Has Bitcoin [BTC] bottomed out in oversold territory?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Bearish momentum waned as BTC compressed into a tight range.

- Rising mean coin age suggested active buyers were looking to buy BTC at lower prices in anticipation of a price rebound.

Investors continued to approach Bitcoin [BTC] with cautious sentiment, as the market slowly recovers from the panic wave over the past week. BTC’s sharp drop from $28.5k to $25.2k on 17 August sparked fear across the crypto market.

How much are 1,10,100 BTCs worth today?

Nonetheless, the king of cryptos’ sideways price action hinted at price bottoming out. Along with increasingly positive signs from chart indicators, traders could witness a price rebound in the near term.

Are bears exhausted?

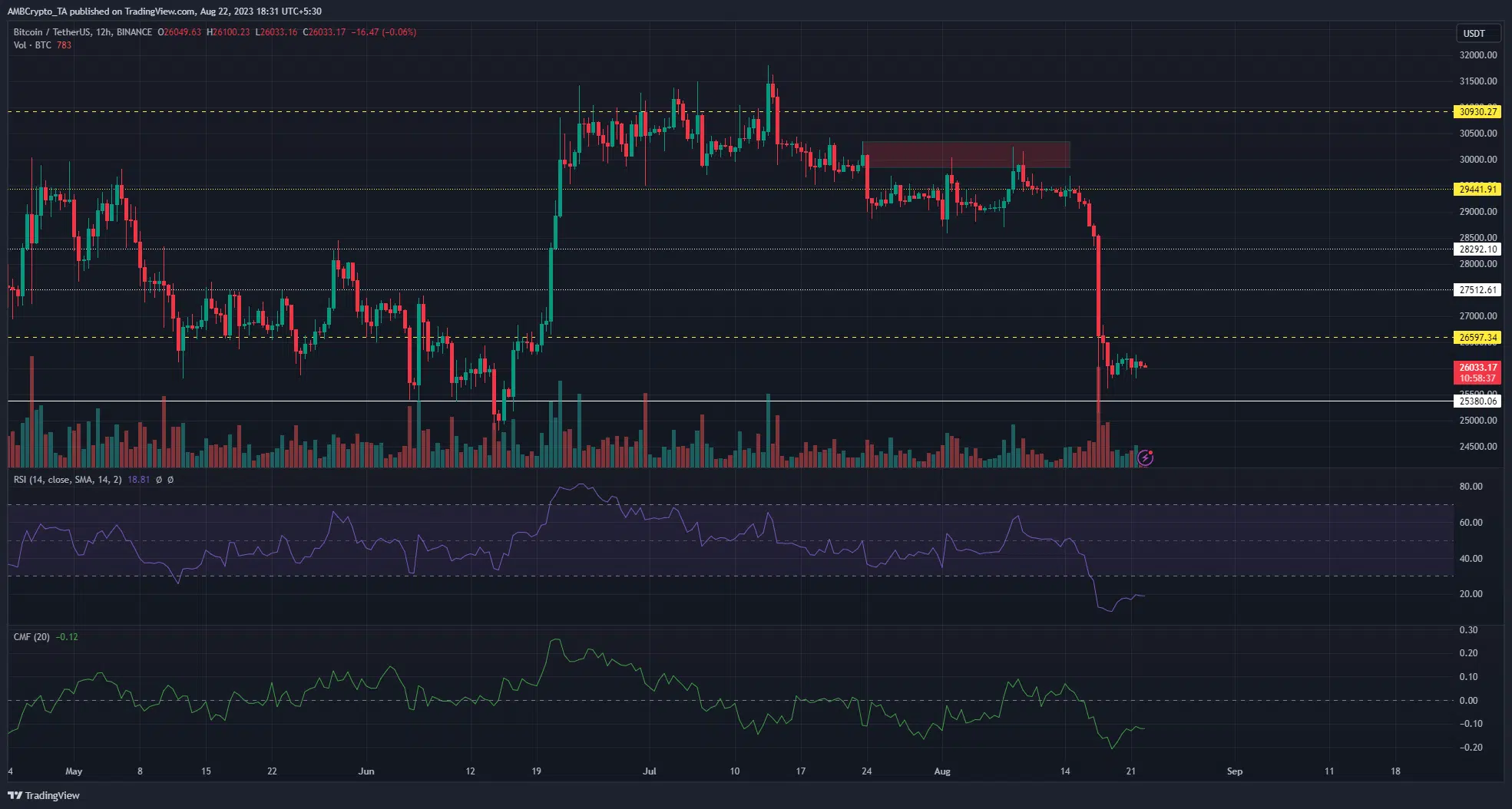

Sellers appeared to have lost steam as the selling pressure waned after BTC broke below the $26.5k support level. A mixture of bullish and bearish candles on the 12-hour timeframe raised the notion of a bullish comeback for Bitcoin.

A look at the Relative Strength Index (RSI) and Chaikin Money Flow (CMF) suggested that a price rebound could happen soon. Although the RSI remained in the oversold zone, it pushed up from 9 to 19 to hint at recovery efforts by the bulls.

Therefore, a climb out of the oversold zone could significantly accelerate BTC’s rebound. Likewise, the CMF moved from -0.21 to -0.11 signaling a slow recovery of capital inflows.

If bulls are able to take back the $29.5k level along with the positive indicators, buyers can make a push for $27k to $27.5k. On the flip side, sellers could be waiting in the wings for one more significant shorting opportunity to the $25.3k support before any substantial price reversal.

The rising mean coin age suggested buyers were active

Data from Santiment showed that the 90d mean coin age has been on an uptrend since 18 August. This hinted at an accumulation of BTC at low prices with the intention of mounting a sustained bullish rally.

Read Bitcoin’s [BTC] Price Prediction 2023-24

With the Market Value to Realized Value (MVRV) standing at -8.58%, it meant long-term holders were still holding onto unrealized losses.

Together with the rising mean coin age, long-term holders could be buying at lower prices with the goal of making a marginal profit in the event of a price rebound.