GameFi slows down but Avalanche shows signs of resurgence- Here’s why

The latest data surrounding the GameFi industry has raised questions for Avalanche of late.

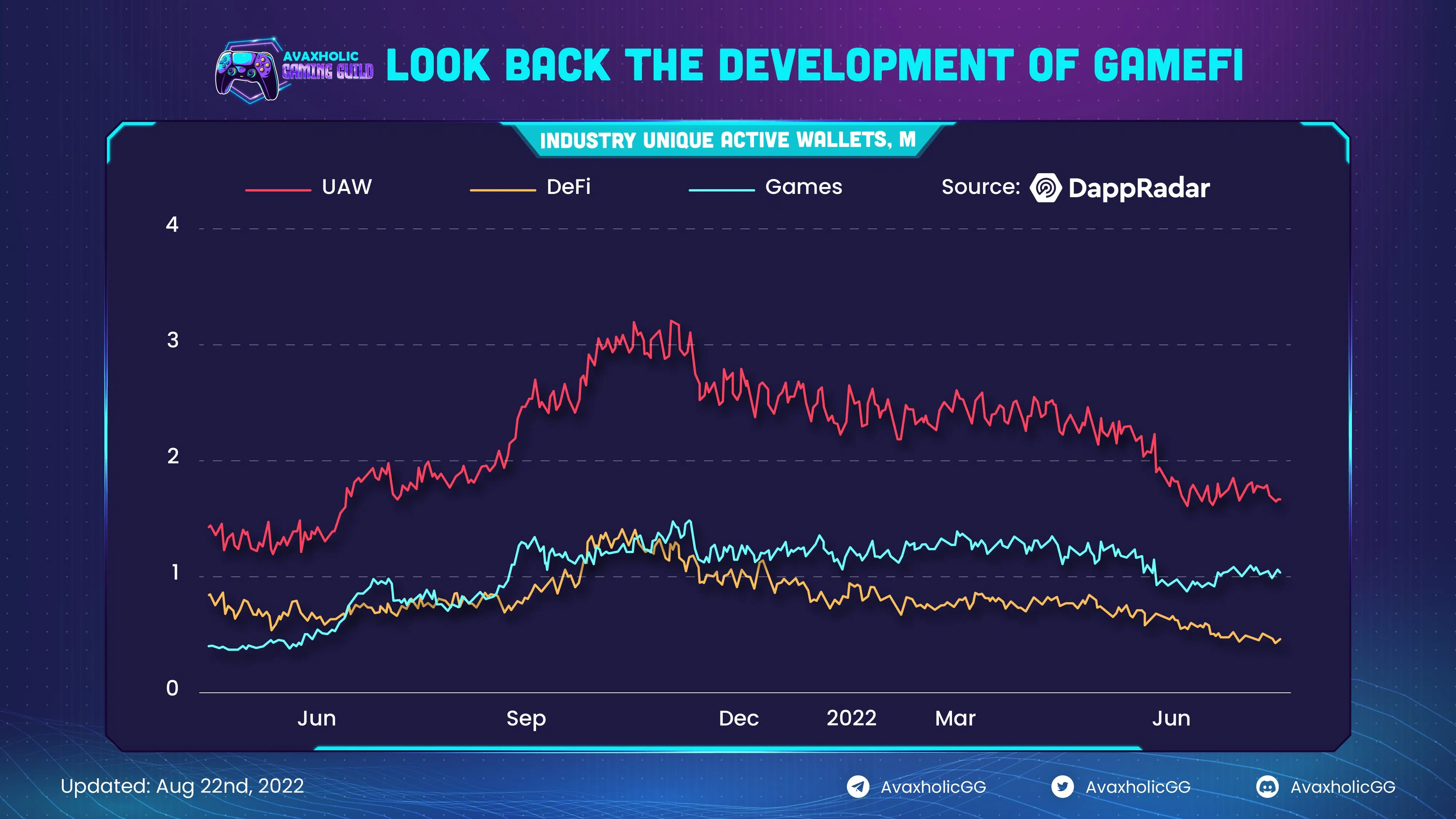

According to DappRadar, GameFi addresses witnessed a significant rise to 1.5 million in the second half of 2021, then declined gradually to around one million.

In retrospect, this is a much better performance as compared to DeFi address performance in the same period. It simply means that the GameFi industry has matured and can still retain users in the downtrend.

Source: Avaxholic/ Twitter

Despite this drawdown, Avalanche has seen development spike across some of its subnets in GameFi.

