GRT plots rising graph as it surges 30% in 24 hours: More to come?

- The Graph (GRT) has surged over 100% in value in February so far.

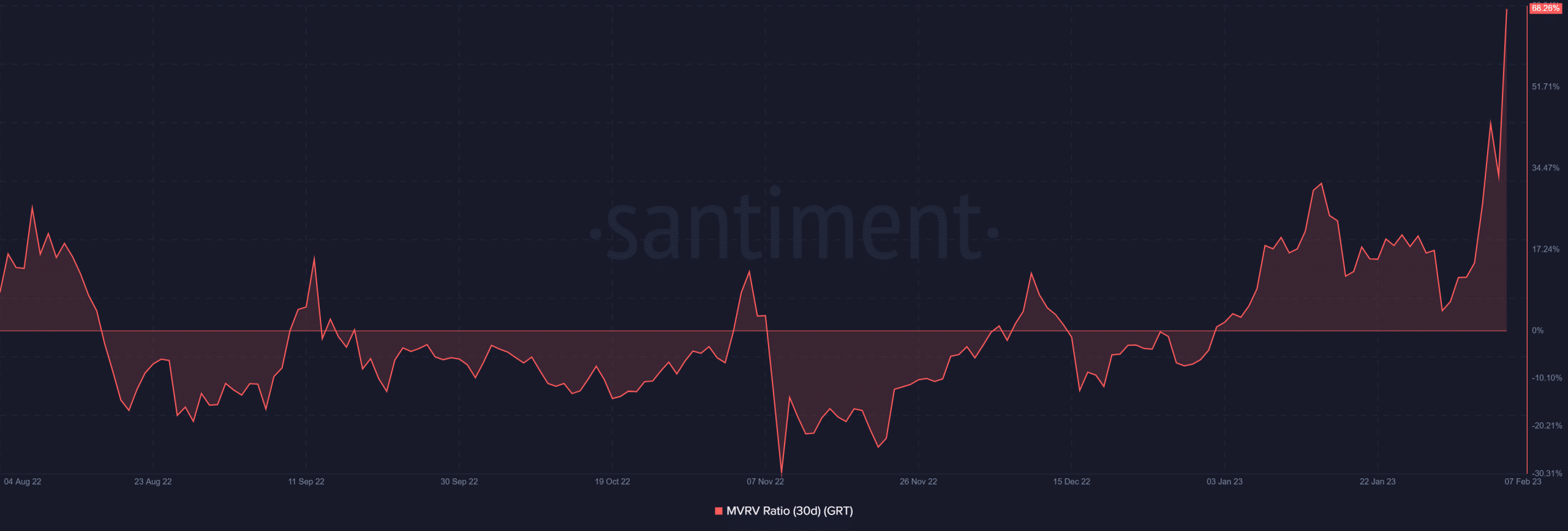

- The token was overvalued at press time.

Following a decline in value in 2022, The Graph [GRT] has recovered alongside the rest of the cryptocurrency market. The value, however, has been rising even more rapidly since the beginning of February 2023. So, to what ends might this be happening, and what might the future hold?

