Flare crypto investors see hope, then despair – Here’s how

- Flare crypto bulls attempted a breakout but faced rejection.

- The clues from the volume trends showed a sustained upward move and recovery was yet unlikely.

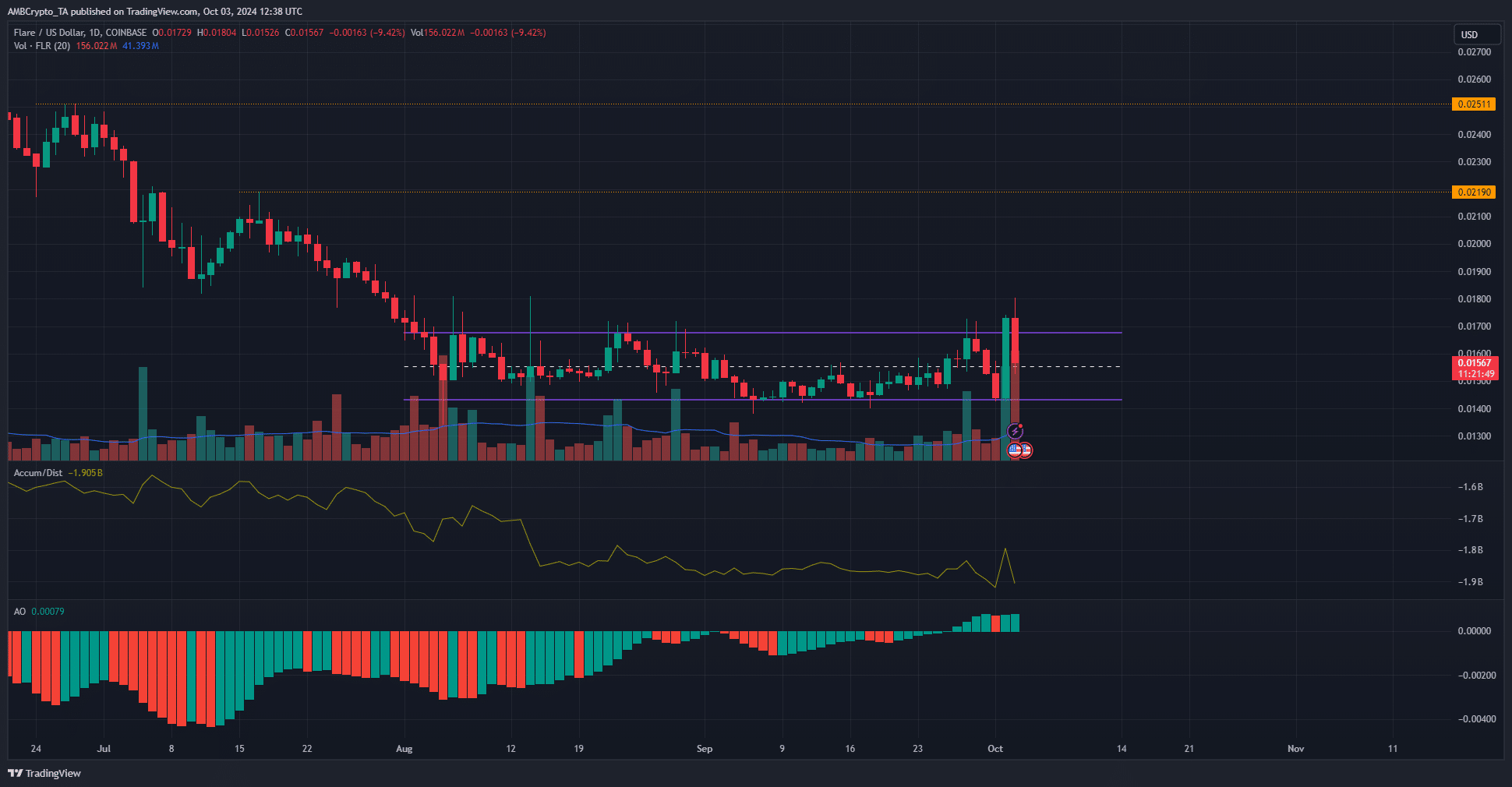

Flare [FLR] has been trading within a range since early August. This range extended from $0.0143 to $0.0167, with the mid-point at $0.0155. The token saw a strong surge in trading volume on the 2nd of October.