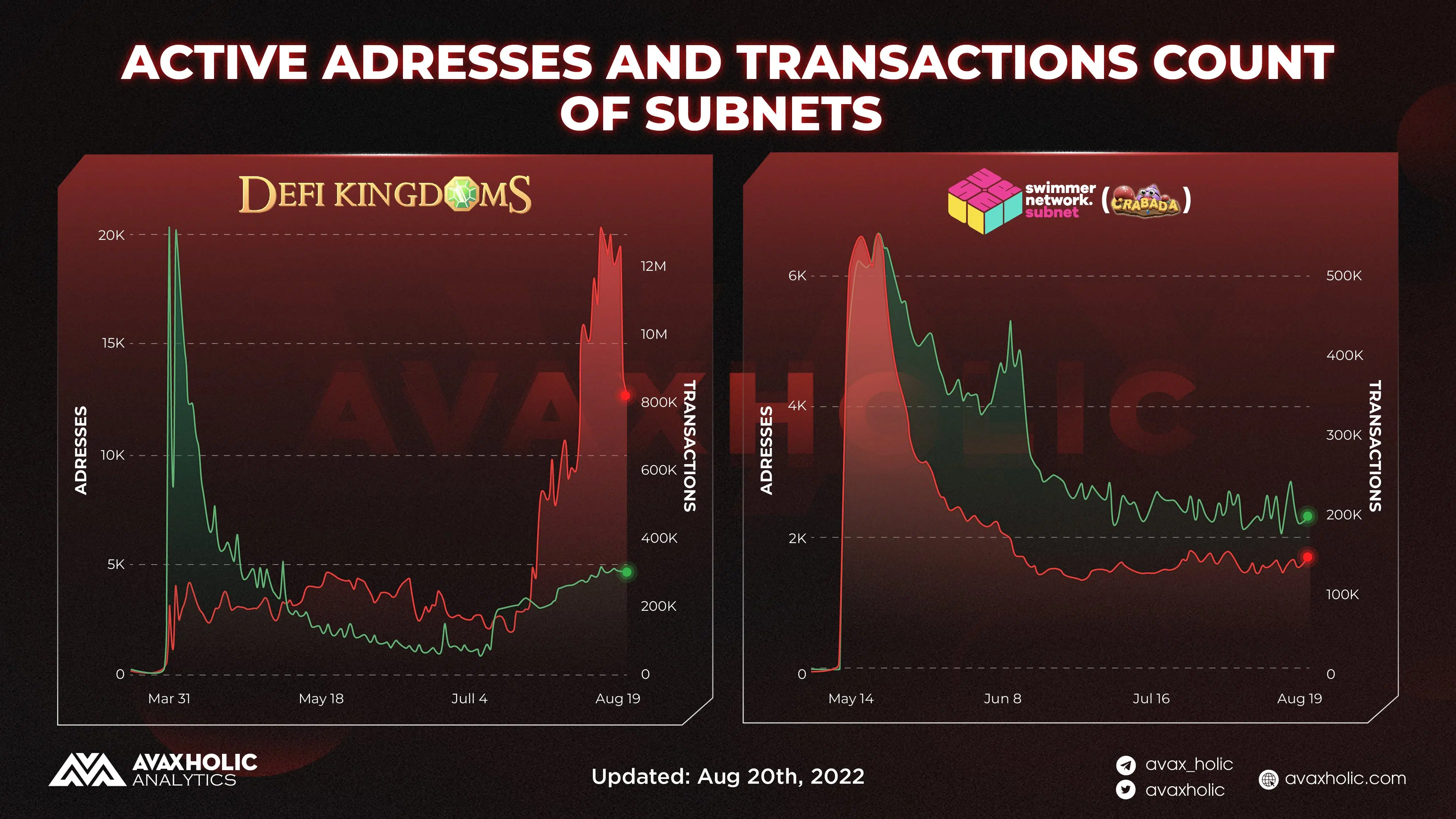

According to a recent update, there has been a remarkable spike in daily active users and transaction count since the launch of the following subnets: DeFi Kingdoms and Swimmer Network.

In the case of the former, there has been a major uptrend recently because of new features and the Harmony Bridge upgrade.

However, the figures have dropped gradually since as seen in the charts below.

Building for the future

Meanwhile, Ava Labs has been busy in August with many projects outperforming their July progress.

In return, some of the top-performing projects on Avalanche this month have received social recognition from the community.

These include VaporFi, CertiK, Avalaunch, and ImperiumEmpires among others.

Avalanche has seen modest performance since 21 August on the network. There was a 0.54% increase in its DeFi TVL which now stands at $2.07 billion.

Aave continues to head the Avalanche DeFi with a TVL of $915.3 million as of 22 August.

The Avalanche market cap also saw a decent increase, at press time, totaling at $6.48 billion after a 0.9% hike.

Among its projects, GMX, ODDZ, and SNX were the top performing tokens on the daily chart on 22 August.

Conclusion

GameFi continues to shape new moves as the bear market takes a toll on the digital asset market.

But Avalanche is building on all fronts as it steams forward past the halfway mark of Q3 2022.

However, AVAX is not able to keep up with the pace and is showing signs of weak growth.

In the past week, AVAX was down by a staggering 22% which brings the crypto to $21.69 according to CoinMarketCap.