Curve Finance totals record losses- Assessing potential of its growth

As far as DEXes go in the crypto market, Curve Finance is usually spotted among the top-performing exchanges. However, since the past month or so the DEX has been massively underwhelming.

The fall from its grace began in Q2 as it led the DEXes, but it has been replaced by Uniswap ever since.

Curve’s performance reflects the sharp decrease in demand for crypto assets in the wake of the intense volatility among crypto prices.

Hanging by a thread

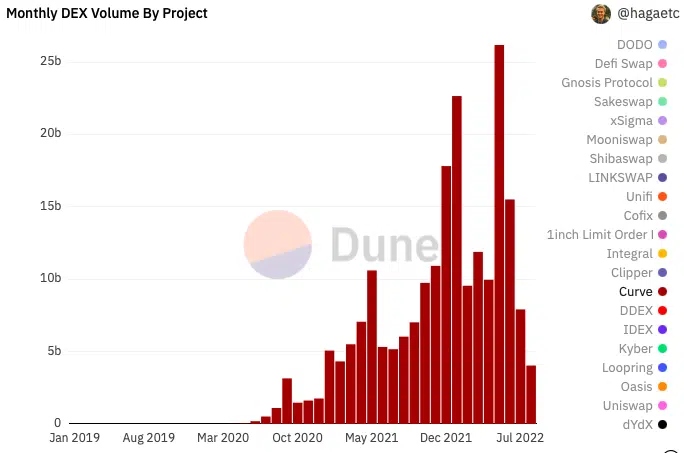

Notably, Curve Finance recorded a $26.1 billion volume on its exchange during May 2022.

Several high-profile events were set in motion after this month saw the crypto market collapse to new lows. The effects can be seen in Curve’s falling volume since May.

In June, Curve accumulated over $15.5 billion followed by a 48% decline to $7.9 billion in July.

Finally, the exchange has been able to record just $4.03 billion so far in August as we approach the final week of the month.

It seems unlikely that Curve will be able to reach even $5.25 billion as of now.

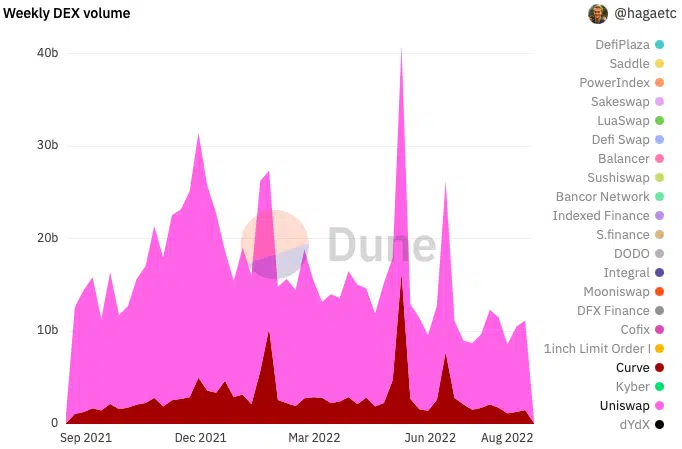

At present, it is lagging heavily behind Uniswap among major DEXes. In the past week, Uniswap totaled a volume of $9.4 billion while Curve accounted for just $1.5 billion.

While Uniswap has made the most of the bear market in Q2 2022, Curve has fallen far behind. This is further reflected in the weekly chart of Uniswap and Curve since September 2021.

What about CRV?