This surge came alongside a sharp hike in prices. FLR rocketed from the range lows to achieve a breakout on the same day but has been forced to drop lower since then.

Range breakout was denied emphatically

This price drop measured 12.42% from the local high of $0.018. It took FLR back into the range formation, retesting the mid-range level as support.

AMBCrypto looked at the A/D indicator to see if the price trend was likely to resume its upward impulse.

The A/D has slowly fallen since mid-August. The surge on the previous day was unable to break the highs from August.

The clues from this volume indicator were bearish – Flare is likely not gearing up for a recovery toward the March levels.

The attempted range breakout can be classed as a failure since the range highs were not flipped to support.

It is possible FLR bulls can achieve this in another try, but traders and long-term holders need to remain cautious until the volume indicator trends upward.

Social activity swells following price activity

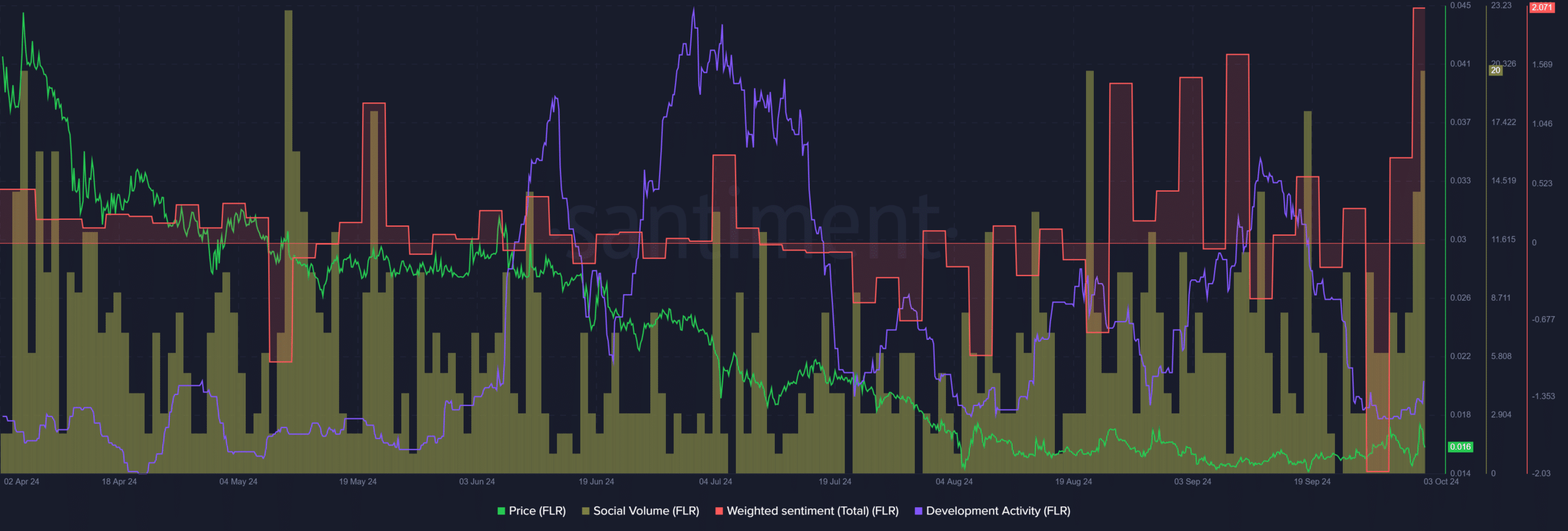

Source: Santiment

The weighted sentiment surged higher, reaching highs not seen since January. This reflected intensely positive social media engagement after the Flare range breakout.

Realistic or not, here’s FLR’s market cap in BTC’s terms

The social volume also saw a noticeable growth.

The development activity has trended lower in recent weeks and is well below the highs it maintained in July and September. This could be a worry for long-term investors.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion