Gauging Ethereum’s [ETH] increasing deflationary pressure amid Shapella preparation

![Gauging Ethereum’s [ETH] increasing deflationary pressure amid Shapella preparation](https://ambcrypto.com/wp-content/uploads/2023/03/po-2023-03-29T094001.092.png)

- ETH supply continued to decline at a fast pace.

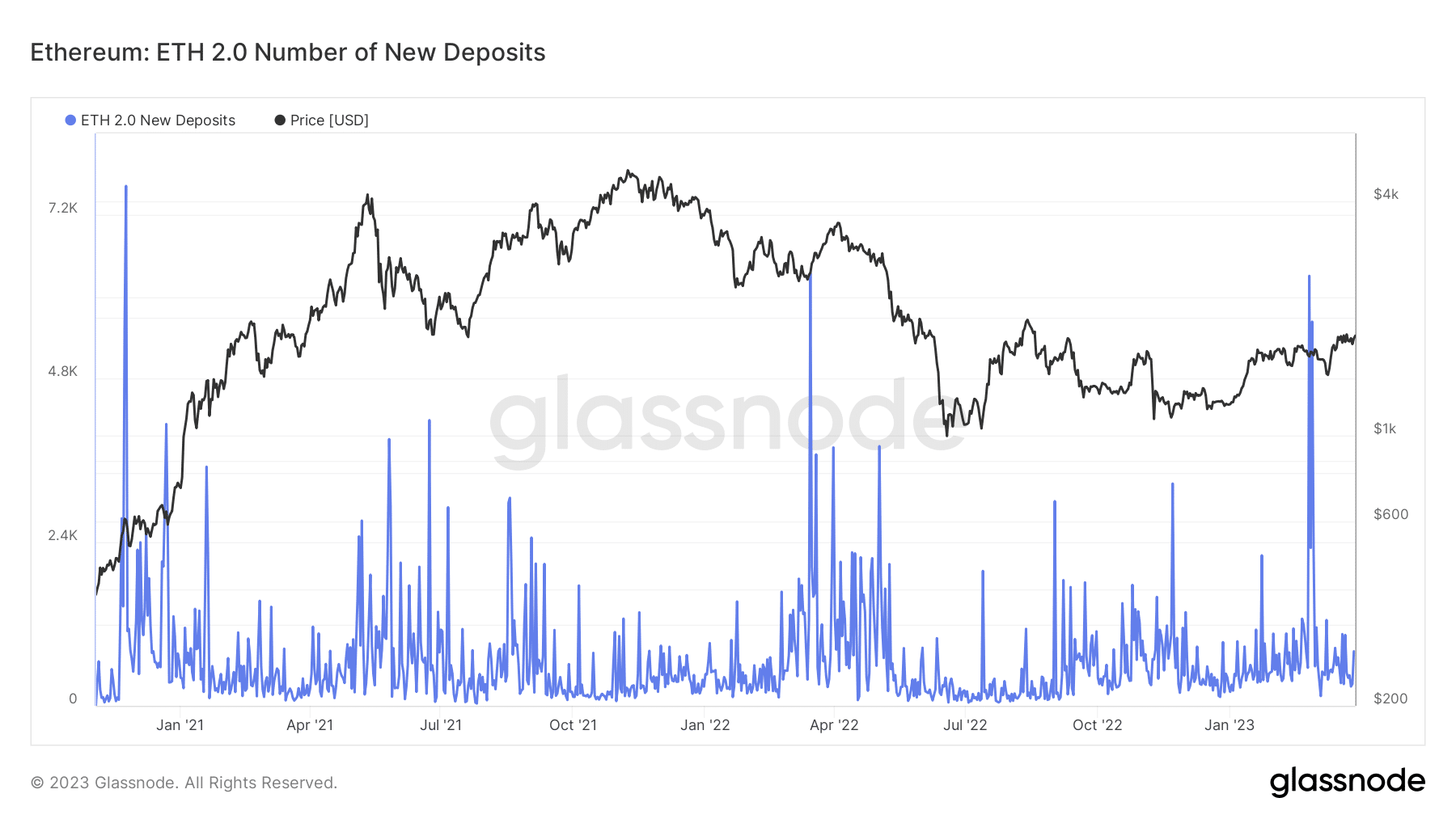

- The number of new ETH 2.0 deposits has not reached January and February highs.

With about two weeks left until the Shanghai-Capella hard fork, Ethereum’s [ETH] supply has continued to diminish. According to Delphi Digital, the altcoin’s supply has fallen off by 70,000 ETH since it transitioned to the Proof-of-Stake (PoS) consensus mechanism.

Ethereum's supply has decreased by more than 70,000 $ETH since The Merge. pic.twitter.com/RDkg5oCp9e

— Delphi Digital (@Delphi_Digital) March 28, 2023

How much are 1,10,100 ETHs worth today?

ETH: Burning at a faster pace

This increase meant that the number of Ether entering circulation was lower than those being burned. For context, scarcity in the supply of an asset is bound to increase its value in the long term. This, sometimes, draws investor attention to the asset.

However, the crypto community was aware ETH’s supply would decrease after the Merge. It was expected, as the burning of transaction fees was one condition for the PoS switch.

In 2021, the projection was that ETH issuance would reduce by 2% yearly. But the supply has been decreasing at an unexpectedly rapid rate. At the same time, projections of a slow deflationary status were only supposed to occur in the early stages of ETH 2.0.

Nonetheless, since staking withdrawals are expected to resume by 12 April, it means that the ETH 2.0 was near. Ethereum could now edge toward full-scale deflation pressure.

Meanwhile, the deposit rate on ETH 2.0 has significantly tumbled after registering notable spikes in January and February. At press time, Glassnode’s data showed that the number of new deposits was around 800.

It implied that the validators who were faced with contributing 32 ETH to the ecosystem were restricting extra input.

Formation underway

Furthermore, Ethereum developer Tim Beiko gave some updates regarding the upgrade. In a 28 March tweet, he mentioned that users should upgrade to the new Ergion version as v2.41.0 has been trashed for v2.42.0.

Erigon in Ethereum allows users to deploy nodes and is only archived by the default node on the consensus layer. Beiko gave this update as it was crucial to the Shanghai upgrade mission.

Note: the previously announced Erigon version had an issue, which has just been fixed in a new release. Erigon users should update to: v2.42.0https://t.co/qZXTwMImpo pic.twitter.com/qeYK0VaIQ0

— timbeiko.eth ☀️ (@TimBeiko) March 28, 2023

Is your portfolio green? Check the Ethereum Profit Calculator

Another metric to watch out for is stake effectiveness. The metric, calculated as the ratio of the total effective balance to the total staked balance, was 0.941 at the time of writing. A close look at the on-chain data showed that the effectiveness has been on the decline for some time now. This implies that active participation in consensus to the staked ETH has severely dwindled.

ETH did not yield any noteworthy results at press time, due to the increased burn activity. The asset hovered around $1,804, registering a 0.43% increase in the last seven days.

![Ethereum [ETH] stake effectiveness](https://ambcrypto.com/wp-content/uploads/2023/03/glassnode-studio_ethereum-stake-effectiveness-1.png)