GMT ‘runners’ look dismayed; will STEPN lose the race to the bottom

Following the tragedy that trailed TerraLUNA and its eventual collapse, regulators worldwide have become skeptical of cryptocurrency projects and a clampdown is underway in some regions.

On 26 May, STEPN, a move-to-earn blockchain project, via a series of tweets announced that in order for its activities to comply with regulatory policies in China, users in mainland China will be unable to use the services of STEPN. The platform stated that it would stop providing GPS to their accounts from 15 July according to the terms of use and IP location services.

The company stated further that users in the affected region who intend to log in and use their accounts from a GPS or IP location within mainland China are expected to make their own decisions about handling in-app assets.

Following this announcement, STEPN’s governance token Green Metaverse Token (GMT), suffered a severe decline in price forcing the price per GMT token down from $1.24 to $0.83.

A race to the bottom

After registering a 10% spike in price during intraday trading on 30 May, at the time of press the GMT token appeared to have shed these gains. At a 5% decline in price in the last 24 hours, “runners” appear to be taking profits following the temporary spike that the token recorded on 30 May. At the time of press, the price per GMT token stood at $1.19, 70% shy of its ATH of $4.11.

Furthermore, in the last 24 hours, the trading volume for the GMT token declined by 16.42%. This was confirmed through the gradual distribution of the token suggested by movements on the price charts. At the time of writing, the Relative Strength Index (RSI) and the Money Flow Index (MFI) were below the 50 neutral regions, each on a downward curve.

All falls down

On-chain analysis revealed that the GMT token had a terrible performance in the last 24 hours as important metrics appeared to have reached positions downwards.

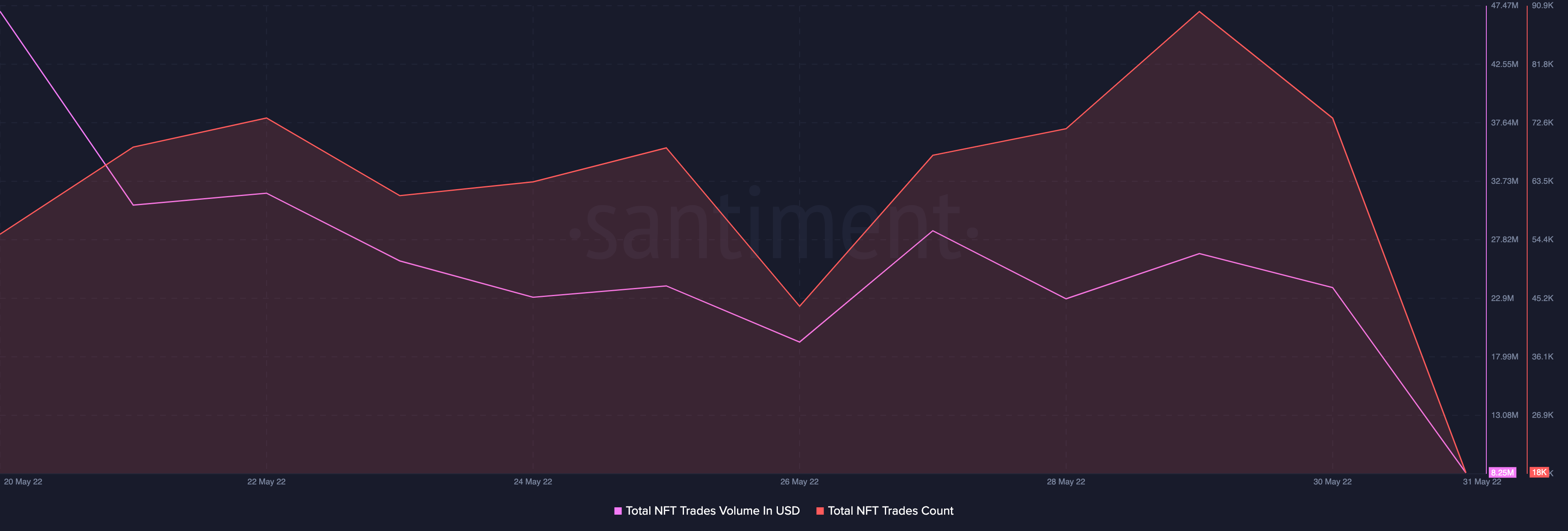

At the time of press, the total NFTs trade count was pegged at 18,044. In the last 24 hours, this has declined by 75% which is suggestive of an increased lack of interest in “runners” once they cash out their earnings on the platform. As a natural consequence, the total NFTs trade volume also recorded a 65% decline from $23.8m recorded on 30 May to $8.25m recorded on 31 May.

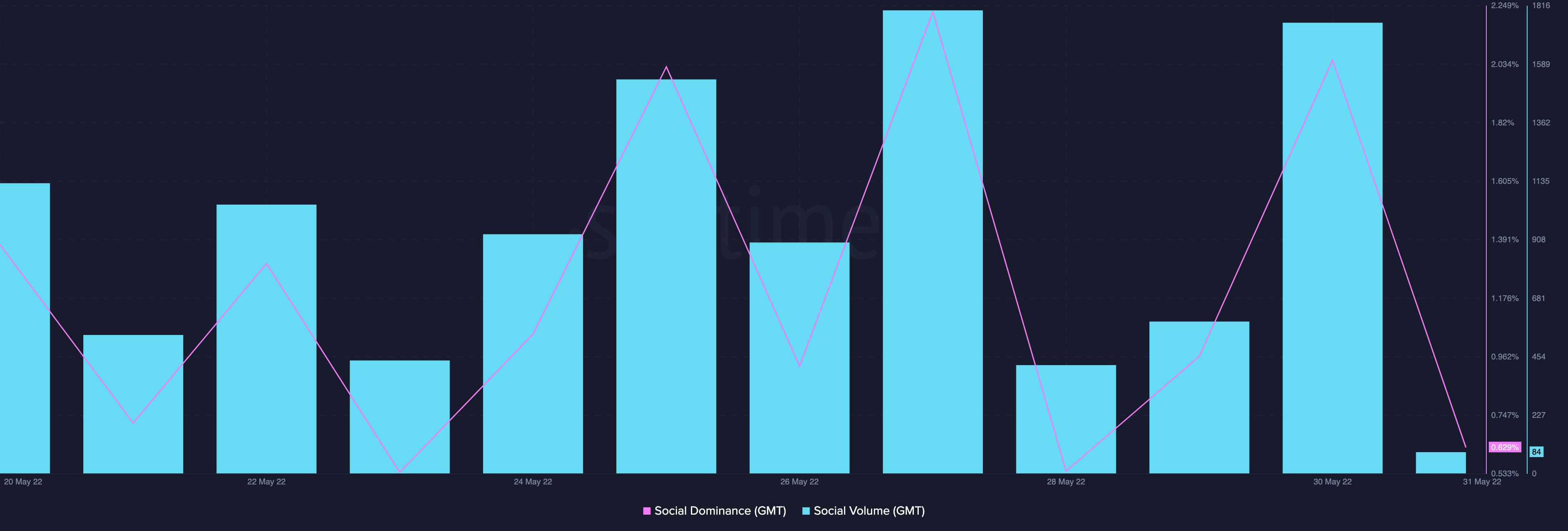

On a social front, the token also suffered declines in the last 24 hours. The social dominance went down by 69%. Also, the social volume saw a 95% decline.

The Web3 ecosystem is becoming increasingly infiltrated with play-to-earn gaming models. With the launch of a Sex-to-Earn platform, it is unclear how else this gaming model might be deployed.