FUD around DYDX rises: Should you be concerned?

- DYDX was up by nearly 4% in the last seven days, but trading volume dropped.

- Though metrics looked positive, a few market indicators supported the bears.

We have entered the festive season, marking the concluding days of 2023. While several cryptos gave their investors profits with Santa rallies, a few others, including dYdX [DYDX], reacted differently.

Thus, should investors be concerned about the token’s performance, especially over the next few days?

FUD around DYDX is rising!

Santiment recently posted a tweet highlighting the behavior of a few cryptos. As per the tweet, DYDX and several other coins had witnessed a substantial rise in negative sentiment.

If history is to be considered, such incidents are often followed by price bounces.

? As markets head into #ChristmasBreak, the coins that have been seeing particularly extreme negative sentiment include $STORJ, $ILV, $LTC, $DYDX. Historically, the assets with the most #FUD correlate with high likelihood of price bounces. ? https://t.co/N7XszdTyyQ pic.twitter.com/L96kfDEBYY

— Santiment (@santimentfeed) December 23, 2023

Not only dYdX, for that matter, but AMBCrypto earlier reported that a similar trend was also seen for Litecoin [LTC]. Our analysis found that LTC’s Weighted Sentiment was down to -2.415.

Coming back to dYdX, though a drop in Weighted Sentiment can generally be perceived as a bearish signal, this time, things were different.

According to CoinMarketCap, the token was up by more than 4% in the last seven days alone. At the time of writing, it was trading at $3.14.

However, its trading volume dropped, signifying the reluctance of investors to trade the token.

Is DYDX expecting a price correction?

Since the increase of its FUD, AMBCrypto checked the token’s supply to see whether there was a sell-off. Our analysis found that investors were still buying the token.

This was evident from the fact that the token’s Supply on Exchanges plummeted sharply, while its Supply outside of Exchanges increased.

Nonetheless, whales did not show much confidence in the token, as the supply held by top addresses declined at the time of the report.

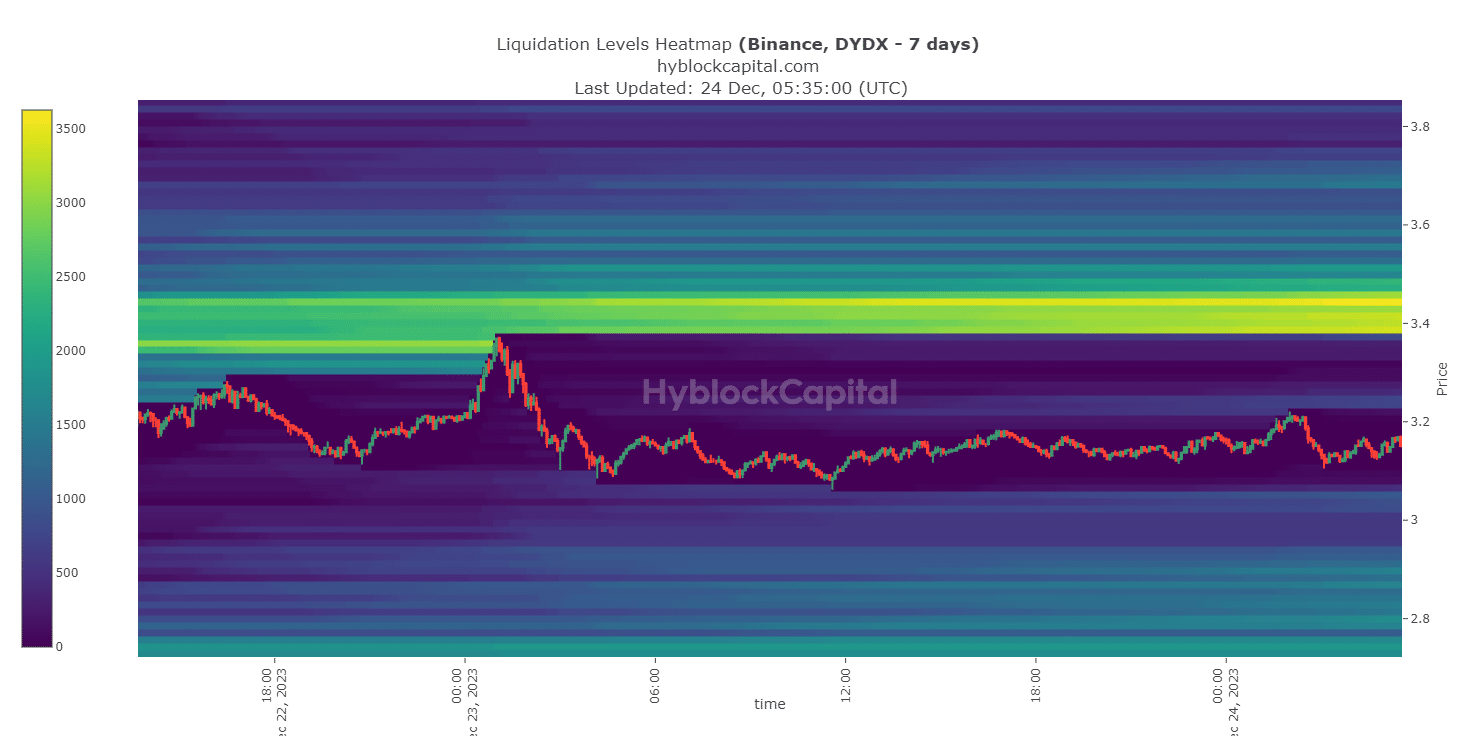

Upon further digging, AMBCrypto found that DYDX did witness a hike in liquidation in the recent past. Our analysis of Hyblock Capital’s data pointed out that investors sold their holdings when the token’s price touched the $3.38 mark.

If the token manages to continue its upward price movement, it has to first go past this barrier to push its price further.

The possibility of DYDX sustaining its growth momentum seemed likely if on-chain metrics were to be considered. For example, the token’s MVRV Ratio went up on the 21st of December.

Other positive metrics include dYdX’s transaction count and daily active addresses, which remained relatively high throughout the last week.

To better understand what to expect from the token, AMBCrypto looked at the token’s daily chart. The token’s Money Flow Index (MFI) registered an uptick and was headed further away from the neutral mark.

Realistic or not, here’s DYDX’s market cap in BTC’s terms

Its Chaikin Money Flow (CMF) also somewhat rested above the neutral zone, increasing the chances of a price uptrend.

However, the Bollinger Bands told a different story. As per the indicator, DYDX’s price was in a highly compressed zone, which could restrict its price from moving up in the days to come.