Has Solana’s liquid staking received a power pill?

- Weekly deposits comprehensively outweighed withdrawals on Jito.

- Solana’s low liquid staking market cap provided huge opportunities for growth.

Solana’s [SOL] largely untapped liquid staking market started to look promising, driven by efforts of emerging liquid staking protocol Jito.

How much are 1,10,100 SOLs worth today?

Jito makes SOL liquid

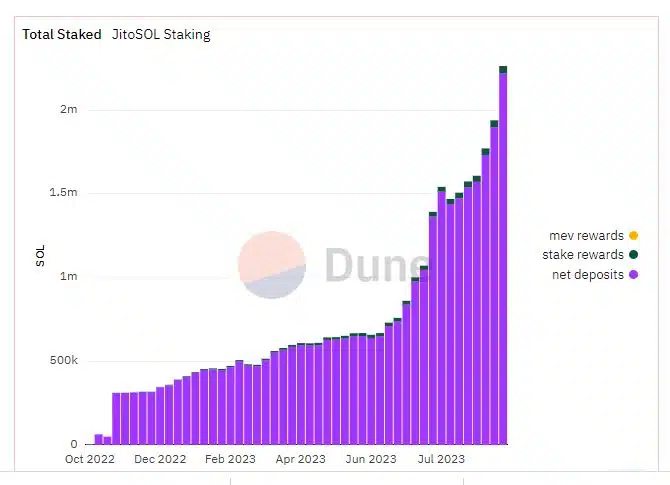

According to pseudonymous on-chain researcher Emperor Osmo, staking deposits on Jito went parabolic, with a sharp increase observed in Q3 2023. As of data at the time of publication, more than two million SOLs were staked on the platform, additional data from a Dune dashboard revealed.

Moreover, a steady rise in the weekly count of stakers was also observed over the last three months. The fact that weekly deposits comprehensively outweighed withdrawals demonstrated users’ trust in the staking process.

Will Solana exploit the untapped potential?

As is well known, liquid staking allows users to directly participate in staking while also maintaining the ability to use them elsewhere in decentralized finance (DeFi) for higher yield opportunities.

Lido Finance [LDO] for instance, arose to fill shortcomings in the conventional Ethereum [ETH] staking mechanism.

While Solana boasted of one of the largest staking market caps, just about 5% of the supply was available through liquid staking tokens (LST). Contrast this with Ethereum, which had a liquid staking share of 37% at the time of writing.

And therein lies the big opportunity to unlock Solana’s remaining stake for liquid staking. If such a vision were to come to fruition, it would significantly boost Solana’s DeFi potential.

The Jito Stake Pool enables users to stake their Solana tokens in exchange for an LST called JitoSOL. As like other protocols, the token accrues value through staking rewards over time.

A glance at Solana’s staking numbers

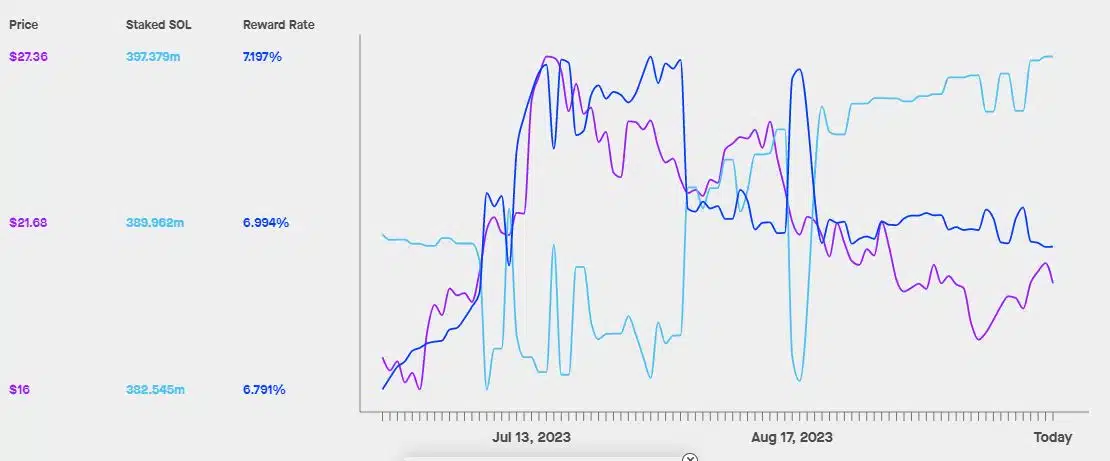

According to The Staking Explorer, Solana’s staking market cap was $7.77 billion, with an annualized average reward rate of 6.97% at the time of publication.

Realistic or not, here’s SOL’s market cap in BTC terms

While staking momentum has clearly picked up over the last few months, the staking yields have dipped. The proof-of-stake (PoS) concept is to be blamed, according to which the more stakers there are, the more thinly the yield gets spread out.

At the time of publication, SOL exchanged hands at $19.58, down 2.6% in the last 24 hours. SOL battled bearish market sentiments, which caused the coin to lose 19.58% of its value over the past month, data from CoinMarketCap showed.