Grayscale’s Ethereum Trust added over 10,000 ETH during price correction

Given the price correction in the market, the value of most cryptos has been trending lower. The largest altcoin in the market, Ethereum has slipped by 25% from the top observed at $2,130. The blow on 23rd February pushed the digital asset’s value to $1,348, however, ETH’s price stabilized quickly. At the time of writing, it was trading at $1,614.

Despite the fall, the recovery painted a bullish picture for Ethereum, especially for the buyers. The institutions have been capitalizing on the short-term falls of digital assets like Ethereum and Bitcoin to fill their bags. According to data, when ETH’s price dropped under $1400, Grayscale’s Ethereum Trust added over 10,000 in the digital asset in the past day.

With this latest addition, its total Ethereum holdings reached 3.17 million ETH or $5.1 billion, at the current value.

Source: Twitter

Despite the recent downtrend in the value, the overall momentum in the Ethereum market has remained bullish. The second-largest digital currency has been returning 118% year-to-date to its investors. The steep drops witnessed in the market before hitting the ATH above $2k were just used as an opportunity by the institutions and others to acquire more ETH.

Ethereum has become the other exciting crypto investors are looking at. With its price also noting a great surge, users have been hoarding the digital asset expecting greater returns. Data from Skew highlighted that fewer liquidations were taking place whenever ETH value dropped, reinforcing the holding narrative.

Less liquidations on the way up pic.twitter.com/gHFh5cxHAM

— skew (@skewdotcom) February 24, 2021

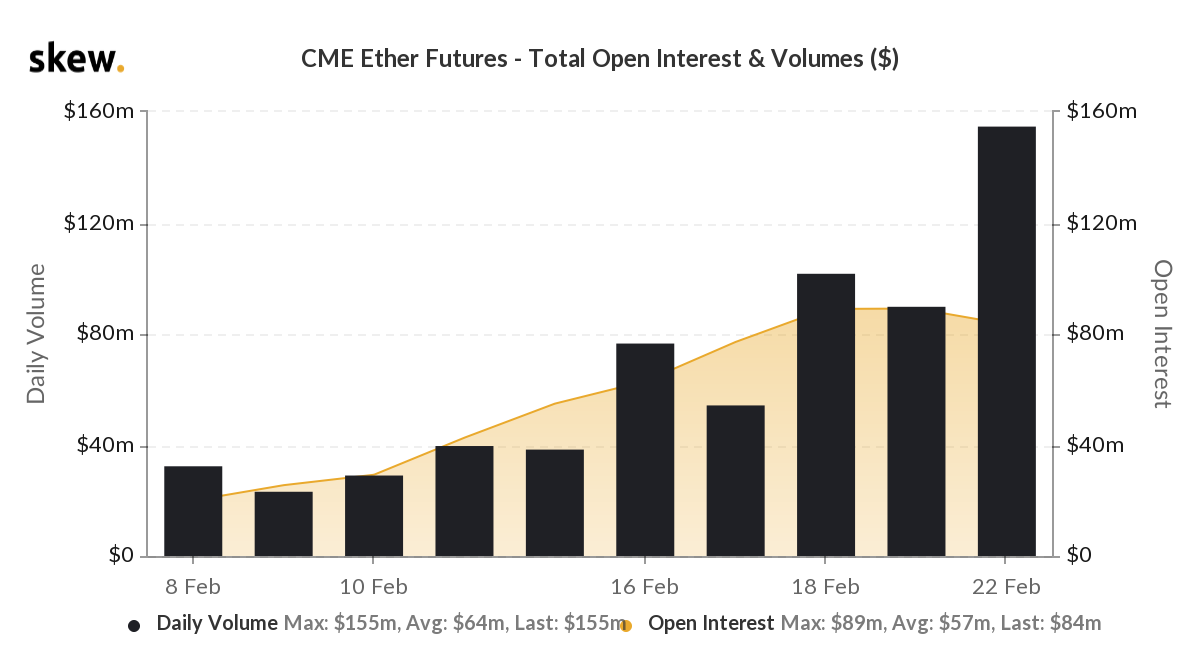

The Ethereum market has been seeing a heightened interest also because of the launch of Ethereum futures by CME. The platform has been noting record trading volume close to $160 million on 22 February when the prices were plunging.

Source: Skew

As the interest in the market grew, it contributed to the rising price of gas on the Ethereum network. As the price retraced from $2k, ETH fees peaked at $37.60 on Wednesday which is the highest level observed in almost its 6-year history. The interest may not be visibly impacted right now, but the high gas fees will continue making ETH a rare digital asset for individual investors.