Read The Graph’s [GRT] Price Prediction 2023-24

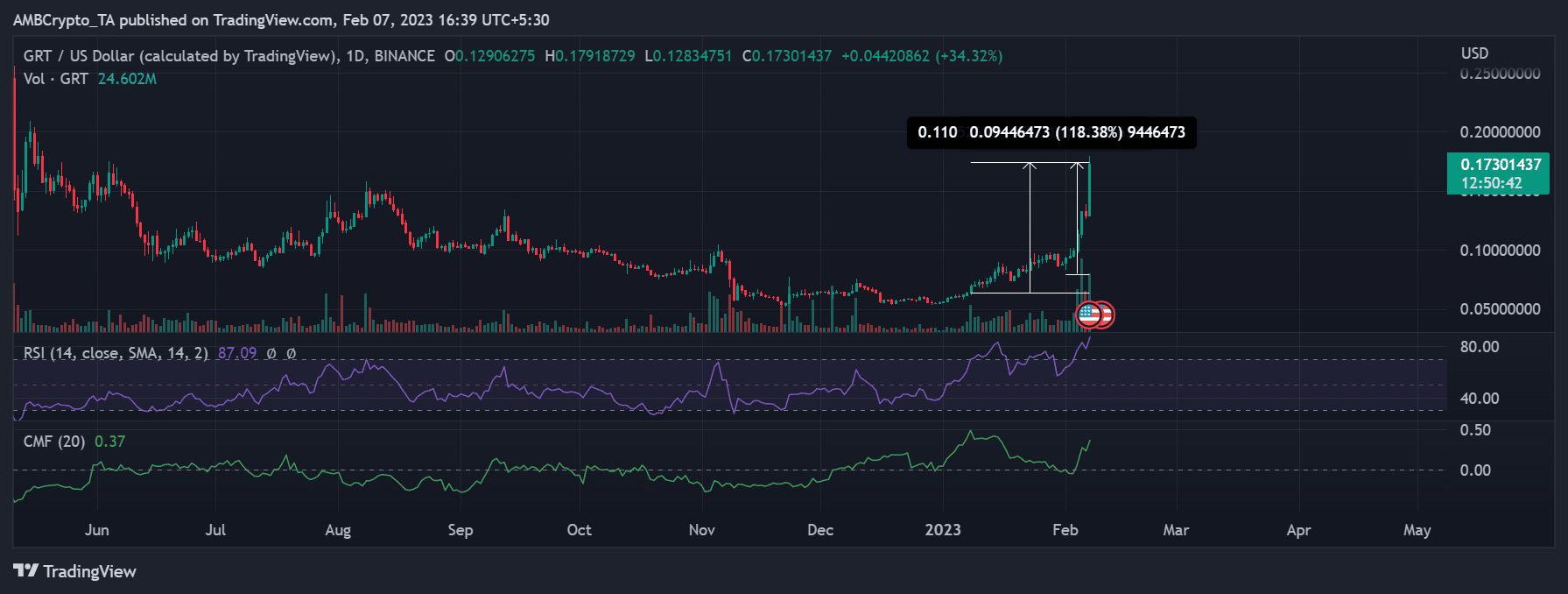

February increase at 118%

The daily timeframe of Graph Token revealed an intriguing price pattern. As of the time of writing, the token has increased by 30% within the observed trading period. Additionally, it has increased by 170% since 8 January, with the gain in February accounting for over 118% of the total growth.

The Relative Strength Index indicated that it was in a bull trend as of this writing and was trading at about $0.16. The RSI line also hinted at a potential price reversal, which showed that the token was in the overbought region.

The Graph sees an increase in query fees and staking inflow

Querying and indexing data from blockchains is made possible via the decentralized protocol known as The Graph. Instead of managing their own full nodes or dealing with the complexities of low-level blockchain data structures, it enables developers to quickly access and use data from decentralized apps (dApps).

As a result, developing applications that run on top of blockchains was made simpler. Furthermore, the GRT token was used to encourage people and businesses to contribute computing power to the network.

Messari’s data showed that The Graph‘s query fee revenue grew 66% from the previous quarter to the fourth quarter of 2022. This represented a growth of 5% from the previous quarter and 265% from the previous year when converted to US dollars. According to the research, query fees will keep rising over the next few quarters as more subgraphs are transferred to the mainnet.

Additionally, as of this writing, the influx of token staking also appears to be dominant, according to data from Dune Analytics. The inflow volume was more than the outflow volume, as could be seen on the chart. In other words, more investors are making GRT contributions to the network at present.

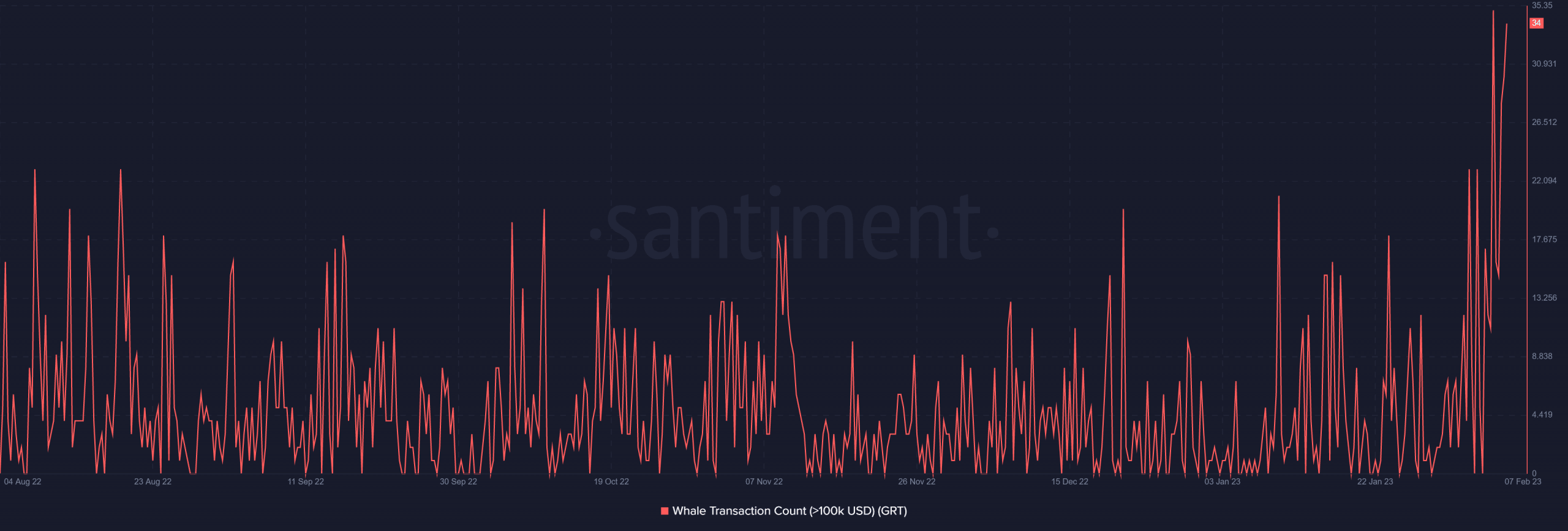

Whale transaction count increases as GRT enters the overvalued zone

Furthermore, the Santiment whale transaction count revealed that whale transactions have lately increased. According to what was noticed, February has been recording high counts. The total whale transaction that was reported on 5 February was the largest in six months.

How much are 1,10,100 GRTs worth today?

The Graph was overvalued at press time, according to the 30-day Market Value to Realized Value ratio. The indicator showed that GRT was making a profit of almost 48% as of this writing.

The value of GRT may continue to rise due to the rise in the number of whale transactions and staking inflow. A price reversal, however, might occur at some point and offer a fantastic entry position. The popularity of Artificial Intelligence (AI) projects could contribute to the increase in the token’s price.