Fund inflows support Bitcoin’s recovery story, but this crypto continues to lag

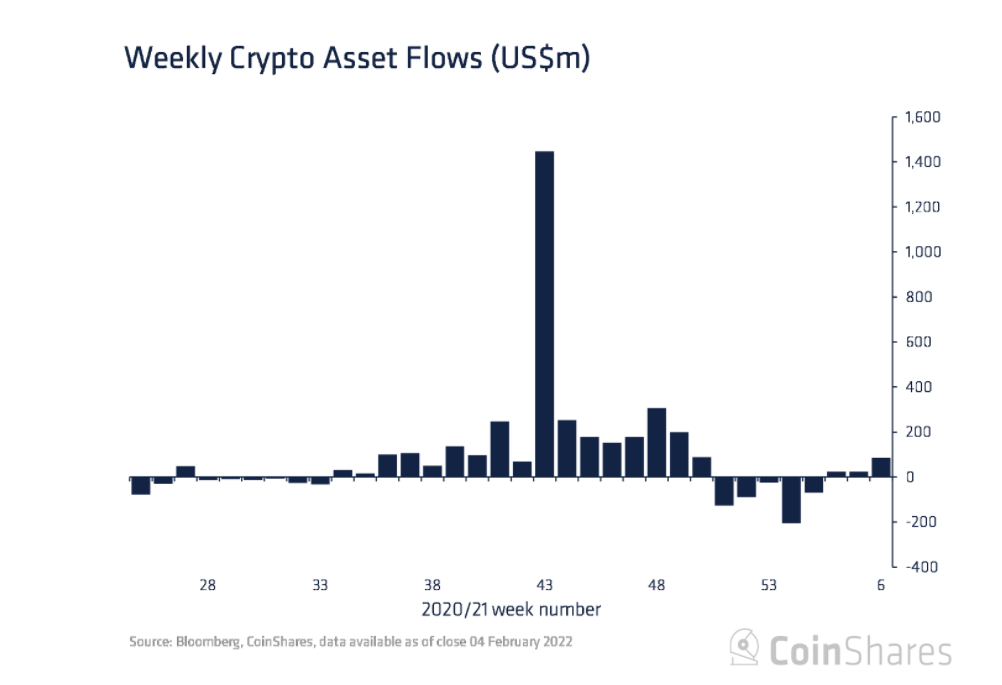

The month of January was responsible was a downward spiral in the crypto-market. And, the downtrend was also responsible for reducing fund flows for all digital assets. However, for the third straight week, the trend seems to be reversing with recovery on the way.

While it briefly breached the crucial $45K level today, Bitcoin has recovered by 13% over the past week. In the last 24 hours, the global cryptocurrency market cap has risen north of $2 trillion on CoinGecko.

As per CoinShares’ Digital Asset Fund Flows Report for the week ending 4 February, sentiment continues to improve with the third week’s inflows totaling $85 million.

The report further gives an asset-wise bifurcation, with Bitcoin again leading the week with inflows of $71 million. This figure reportedly points to the largest inflows since early December, a time before sentiments started turning sour.

Over the past three weeks, the cumulative inflows were recorded to be $108 million. The report highlighted,

“Volumes in Bitcoin investment products remained low last week at US$1.8bn versus US$3.4bn the previous week.”

On the contrary, Ethereum registered outflows for the ninth week while other altcoins like Solana, Polkadot, Terra, and Cardano saw inflows in the range of $1-$2 million. What is worth noting, however, is that despite its recurring outflows, Ethereum has seen a healthy uptick of 15% over the past week.

While the picture is not all rosy for the digital asset market, there has been positive news for crypto-adoption on the institutional front. KPMG Canada yesterday revealed that it has added Bitcoin and Ethereum to its corporate treasury. Further, even Coinshares noted that while Europe has seen inflows of $10.3 million, the majority of the funds came from Brazil and Canada (US$75m).

Meanwhile, MicroStrategy, a company heavy on Bitcoin to the tune of over 90% of its treasury, doesn’t seem to be hitting the pause button. The company reportedly added 660 BTC worth around $25 million between December 30, 2021, and January 2022.

With respect to BTC, Saylor told Yahoo Finance,

“My time horizon is a decade or more.”

That being said, Wells Fargo Investment Institute has called crypto a “viable investment” tool in a recently released report. Furthermore, it highlighted the parallels of cryptocurrencies and the early days of the Internet as an investment opportunity, as pointed out by several analysts in the past.