FTX users could get 40% of their deposits back, only if…

- FTX users could get half of their deposits back

- They will need to be patient because bankruptcy proceedings can take too long to complete

Sam Bankman-Fried (SBF) officially filed for Chapter 11 bankruptcy for FTX, FTX US, and Alameda Research on Friday, 11 November 2022. According to reports, FTX creditors could reach one million. Adding FTX users, or about one million, that total number raises doubts about whether everyone can be covered and compensated.

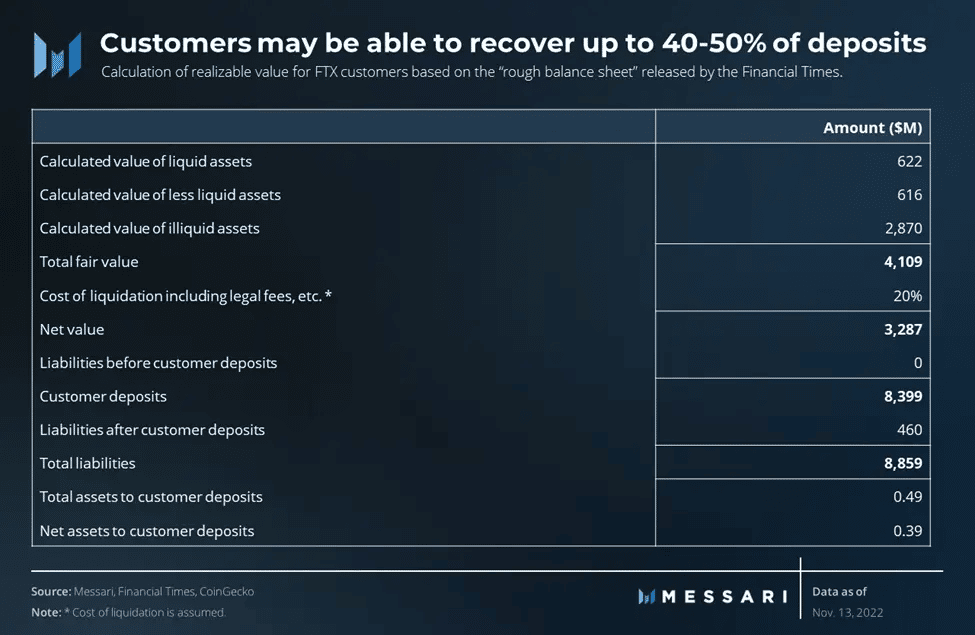

According to Messari, FTX users can quickly recover 40-50% of their deposits if they are sorted out first. Using a preliminary FTX balance sheet published by the Financial Times, Messari noted that FTX customers’ deposits total $8.4 billion.

Compared to the $4 billion in realizable FTX assets, selling these assets, which include stablecoins and BTC holdings, can help customers recover about 50% of their deposits.

The above analysis by Messari makes three assumptions to reach its conclusion. It assumes that some FTX-linked assets, such as serum (SRM) and FTT, will be zero. It also assumes that FTX users (“customers”) will be paid first and that the preliminary balance sheet used is error-free.

The first assumption that FTT and SRM will be zero is plausible, given the current FUD. Although we cannot substantiate the integrity of the preliminary balance sheet, FTX users will certainly not be paid out first.

Bankruptcy proceedings may complicate matters for FTX users

Any financially distressed company can choose the type of bankruptcy procedure that suits its needs. FTX has opted for the Chapter 11 procedure.

The chosen procedure gives high priority to secured creditors. In second place are unsecured creditors, i.e., individuals or companies that loan money without obtaining collateral for their line of credit. Finally, the shareholders can receive their claims once the first two creditors have been satisfied.

These depend on the bankruptcy court and how it categorizes each group. For comparison, Voyager account holders have been categorized as “general unsecured creditors.” This means they can only be served once the higher-priority creditors are sorted.

Celsius and FTX users could fall into the same category under the Chapter 11 bankruptcy process. Therefore, it is likely that FTX users will be the last, if not the second, to be included in the claims process.

In addition, bankruptcy proceedings take a long time to complete. For example, the bankruptcy proceedings of Mt. Gox, a former Bitcoin exchange based in Japan, are ongoing and were started in 2014. It was in October 2022, eight years later, that the court began paying out claims.

In addition, the blocked assets of users are valued differently over time. Users can only get what they are given when the day of reckoning comes. In short, the current value of realizable assets, which Messari’s analysis suggests could cover customer deposits, may fall or rise over time.

FTX’s bankruptcy filing gives creditors, investors, and users of the FTX platform a chance to recover their investments and crypto assets. But the process is not easy and could take longer.

If anything, Voyager’s bankruptcy offered crypto investors an unforgettable bankruptcy law 101. In most cases, you will be the last in line for compensation without any guarantees. That’s why it is important to remember that “not your keys, not your crypto.”