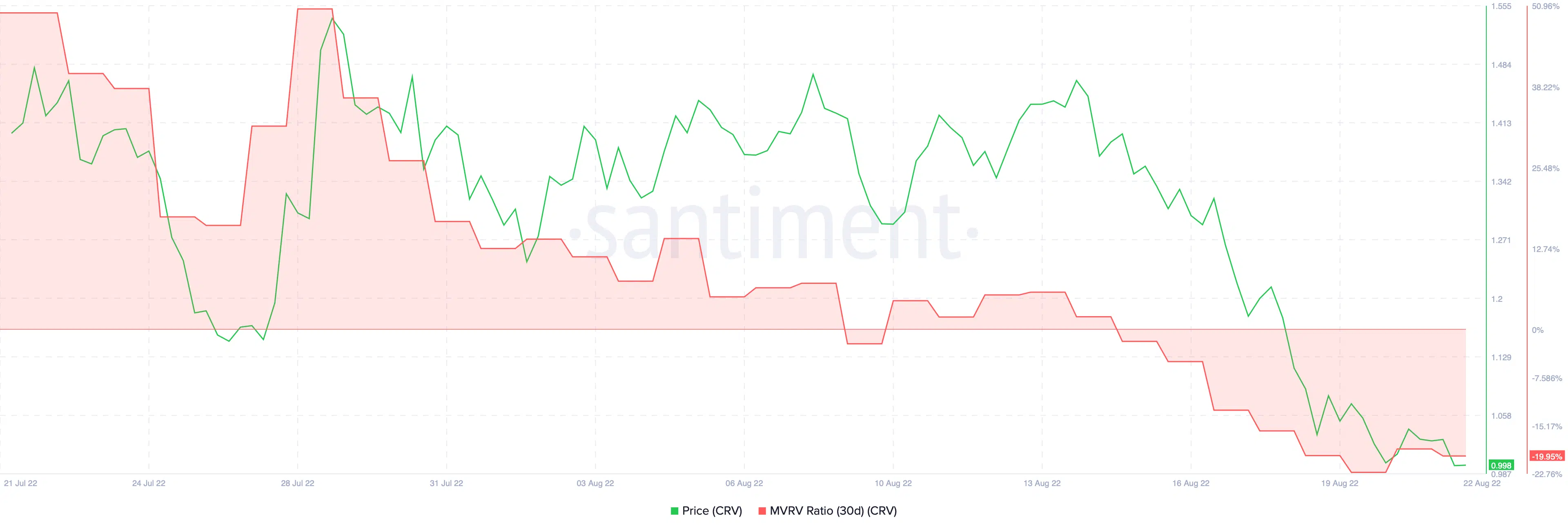

The bear market headwinds that continue to plague the Curve DEX is also affecting the CRV token.

The profitability of CRV holders has dipped to a new low as things stand.

According to Santiment, the MVRV value of the Curve DAO token is -19.95%. This means that over 1/5th of present CRV owners are holding losses with the token value now at $0.99.

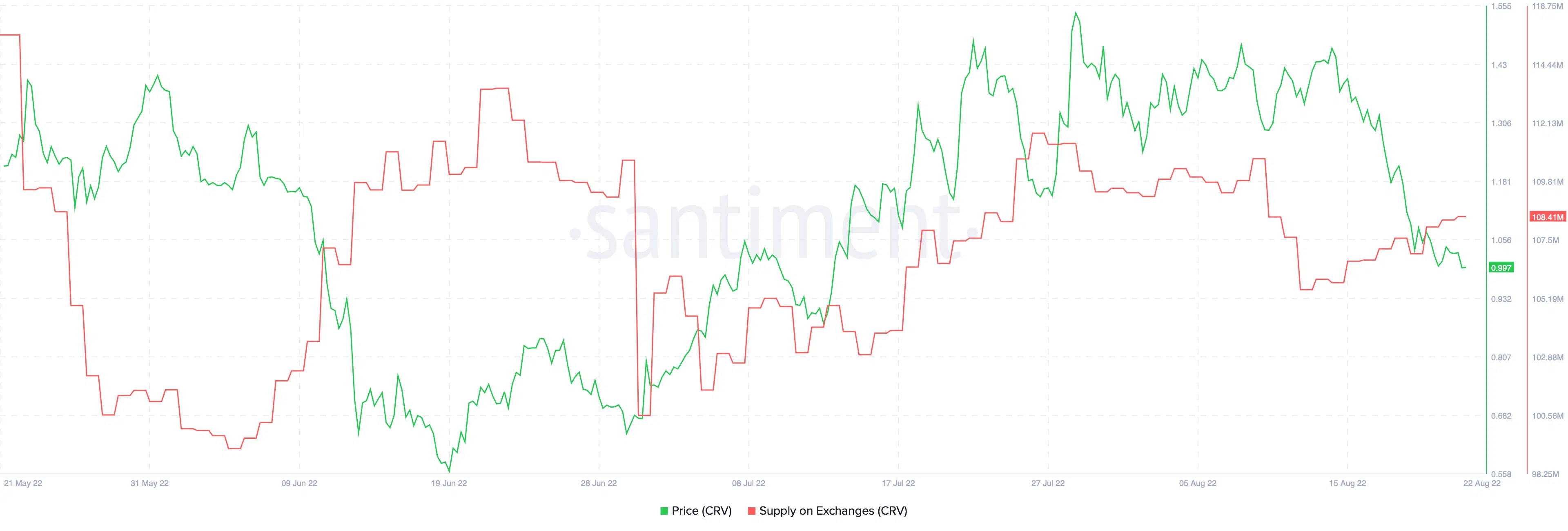

The falling prices of the CRV have also led to a change in its supply on exchanges.

Since the beginning of July 2022, more than eight million CRV has been put up on exchanges. It represents failing confidence in the token as investors are looking to offload their holdings soon.