Heavy speculative demand for Aptos in South Korea tied to hopes of…

- Debunking the reason behind Aptos’ sudden rise to fame.

- Demand for APT slows down in the prevailing market conditions.

Every once in a long while, a crypto project makes it into the list of the top blockchain networks and rapidly climbs up the ranks. Aptos is the most notable project to achieve this, but why has it rapidly become so popular?

Is your portfolio green? Check out the Aptos Profit Calculator

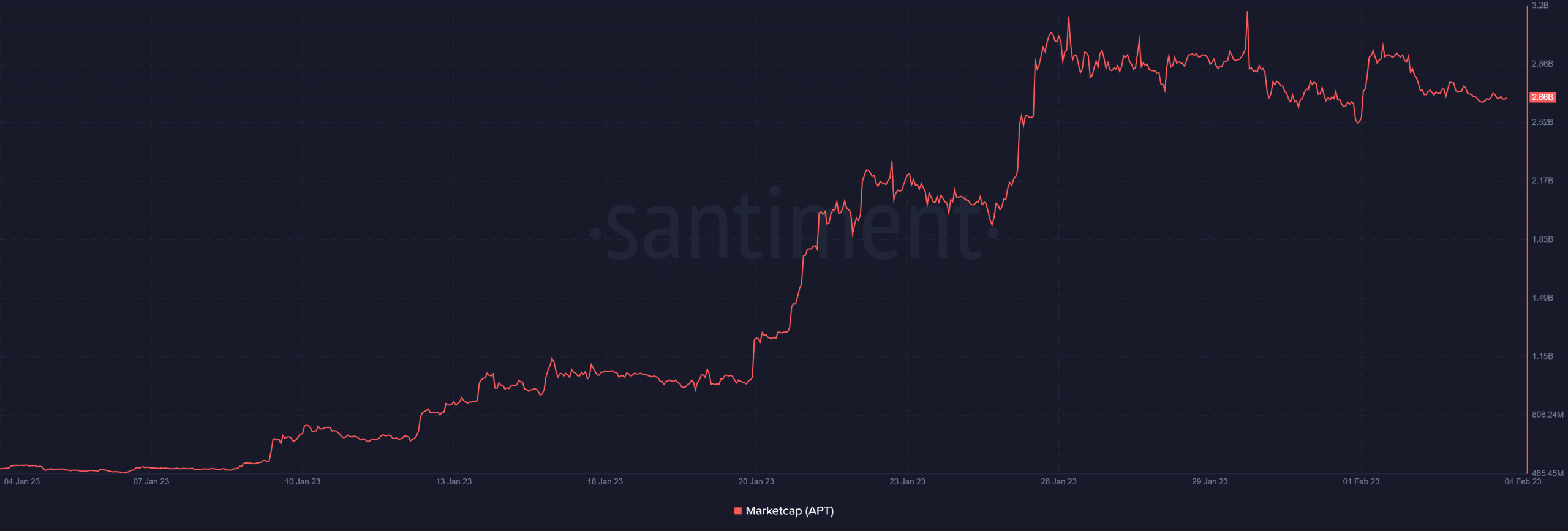

Aptos’ market capitalization was just over $2.5 billion at the time of writing. For perspective, its market cap at the start of 2023 was less than $500 million, hence it grew by slightly over $2 billion within the last five weeks.

This growth has earned it a spot in the top 30 blockchain networks by market cap. An abnormally large influx of capital in such a short period, especially for a lesser-known project.

There is no official word out on why Aptos’s native cryptocurrency APT is experiencing such strong demand. However, there are claims that Koreans have been calling the native coin “apartment.”

The narrative behind this is that Koreans have been buying and holding APT hoping that it will one day be high enough to support an apartment purchase.

For those of you wondering why $APT is $17. Aptos is a meme coin in Korea.

The #1 asset class in Korea is real estate — more specifically, Apartments.

Retail is calling Aptos “apartment” claiming people can one day afford to purchase an actual apartment if they hold $APT.

— Alex Shin (@AlexShin) February 4, 2023

A bird’s eye view

Previous reports indicated that there was strong buying pressure coming from South Korea. Unsurprisingly, Aptos hails from Korea and has a strong community in the country. The network just concluded its first hackathon which was held in Seoul, the capital of South Korea.

.@Aptos_Network's Seoul Hackathon has come to a conclusion.

It was a pleasure meeting so many friends that flew in from around the world and also the Korea-based teams that are building projects on Aptos!

See everyone at the next hackathon.

