecoin team.

FIL due for a price drawdown

At press time, FIL traded at $5.60. Also impacted by the price rally in the market in the last month, FIL’s price has grown significantly by 86% since the year started, returning it to its pre-FTX collapse level, data from CoinMarketCap revealed.

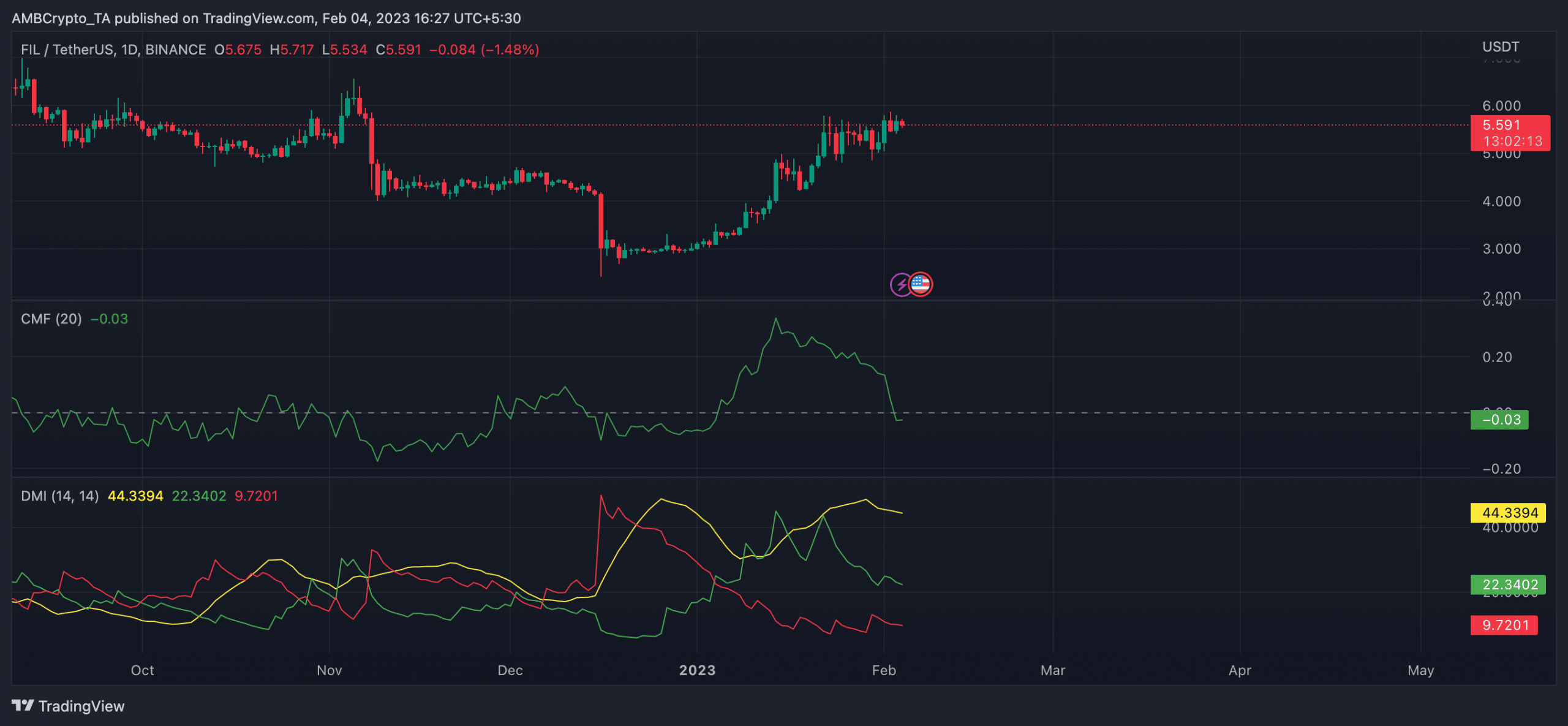

A look at the alt’s movements on a daily chart, however, revealed that FIL traded in a tight range on 22 January and remained in that position at press time.

When an asset’s price oscillates within a narrow range, this can indicate indecision in the market, where both buyers and sellers were reluctant to make a move. It could also indicate a lack of market momentum or volume, making it difficult for the price to break out of the range in either direction.

Since this started, buyers lost control of the FIL market. A steady decline in the alt’s Positive Directional Indicator line (+DI) confirmed this. At press time, this was at 22, gearing up to intersect with the Negative Directional Indicator (-DI) line. Once this happens, the sellers would regain full control of the market, and a price reversal would begin.

Realistic or not, here’s FIL market cap in BTC’s terms

Further, an assessment of the Chaikin Money Flow (CMF) revealed that a bearish divergence between this indicator and FIL’s price had been in place since mid-January. While FIL’s price rallied, its CMF fell.

This type of divergence is common in a market where buying pressure is weak, and the rally in price merely mirrors the general market growth. It is a bearish signal and may indicate a potential trend reversal or a market correction.