Hint: sooner than you think

— Ferum (@ferumxyz) February 5, 2023

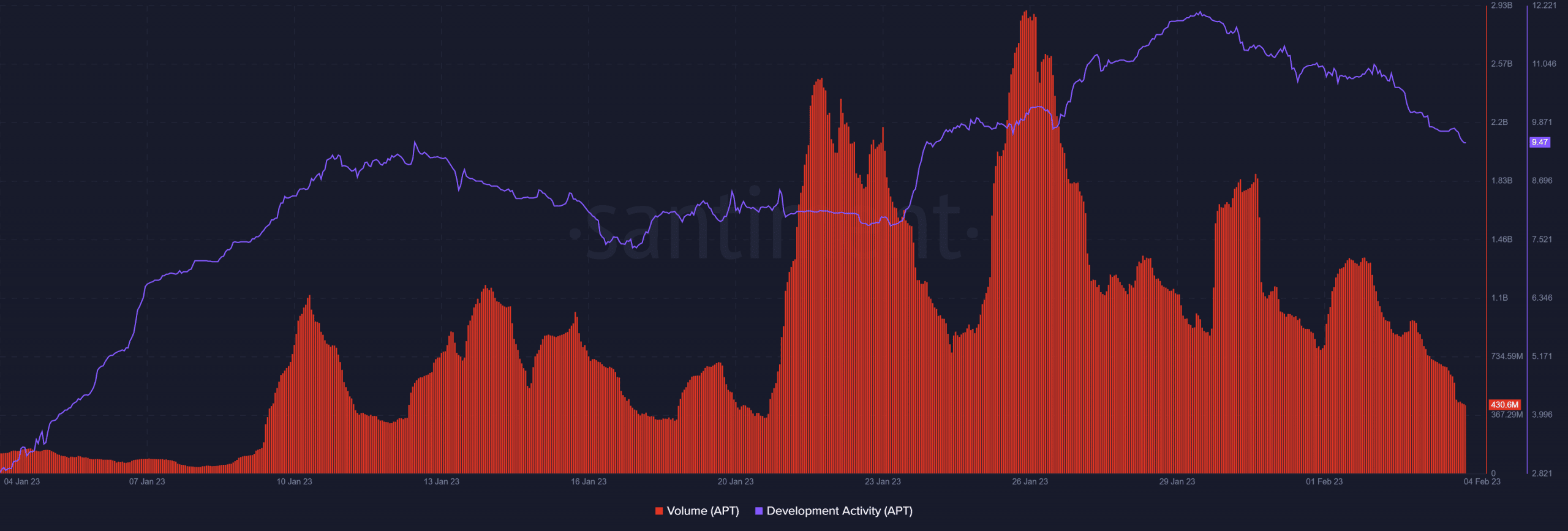

Furthermore, Aptos experienced a surge in development activity since the start of January. However, the development activity dropped significantly during the last few days of the hackathon.

Similarly, it experienced a strong surge in volume within the last four weeks, which then peaked in the last week of January.

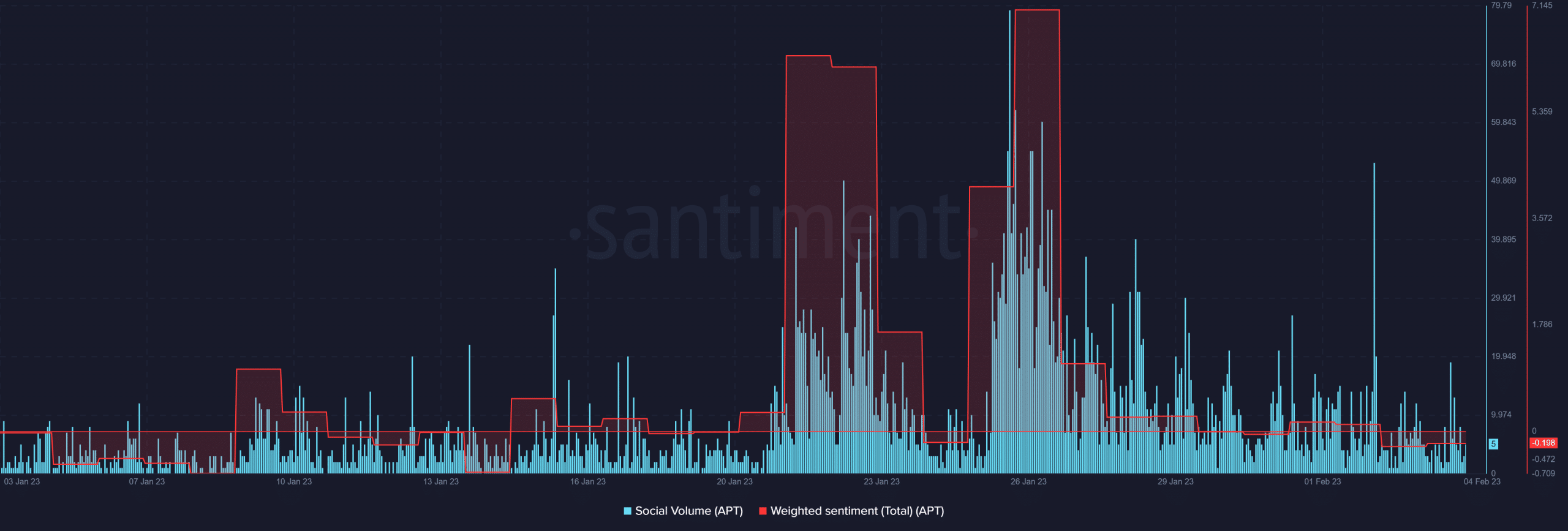

Can Aptos maintain this demand? Well, so far we have seen a drop in the network’s social volume. This coincides with lower volume, hence visibility has been fading.

The weighted sentiment also tanked in the first five days of February, confirming that there is now a bearish bias.

The sentiment reflects the market cap performance. The token’s market cap, at press time, was down by over $500 million within the last six days, hence there has been some selling pressure.

This means the wave of demand as seen in January has come to its conclusion and profit-taking has been happening as indicated by the market cap decline.

The rate of outflow also suggests that many APT holders are opting to HODL rather than sell. This is why the selling pressure observed in the last few days has not manifested as a massive drop.

APT’s current performance appears in line with the overall crypto market performance even at its $15 press time price.

Conclusion

A bit of research reveals that there is not much of a difference that sets Aptos apart from other PoS networks. The key defining characteristic is that it is South Korean and it is receiving a lot of support from its home market.